Introduction

Fiscal relations in India between the union and state governments have undergone significant changes in recent years. Three landmark changes in union-state fiscal relations since 2015-16 have been: (i) the abolition of the Planning Commission in January 2015 and the subsequent creation of the NITI Aayog; (ii) fundamental changes in the system of revenue transfers from the centre to the states by providing higher tax devolution to the states from the fiscal year 2015-16 onwards based on the recommendations of the Fourteenth Finance Commission (14th FC); and (iii) the Constitutional amendment to introduce the Goods and Services Tax (GST) and the establishment of the GST Council for the central and state governments to deliberate and jointly take decisions.

These changes have far-reaching implications for union-state fiscal relations and the provisioning of public services.

After the constitution of the 15th Finance Commission (15th FC) and the formulation of its Terms of Reference (TOR), whose award will cover the period (2020-21 to 2024-25), the discussions and debates that followed have highlighted many important issues on the the very nature of union-state fiscal relations 1Three important interventions in this context need special mention here: (a) The Joint Memorandum by selected states to the President of India to change some of the contentious provisions of the TOR; (b) A paper by Arvind Subramanian on the framework of union-state fiscal relations; (c) The Professor Sukhomay Chakravarty Memorial Lecture by Dr. Vijay Kelkar titled “Towards India’s New Federalism” delivered at the 55th Annual Conference of the Indian Econometric Society; (d) The Madras Institute of Development Studies, Foundation Day Lecture, by Y V. Reddy on 26th March, 2019 titled “New Approaches to Fiscal Federalism in India”. in India and the framework that may emerge in the future.

These debates have centred around three broad themes: (a) the role the Constitutional body that is the Finance Commission should play in providing conditional and unconditional transfers to the states, (b) the use of the transfer system to achieve development and policy outcomes and (c) the future framework of sub-national (state government ) borrowing.

The TOR of the 15th FC have also raised concerns among a group of states on the use of the population of each state as recorded in the 2011 census for the determination of resource needs. This replacement of the 1971 population numbers, which have been used the past three decades, by the 2011 population has worried the states which have been successful in reducing their population growth since 1971. Their concern is that it will affect the 15th FC transfers to them and favour those who have not been as successful in lowering population growth rates. This potentially adverse impact on the “horizontal” allocation of resources, as it is called, has been another focus of debate.

This article analyses some of these issues and their possible implications for union-state fiscal relations.

Fragmented Transfer System: Conditional and Unconditional Grants

A “fragmented” transfer system is an important feature of the Indian federal fiscal arrangements between the union and the states.

The financial resources transferred (or devolved) from the union to the states flow through different streams which could broadly be classified as (i) general purpose transfers (the states can spend these resources on priorities that they can draw up) and (ii) conditional transfers (the centre transfers resources which the states have to spend on programmes and schemes that the former has drawn up)

The share of general purpose transfers, 1Three important interventions in this context need special mention here: (a) The Joint Memorandum by selected states to the President of India to change some of the contentious provisions of the TOR; (b) A paper by Arvind Subramanian on the framework of union-state fiscal relations; (c) The Professor Sukhomay Chakravarty Memorial Lecture by Dr. Vijay Kelkar titled “Towards India’s New Federalism” delivered at the 55th Annual Conference of the Indian Econometric Society; (d) The Madras Institute of Development Studies, Foundation Day Lecture, by Y V. Reddy on 26th March, 2019 titled “New Approaches to Fiscal Federalism in India”. which are unconditional in nature and come with no strings attached, in total central transfers increased from 51.41% in 2011-12 to 59.95% in 2017-18 (Budget Estimates or BE), while that of specific purpose transfers, which are conditional in nature, have declined from 48.59 % to 40.05 % during this period (Figure 1). In other words, around 40 % of total transfers are still linked to various schemes and are therefore conditional. The primary drivers of these large conditional transfers are the various Centrally Sponsored Schemes (CSS). Transfers made under the CSS are outside the purview of resource transfers drawn up by the Finance Commission. These transfers are used by the central government to improve development outcomes in specific sectors, primarily social and economic services.

Given this institutional reality, when a large part of the transfers from the union to the states falls outside the ambit of the Finance Commission, what role can the Finance Commission really play in relation to conditional transfers? This requires a review of the conditional transfers provided by Finance Commissions themselves, their relative importance in total transfers, the design of conditional transfers, and, finally, their impact on spending and outcomes in delivery of services by the states.

The 12th FC had emphasised that grants provided a more effective mechanism than tax devolution to achieve what is called “equalisation” among the states, or achieving the same level of social and economic services across states. The 12th FC therefore gave a higher degree of importance to transfers through grants and increased the share of grants in total transfers. These grants were conditional grants. The Commission had emphasized that “grants are the more effective transfer instrument for State specific and purpose specific targeting” (12th FC Report, p.14).

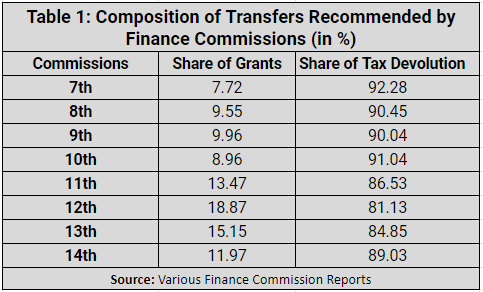

Until the 11th FC, the composition of transfers recommended by successive Commissions was heavily tilted in favour of tax sharing . The share of tax devolution in total Finance Commission transfers declined to 81 % following the recommendations of the 12th FC, from the high of 92% as recommended by the 7th FC.. The moderate shift away from tax sharing and towards grants by the 12th FC was seen as an instrument to achieve greater horizontal equity among the states. In the case of the 13th FC award, the share of tax devolution rose again due to the corresponding decline in conditional grants, and went even higher in the 14th FC award (Table 1).

The TOR of 15th FC indicate an intent to achieve a set of policy outcomes at the state level in various sectors through conditional grants.

The TOR stated,

The Commission may consider proposing measurable performance-based incentives for States, at the appropriate level of government, in following areas: (i) Efforts made by the States in expansion and deepening of tax net under GST; (ii) Efforts and Progress made in moving towards replacement rate of population growth; (iii) Achievements in implementation of flagship schemes of Government of India, disaster resilient infrastructure, sustainable development goals, and quality of expenditure; (iv) Progress made in increasing capital expenditure, eliminating losses of power sector, and improving the quality of such expenditure in generating future income streams; (v) Progress made in increasing tax/non-tax revenues, promoting savings by adoption of Direct Benefit Transfers and Public Finance Management System, promoting digital economy and removing layers between the government and the beneficiaries; (vi) Progress made in promoting ease of doing business by effecting related policy and regulatory changes and promoting labour intensive growth; (vii) Provision of grants in aid to local bodies for basic services, including quality human resources, and implementation of performance grant system in improving delivery of services; (viii) Control or lack of it in incurring expenditure on populist measures; and (ix) Progress made in sanitation, solid waste management and bringing in behavioural change to end open defecation.It may not be inaccurate to interpret “measurable performance-based incentives” as an effort to introduce conditionality-driven transfers through the Finance Commission. This brings us to the two issues of, one, the availability of fiscal space with the Finance Commission for making conditional grants after tax devolution, and, two, the desirability of such grants and the effectiveness of such transfers.

If a large share of Finance Commission transfers is set aside for conditional transfers, will this not fundamentally alter the way resources flow through the Finance Commission to the states? Would not transfer of resources by the mechanism of grants instead of tax devolution affect the freedom and manoeuvrability of the states in setting priorities?

On the issue of desirability and effectiveness, we need to evaluate the share of sector-specific conditional Financial Commission transfers in total sectoral expenditure. How large are these conditional transfers as a share of total spending by the states in specific sectors? In other words, the issue is the volume of conditional grants provided by Finance Commissions and their ability to change states’ spending behaviour.

The 14th FC in its report argued:

[T]he grants provided by the Finance Commission constitute a very small part of the total expenditure by States on the concerned sectors. It is also difficult to establish the effectiveness of these sector specific grants because there is no continuity in the sectoral priorities from one Finance Commission to another. In some cases, the links between the conditionalities and the outcomes have also been questioned by some States. Furthermore, there are far too many elements of discretion involved in identifying the sector, allocating the amounts and designing the conditionalities.The 14th FC further noted:

If the sector specific grants of the Finance Commission have not been effective, it may be partly because of the Finance Commission is not a permanent body and it would not be possible for it to implement and monitor the conditionalities.At the same time the 14th FC recognised that

there is a case for transfers from the Union to the States for specific sectors or areas, especially those with a high degree of externalities. Given the vast variation in systems and institutions, the involvement of States in the design of such schemes is critical for the desired outcomes. In order to have such a mechanism in place the Commission proposed a “new institutional arrangement embodying the principles of cooperative federalism.” This, unfortunately, was not followed up and acted on by the Government.Structure of Expenditure in a Federal Setting: The Issue of Overlapping Functional Space

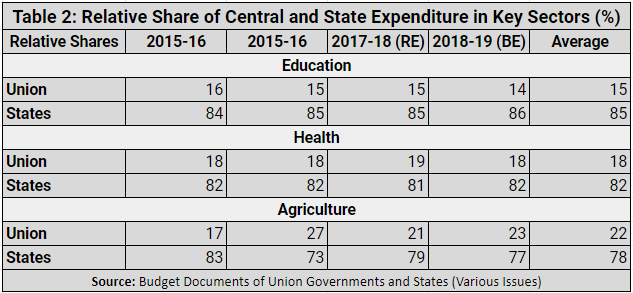

If we consider the structure of expenditure in key sectors, viz, education, health and agriculture, state expenditure is more than 75 % of the combined expenditure of the union and the states ( Table 2). In fact, it is as high as 85 % in education and 81 % of the combined expenditure in health. Since the primary expenditure responsibilities are at the state level, it is a big question if conditionality-driven transfers can change States’ spending behaviour.

Despite this structural skewedness in expenditure between the union and the states where the states have the primary responsibility in spending, central intervention in state subjects has increased significantly in the overall union budget. Analyses by Chakraborty eta al (2018) show that a large part of the revenue expenditure of the central government is spent on State and Concurrent lists subjects with a corresponding decline in expenditure on Union List subjects.

As evident, from Figure 2, the central government used to spend around 13 % of its revenue expenditure on State Lists in 2002-03, which increased to 23 % in 2008-09. Subsequently, though this share has declined, it remains as high as 16 % of the union government’s revenue expenditure (according to 2015-16 estimates). In the Concurrent List subjects the central government expenditure share has increased from 11.8 % of total revenue expenditure in 2002-03 to 16.4 % in 2015-16 (Figure 3).

Given this pattern of expenditure, there is a need to seriously think about re-prioritisation of union government expenditure. When most of the current expenditure responsibilities, be it health, education, or water supply and sanitation are with the state governments, should the central government make such large expenditure on the areas in the State and Concurrent Lists of the Constitution?

Some of this expenditure by the central government may indeed be necessary. The optimal levels of spending need to be determined keeping in mind the allocative and technical efficiency of government spending.

Since the central government has done away with the earlier setting of a revenue deficit target, it should also recast the union’s expenditure responsibilities for greater efficiency of public spending and prudent fiscal management. All this keeping in mind the Constitutional responsibilities and the fiscal space available at each level of government..

Figure 4 illustrates the increasing tendency of the central government to finance transfers to states through borrowings. Total grants as a percentage of the GDP have exceeded the centre’s revenue deficit in almost every year. This gives rise to a paradoxical situation where, on the one hand, the centre is spending on State and Concurrent List subjects, and, on the other hand, it has to resort to borrowings to transfer resources to states on subjects that are the primary responsibility of the states. Does this not require a relook at the way borrowing limits are fixed by the union government?

In this context, it needs to be highlighted that states in their representation to the 14th Finance Commission on the terms of functioning of the commission, argued that, “apart from the merits and demerits of the Centrally sponsored schemes (CSS), the increase in their number as well as of Plan grants to States reveals the excess fiscal space available to the Union Government”.

On the other hand, as summarized by the 14th FC in its report

[V]arious Ministries of the Union Government made a strong case for making larger resources available to them to fulfil their respective obligations. They also explained the rationale for nation-wide approaches to sectoral policies and the need for the Union Government to provide guidance, incentives and disincentives to the States. They have also indicated that there is an increasing awareness among Union Government Ministries about the need to provide greater flexibility to the States in implementing CSS.We need to arrive at an optimal mix of general and specific purpose transfers without violating the principles of fiscal sustainability at each level of government.

The other important aspect of CSS financing is the imposition of cesses. Constitutionally, the collections from cesses and surcharges are not shareable with the states. These collections have increased over time, both in absolute amounts and also as a percentage of the centre’s revenue receipts. As is clear from Figure 5, collection from cesses and surcharges increased from 9.43% of the centre’s gross tax revenue (GTR) in 2011-12 to a high of 16.47% in 2015-16. Though it has fallen thereafter, it is still a significant proportion of GTR.

The union government has increasingly relied on cess and surcharge revenue to meet its expenditure requirements.

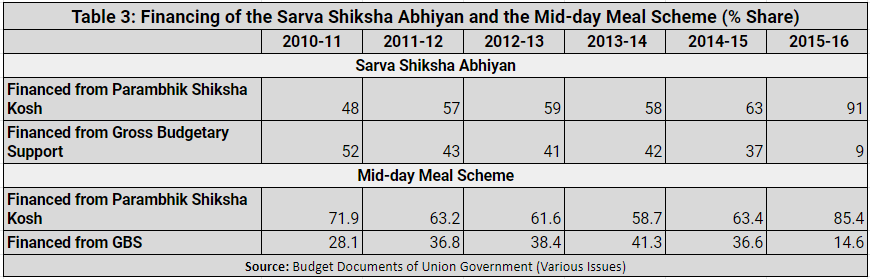

For example (Table 3), 90% of the funding for the Sarva Shiksha Abhiyan (SSA) came through the Parambhik Shiksha Kosh (PSK), the latter being financed by a cess. A similar trend can be observed for the Mid-Day Meal (MDM) scheme as well, which was financed up to 85% through the PSK. When the centre earmarks revenue it collects to finance programmes that are predominantly in the states’ domain, it not only encroaches on the states’ fiscal autonomy, but by reducing the divisible pool of taxes it also reduces the flow of untied resources to the states through tax devolution.

Conclusions

To conclude and reiterate, the Finance Commission’s fundamental task is fiscal equalisation across states. The principle of fiscal equalization tries to provide certain levels of resources to each state so that it will be possible to provide an equal provision of public services across all states. It may be inadvisable to channel conditional grants through the Finance Commission.

Hopefully, the recent changes in union-state fiscal relations would take note of the absence of a framework for non-Finance Commission grants. In the absence of the Planning Commission and discontinuation of the distinction between Plan and Non-Plan grants from 2017-18, clarity is required on the treatment of grants outside the purview of the Finance Commission. A discussion on a new framework of grants outside Finance Commission transfers should start among the stakeholders at the earliest. The new framework of grants should ensure stability in resource flows to the states to reduce state specific development deficits and these should happen outside the Finance Commission. It will be wrong to use the Finance Commission mechanism to drive conditionality-driven transfers when a significant part of transfers still fall outside the Finance Commissions.

[The views expressed here are personal]