In 2015, global carbon dioxide (CO2) emissions plateaued even as the world economy grew by about 3%. Emissions rose, but only slightly, the following year. There was much relief, even triumph, in the mainstream press and some scholarly literature, that the world economy had begun decarbonising. Reports suggested we were experiencing “a partial decoupling between the growth in CO2 emissions and that in the economy”.

Since 1970, CO2 emissions from fossil fuels―coal, oil, and gas―had grown by about 0.4% for every one percentage point rise in world GDP. But now writers surmised, they would stay flat or even decline while economic growth continued.

A second proposition, connected to the first, suggests we have been witnessing an energy transition worldwide: a shift away from fossil fuels and towards a huge expansion of renewable energy, led primarily by solar and wind power. Referring to one such fossil fuel, the energy analyst and executive chairman of Brookings India, Vikram S Mehta, wrote a couple of years ago, “Historians will look back on 2016 as the year of inflexion for the oil industry … the year the oil era began to slowly but inexorably hand over the energy baton to clean energy”(“Over the Barrel”, Indian Express, 6 February 2017). The climate change activist and writer Bill McKibben recently wrote approvingly “ … in the next few years, we will reach the peak use of fossil fuels, not because we are running out of them but because renewables will have become so cheap. … [Kingsmill] Bond writes that in the 2020s―probably the early 2020s―the demand for fossil fuels will stop growing.” ( "A Future Without Fossil Fuels", New York Review of Books, 4 April 2019)

This essay probes whether, and to what extent, these two propositions hold water. It builds on arguments made by others that talk of an energy transition is misleading (Sweeney and Treat 2017) or very partial (Pirani 2018). Using the latest available data I show that whereas we are undoubtedly witnessing an expansion of renewable energy worldwide, it does not amount to a transition. Not as yet. For the concept energy “transition” also implies that we are transiting away from what was dominant earlier and relegating it to a small proportion of the energy landscape. That is certainly not happening with oil and gas. Whether we are even transiting from coal is moot.

What’s more, given the accelerating impacts of global warming in recent years, are we transiting away from fossil fuels at anywhere near the pace that the science demands? This question has acquired even greater salience with the eruption of the “Extinction Rebellion” and other movements in Europe and elsewhere, including India, by school students and others demanding sharp cuts in emissions and the declaration of a climate crisis, both in India and on a planetary scale.

There are five sections in this article: one, on the extent to which renewables have expanded in the electricity sector worldwide; two, developments in other key sectors; three, what these trends imply for fossil fuel use over the next two decades; four, on how CO2 and methane emissions could unfold in the near future, and, finally, a brief conclusion, including some implications for those who seek a more rapid transition away from fossil fuels and a warming planet.

Limited strides in power

The greatest changes in the energy landscape worldwide have occurred in the electricity sector. According to BP’s longstanding dataset, 26,615 terrawatt-hours (TwH) 1A terawatt-hour equals a billion kilowatt-hours (kwh). One kwh equals one unit of electricity, units that appear in our electricity bills. It is, say, the energy consumed in running a typical 2,000-watt water heater for half an hour. of electricity were generated worldwide in 2018, 938 TwH more than in the previous year. Of that rise, the share of renewables - which in this BP dataset does not include hydropower - was exactly a third, led primarily by wind (142 TwH) and solar power (131 TwH) (BP 2019a: 54). In some countries, such as Denmark, Spain, and Germany, wind power now supplies a significant share of the electricity consumed. It is this kind of rise in proportion at the margins or in specific countries that has generated so much excitement about renewable energy.

The expansion of renewable energy has at least three, interrelated facets. One, the price of solar power worldwide has plummeted. Auction bids of less than 5 cents/kwh, “unthinkable for most [solar] projects even a few years ago, are now almost commonplace”, wrote Spencer Dale, BP’s group chief economist, in the 2018 edition of BP Statistical Review. In step with falling prices elsewhere, in India too the cost of generating solar power has fallen sharply, from nearly Rs 18 per kwh in 2010 to Rs 2.44 per unit in 2017. Wind power tariffs too have fallen to a record Rs 2.44 per unit, partly because of the fall in the prices of wind turbine generators.

[T]he energy transition has been limited even in the power sector worldwide, contrary to what is widely perceived.

Two, investments in power generation from renewables have risen sharply. Barely $60 billion in 2000, they grew to five times that to an average of around $300 billion a year during 2011‒2017. What’s more, they have added up to more than the investments in electricity generation from fossil fuels, which remained largely flat at $110‒130 billion over 2006‒2015. Three, this has expectedly increased generation capacities in both solar and wind. Over 2006‒2015, installed wind power capacity rose from 74 gigawatts (GW) to 433 GW, and solar, even more impressively, from 6.5 GW to 224 GW. In 2017 alone solar generation capacities increased by nearly 100 GW worldwide.

However, notwithstanding this impressive expansion in recent years, the energy transition has been limited even in the power sector worldwide, contrary to what is widely perceived. Perhaps because the numbers, particularly in popular writing, tend to typically focus on capacity, it masks the fact that the actual generation and consumption of electricity from renewables―which tend to be much lower than capacity―are quite modest as a proportion. Include large hydropower―which gives rise to a range of societal, displacement issues and considerable resistance―and still its share is less than a quarter of the primary energy 2Primary energy is energy as found in Nature, or in its natural state. It includes non-renewable sources such as coal, crude oil, gas and uranium, and renewable sources such as solar, wind, flowing water, tides, biomass, and geothermal (the Earth’s heat). They are transformed by the world’s energy systems (oil refineries, coal power stations, solar plants) to produce energy carriers (secondary energy) such as petrol, diesel or electricity. consumed in the power sector worldwide.

If one considers only wind, solar power and other new renewables, the share of electricity actually generated and consumed is as low as 8% (BP 2019a). This is the case in India as well. The share of renewables in total installed capacity in India has reached an impressive 22% as of May 2019, but its share of electricity generation is again only marginally over 8%.

Significantly, there has been hardly any shift in the fuel mix within the power sector worldwide over the past 20 years. The proportion of coal used in generating electricity (38%) in 2018 was exactly the same as it was in 1998. This is partly because of the enormous rise in coal use some years ago, in particular by China, which preceded its more recent slowing. With renewables growing but the share of nuclear power declining, the proportion of non-fossil fuels used in the power sector is currently also about the same as it was in 1998. Meanwhile, over 2001‒2015, the share of coal, oil, and gas in power generation rose from 63% to 68% (Pirani 2018).

What is happening in the other sectors?

It is not sufficiently appreciated that generating electricity accounts for only a part of the total energy consumed worldwide. According to J P Morgan’s Energy Outlook 2019, electricity accounts for merely one-sixth the energy and less than a third of global fossil fuel use. So, in order to more comprehensively assess whether and to what extent an energy transition is underway, one will have to examine what is going on in other key sectors as well.

In transport, much attention has been bestowed in recent times on the development of electric cars, in particular on the entrepreneur Elon Musk and the Tesla. Simple extrapolations from 2017 data by the International Energy Agency (IEA) suggest that there are currently a little over 4 million electric cars worldwide. These are admittedly early days, but as a proportion of the total number of vehicles―over a billion―that is quite small, merely 0.4%. And although the sales of electric vehicles are growing, particularly in China, they pale in comparison to the sales of conventional vehicles that run on petrol, diesel or gas in some of the world’s largest car markets. The share of electric cars sold in 2017 was barely 2.2% in China, 1.6% in Germany, 1.2% in the United States (US), and 1% in Japan.

There are multiple reasons why the sale of electric cars has so far been low and will continue to be so for some years. For one, many, though not all, electric car brands are expensive. Two, battery-charging points are not easy to come by, even in the US. Whereas an electric car can be charged at a simple socket at home, it is still not easy to find a charging point if one is travelling long distance. Even with the more powerful, fast chargers companies have installed for free public use, one needs to stop and wait at a charging point for half an hour while the car is charging. In countries like India, public charging points are as yet non-existent.

With the introduction of enabling regulation promoting electric vehicles in Europe and elsewhere, one anticipates an expansion of electric vehicles over the next 15 years or so. But with the number of cars and vehicles overall estimated to triple from one billion currently to 3 billion by 2050, even with expanding numbers of electric cars we will very likely end up with many more vehicles running on conventional fossil fuels than there are presently.

The transport sector emits 7 billion tonnes of CO2-equivalent, 5 billion tonnes of which stem from road transport alone. If our concern is global warming, then a shift to electric alone does not help. While these cars are lighter than conventional ones with the internal combustion engine and hence need less energy/power, the volume of emissions from charging the car battery depends on the source of its energy. As far as carbon emissions are concerned, electric cars merely displace the problem if the major source of electrical power is coal, as is the case in India and China. CO2 emitted by the coal burnt somewhere to charge the car, spreads evenly in the atmosphere in about a year irrespective of where it is emitted, contributing further to global warming. This is to say nothing about the emissions in the car’s manufacture, which are thousands of kilograms of CO2 for each car. This would improve somewhat when a greater proportion of electricity is generated from renewables, but until such time the satisfaction about climatic gains from electric vehicles needs to be tempered.

Additionally, within the transport sector there are also emissions from aviation (543 million tonnes or mt of CO2 in 2017), which has a huge carbon footprint per flyer, and from shipping/international trade (677 mt). Taken together, they are more than the carbon emissions of most countries. In neither sub-sector has there been any transition away from fossil fuels of any kind whatsoever.

So the energy transition has been limited even in the electricity sector and only the very initial steps have been taken in transport. In other key sectors of the world economy, it has been negligible. The challenges of producing very intense heat for industrial process but without using coal or other fossil fuels have not been tackled (Pirani 2018: 183). Emissions from industry in 2010 totalled over 15 billion tonnes (IPCC data), which include direct CO2 emissions, emissions from the application of heat, from processing, and from waste and wastewater. Emissions from cement production totalled 2 billion tonnes. In all this, progress has been infinitesimal.

The same holds for the homes and buildings sector. The need for heating and cooling is changing in different countries, partly influenced by global warming itself. Better-off homes and buildings that are heated or cooled are overwhelmingly dependent in the northern hemispheric winters on gas for heating and on other fossil fuels for air-conditioning, which has spread among the middle classes across the world. In an interesting but worrying development, US energy consumption rose sharply last year partly because households upped their use of gas for heating and air conditioners for cooling homes and offices to cope with extra hot days and excessively cold days at different times of the year. This occurred in China and Russia as well. To the extent that this erratic weather may be caused by climate change, this feedback loop may well occur more frequently and severely in the future, increasing the demand for energy, in turn raising emissions and future warming.

Finally, agriculture. It is one sector in which all the three major greenhouse gases―CO2, methane, and nitrous oxide―are emitted significantly, and emissions are hence measured in terms of CO2-equivalent, roughly 6 billion tonnes of CO2-eq a year. This socially crucial sector, especially in a country such as India where half the working population is still in agriculture, as a whole relies heavily on fossil fuels. This dependence is expanding―to run tractors, combined harvesters, and diesel irrigation pumps, to say nothing of the transport of inputs and produce in and out of farms.

What this implies for fossil fuel use

So what does this very limited transition in most economic sectors imply for the world’s dependence on and use of fossil fuels?

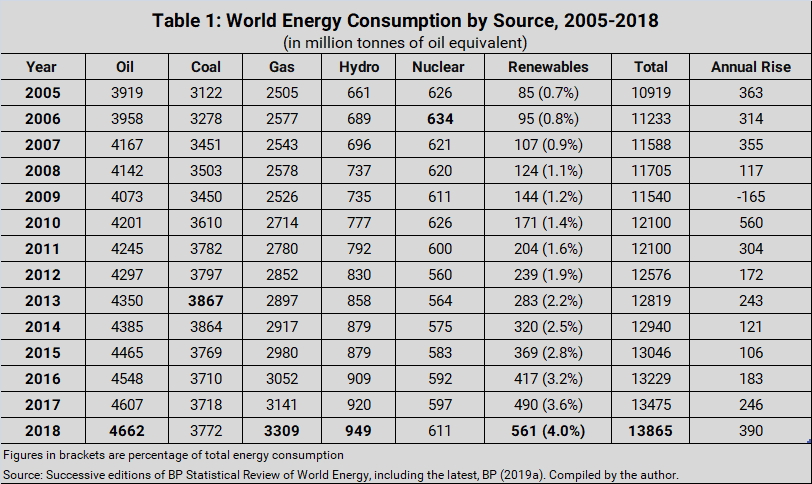

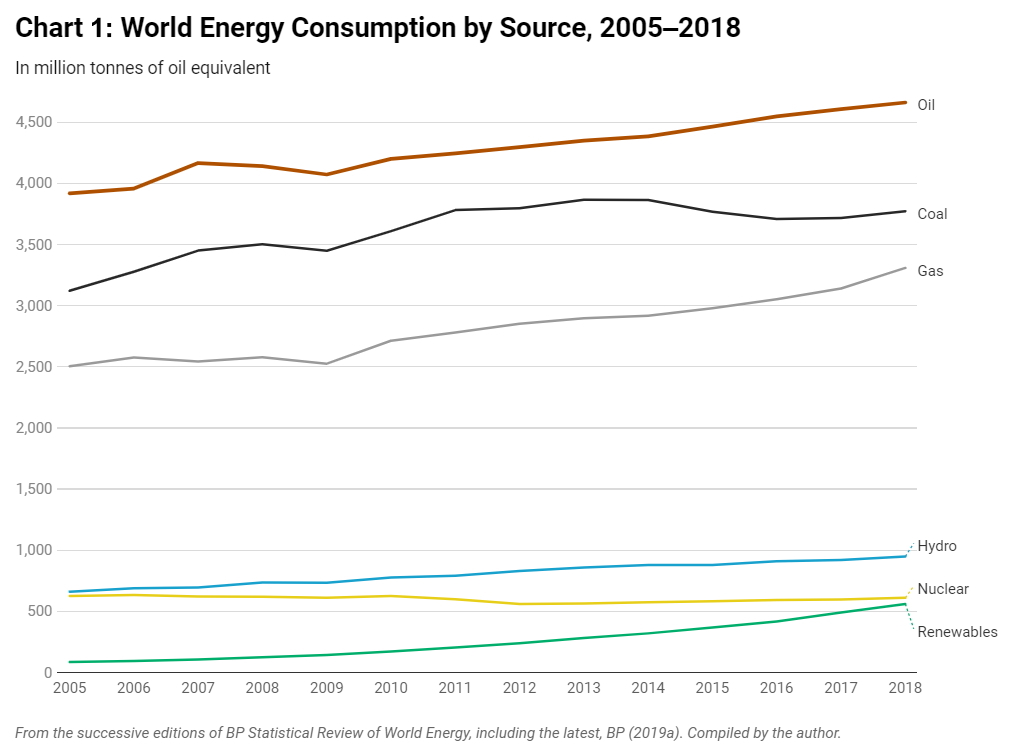

The latest data, made available in early June, suggests that in 2018, 13,865 million tonnes of oil equivalent (mtoe) 3The measure tonne of oil equivalent refers to the amount of heat equal to a tonne of oil that can be derived from any other energy source, from, say, burning coal or gas. For example, the heat derived from one tonne of oil equals a little less than 1.5 tonnes of coal, 3 tonnes of lignite, or 12 megawatt hours (MwH) of electricity. Put differently, about a 1.5 million tonnes of coal of average quality would equal a million tonnes of oil equivalent. of primary energy was consumed worldwide (not counting biomass). Of this, oil’s share was 34%, coal 27%, and natural gas 24%. So fossil fuels still currently comprise 85% of primary energy consumption (see Table 1 and Chart 1). The share of renewables is 4%, and 11%, if one includes hydropower within that category.

Figures in bold in Table 1 indicate the year in which the respective source’s consumption was at its highest ever. If an energy transition is indeed underway in all earnestness, it would imply that not just is there a considerable expansion of renewables (which is happening, column 7), but also that we are moving away from fossil fuel use. The data suggests no such thing. The only year the three fossil fuels showed a dip was in 2009 -- immediately following the economic crisis of 2007‒2008 --but they rose again following various economic stimuli applied in the US, China, and other countries.

Coal’s use peaked in 2013. It then fell slightly for three years, due to reduced consumption in the US and a cyclical slowdown in China but the fall was after a massive increase in preceding years. It has risen slightly again in 2017 and even more in 2018, driven primarily by higher coal consumption in India and China. The consumption of oil and gas is steadily rising each passing year, and reached its peak last year.

The continuous overall rise in energy use shown in the last two columns of Table 1 is relevant for future energy trends. Driven by an economic system that is focused obsessively on growth and maximising profits to the exclusion of much else, it will continue to expand in the foreseeable future, although likely at a slightly slower rate than in the past decade. According to the IEA’s World Energy Outlook 2018, 25% more energy will be needed worldwide by 2040. In societies rife with increasingly unequal incomes and wealth, this increased energy demand will largely go to meet rising middle class and elite consumption everywhere.

From where will this increasing energy demand be met, if not by fossil fuels to a significant degree? Nuclear power is experiencing a small revival and expansion since 2012, primarily due to increased use in China. But for three reasons, one does not anticipate a massive expansion of nuclear power worldwide. One, there is considerable resistance to nuclear power in several countries, particularly after the Fukushima disaster. Two, it is proving extremely costly in terms of both money and time, with most nuclear projects overshooting their budgets and timeframe. Three, many currently operating nuclear plants are at the end of their lifespan and would need to be decommissioned as pointed out by the nuclear analyst Mycle Schneider in a talk in Delhi a few years ago.

Large hydropower has been rising consistently, again due to greater expansion in China, but its rise worldwide has been modest. It is also getting adversely affected by droughts exacerbated by global warming, such as the one we are currently suffering in large tracts of India. As for biomass, though it is very significant for energy access by the poor in the poorest countries (biomass currently accounts for about 10% of the world’s primary energy needs and a much higher proportion in India), one hardly anticipates a rise, as they are being increasingly being nudged to shift to cooking gas, such as under the Ujjwala Yojana scheme in India. The extent to which they do so depends on affordability, cultural practices, and incomes.

So that really leaves wind, solar, and other new renewables which will have to expand hugely and provide electricity and energy consistently for a meaningful transition. Two key conditions would define such a transition: not only should there be a large increase in the deployment of renewable energy across sectors, but also that one is well set on a process whereby fossil fuels get relegated to a relatively small corner of the energy matrix. After all, that is what happened with previous energy transitions―it is not just that coal, steam, and later oil and gas expanded. Earlier energy sources such as wind, water, and animal power got reduced to a relatively small part of the global energy landscape.

[I]nvestment in renewables in the world barring China has been falling the last three years.

It is by now commonly held that such a massive expansion of solar and wind will indeed happen, helped by falling prices, growing concerns about climate change and improvement in battery technologies and falling prices of lithium-ion batteries. BP’s Energy Outlook 2019 foresees electricity generated from renewables rising to about 29% by 2040 and since past estimations have subsequently proved to be underestimates, some feel it may be even higher. What’s more, this will be accompanied, some say, by plateauing fossil fuel use.

However, for these two events to happen, a number of challenging barriers will need to be overcome, some of which are structural. For one, the inertia in energy systems, with the widespread existing infrastructure such as oil rigs, gas pipelines, and coal thermal plants having lifetimes of decades. Two, as John Treat and Sean Sweeney (2019) have pointed out, because the private sector is driven by profit-making, the falling renewable prices and profits act as a disincentive for fresh investment. Thus, investment in renewables in the world barring China has been falling the last three years. Three, the shift to the political Right in a number of countries, with parties and individuals hostile to climate change and a rapid renewables expansion in office in Brazil, Australia, and the US, to name just three. Four, there is the continued clout of fossil fuel companies, in many cases backed by state power. Five, there is the spreading, chaotic urbanisation and infrastructure-building worldwide, which will result in growing energy demand, with which renewables alone will find it difficult to keep pace.

Finally, the absence of Green movements demanding more solar and wind. The German renewables expansion under its Energiewende programme was viewed as a hopeful precursor of better things to come. It was aided not just by falling prices but by a strong Green movement backed by local cooperatives, which ensured the massive expansion of decentralised rooftop solar and wind. Such mass support for solar and wind is now slight, and at best growing slowly in other key energy-guzzling countries. I would suggest we pay more attention to China, whose energy consumption in 2018 of 3,273 mtoe was as much as 1,223 mtoe more than all of Europe's energy consumption of 2,050 mtoe in the same year. China continues to consume a little over half the world’s coal.

What does the literature say about the fossil fuel use in a future energy landscape? Is it likely to plateau? BP Energy Outlook 2019 projects energy use worldwide in different sectors and by fuel, up until 2040. Because of the continued growth of conventional cars and other transport and increased demand for oil in what it refers to as “emerging economies’”, the demand for “liquid fuels” (which includes biofuels) rises from 96 million barrels per day (mbd) in 2017 to 108 mbd in 2040.

Natural gas is seen as the key bridge fuel by many analysts, a bridge between the present and a green, renewables future. Its use will continue to rise for the foreseeable future, led by rising demand in the power sector and by industry. The growth in gas consumption has been facilitated by the expansion of shale gas in the US to such a degree that it is currently the world’s largest producer of natural gas. Consumption is also helped by increased and spreading supply through liquified natural gas (LNG) in which natural gas is cooled, liquified, and transported in ships to countries where it is needed. For these and other factors, natural gas consumption, it is estimated, will rise significantly, from roughly 3,550 billion cubic metres (bcm) in 2017 to about 5,400 bcm in 2040 (BP 2019b).

As for coal, its consumption is expected to flatten out and decline marginally, driven primarily by developments in China where consumption is predicted to plateau over the next 10 years or so and then fall. Coal consumption is expected to rise significantly in India. The extent to which it will actually do so is a matter of debate, given varied scenarios, excess current capacities, and subdued demand. BP Energy Outlook suggests that coal consumption will fall to about 21% of energy consumed worldwide in 2040. However, given growing economies and energy demand, as mentioned above, total energy consumption in their evolving transition scenario rises by a third by 2040. And so though coal consumption falls as a share, in absolute terms, it is still about 3,650 million tonnes of oil equivalent then.

So, if one were to summarise, fossil fuel dependence and use over the next 21 years, the consumption of oil rises 12%, and the consumption of gas is about one-and-a-half times as much as it is presently. And as for coal, we would still be consuming in 2040 about as much as we do now, and half a billion tonnes of oil equivalent more than the world did in 2005, the year increasingly regarded as the baseline for carbon emissions reduction by many countries. Fossil fuels constitute nearly three-fourths of the world’s primary energy demand in 2040 (BP 2019b: 15). I fail to fathom how this can be called an energy transition as yet. It is at best a slight shift in the fuel mix, with a greater proportion coming from natural gas. Admittedly, some transitions can take a while. The problem though, with the climate crisis intensifying each passing year, is that we do not have the luxury of time any more.

Are we decarbonising?

If we want CO2 and other greenhouse gas emissions to plateau and fall quickly, as the latest science and the climate justice movement worldwide are demanding, then it is necessary but not sufficient that renewables expand. It is not even sufficient that fossil fuels get reduced to a smaller proportion of energy used. Fossil fuel use should fall quickly in absolute terms from the present. Alas, as shown above, there is little evidence of that happening, not now and not for at least the next two decades. So what does it imply for the theory that the world economy is decarbonising, and for future greenhouse gas emissions?

The latest EDGAR data, published in January 2019, informs us that after being flat for two years, world CO2 emissions from burning fossil fuels rose by 425 million tonnes in 2017 to reach a total of 37.1 billion tonnes. This rise in emissions was driven, as we have seen above, by a small rise in coal consumption. Emissions data for 2018 is still awaited, but a further rise is unavoidable given what Table 1 tells us.

How emissions unfold in the future depends to a degree on economic growth. According to the IMF’s World Economic Outlook for January 2019, economic growth is estimated at 3.7% in 2018. The world economy is projected to grow at 3.5% in 2019 and 3.6% in 2020. Making predictions about economic growth too far into the future has too many uncertainties. With that caveat, one may point out that Thomas Piketty has hazarded that world growth rate will be 3.5% on average from now until 2030, and 3% thereafter, until 2050 (Capital in the 21st Century, p 101).

[W]hereas the years of massive rises in CO2 emissions (which one witnessed in the first decade of this century) are over, emissions will continue to rise in spurts over the foreseeable future.

There is no one-to-one correlation between economic growth and carbon emissions. They are dependent on how much energy we consume for every percentage rise in GDP (energy intensity), and how much carbon we burn for every unit of energy used (carbon intensity). Over 1970‒2010, according to the IPCC in its Fifth Assessment Report, a 1 per cent growth in world GDP resulted in a 0.4% rise in fossil fuel CO2 emissions. However, as manufacturing increasingly began to shift to coal-rich and less energy efficient China in the 1990s, this ratio was worse. During 1990‒2010, CO2 emissions rose 0.5% for every 1% growth in GDP. This is improving and should continue to do so as renewables expand further and China seeks to slow down on coal use, and increasingly shift to gas. The Chinese economy is slowing down and also changing its key driver from government-led capital investment in energy-intensive infrastructure to consumption: domestic consumption contributed three-fourths of its growth in 2018.

To summarise, continued growth in the world economy, its fluctuating carbon intensity, and expanding energy use tells us this: whereas the years of massive rises in CO2 emissions (which one witnessed in the first decade of this century) are over, emissions will continue to rise in spurts over the foreseeable future. Some years of it being flat will intersperse with years when it rises, just like it did in 2017 and 2018.

Further, arguments that we are witnessing a decarbonisation of the world economy tend to rely on CO2 numbers and do not take rising methane emissions into account, the key ingredient in natural gas. No doubt, natural gas produces, when combusted, a little less than half the CO2 that a typical new coal plant does and also less emissions than petrol when used to run a car. Natural gas also does not carry the risks of premature deaths, cancers, cardiovascular disease, asthma, neurological damage, and other health impairments associated with the arsenic, lead, chromium, mercury and other terribly toxic substances that fly ash and coal burning does.

However, the exploration and transportation of natural gas results in the emission of methane, a far more potent greenhouse gas than CO2. It is about 54 times as strong as CO2 in trapping the Earth’s heat if measured since the Industrial Revolution, and 25 times as potent if measured over a 100-year period as the IPCC does. Methane makes up most of natural gas and gets released when the gas is not burnt. It escapes during the drilling and extraction of natural gas from wells, and during its transportation in leaky pipelines. This results in large, fugitive methane emissions and hence methane emissions are far more than is usually reported (Sweeney and Treat 2017: 15).

According to the US National Oceanic and Atmospheric Administration (NOAA), methane levels in the atmosphere have been rising since 2007 and its annual rise since 2013 is much larger than it used to be. The growing consumption of natural gas in China, Europe, and elsewhere, the recent rise of shale gas production and consumption in the US, and the general prognoses of all energy studies of its expanded use into the foreseeable future suggest that methane emissions will continue to rise significantly. Hence, not only is the theory of decarbonisation premature as far as climate change is concerned, it is also incomplete and even less tenable if one were to also take methane emissions into account.

Conclusions

This essay demonstrates two sobering things: to call what is going on in the energy sector worldwide an “energy transition” is extremely premature. Even in the electricity sector, where the energy shifts have been the most pronounced, the transition has been limited. In other key sectors of the world economy, it has been infinitesimal. What is going on is an expansion, of the production and consumption of renewable energy, with the growth of the technologies and infrastructure that accompany it. Two, the decarbonisation of the world economy has not happened as yet and will not happen as a clear trend, for many years to come.

To call what is going on in the energy sector worldwide an “energy transition” is extremely premature.

This is not to claim that an energy transition will not happen. There are pressures to move more swiftly from outside the arcane realms of technology. Extreme events―intense downpours and consequent flooding, wildfires, acute heat stress, etc―droughts, a melting cryosphere, and a host of other changes caused by anthropogenic global warming are become more frequent or intense. Concern about these events is growing, albeit slowly and unevenly. This growing concern puts pressure on political elites to display greater haste. The climate justice movement in different countries has been trying to give this concern a voice and the enemy a face, the fossil fuel industry.

The hesitant and partial nature of the energy shifts has certain lessons for the climate justice movement, but more so for us all. One, anyone remotely concerned about climate change needs to act with far greater urgency to force a real, faster, and more equitable energy transition. Two, campaigns should pay greater attention to fossil fuels other than coal. Three, it is not enough for the climate justice movement to voice slogans to end fossil fuel use by 2025, or whatever date the latest science demands, or merely demand the declaration of a “climate crisis”. We need to direct our energies to urban areas and to sectors in addition to power, such as transport, industry, housing, etc. These have recently been referred to as “technological systems” (Pirani 2018). Fossil fuels are not going to stay in the ground unless the systems on which they depend transform. “I cannot envisage a transition away from fossil fuels,” Simon Pirani told me last year in an interview, “without changing all these systems.” (Nagraj Adve, "Moving Away From Fossil Fuels Isn't Separate from Moving Towards Social Justice", The Wire, 15 December 2018.) Much of the emissions from these systems come from urban areas. It is going to be a long, hard grind.

Underlying these intermediate systems lies an economic system which fosters a culture and practice that seeks to valorise growth and maximize profits at any cost. As such, it is not conducive to a rapid energy transition or decarbonisation. In constantly interrogating and challenging such a system, we need to reach out to those most affected by climate change. The climate justice movement needs to align with movements of farmers, women,forest-dwellers, and workers and all who strive for greater equity and justice, and also inform those movements of the need for urgency to enable a just transition to a decarbonised future.

(This article benefited from detailed feedback by Susana Barria, Abhishek Shaw, and an anonymous reviewer. My warm thanks to them.)