The Trade and Economic Partnership Agreement (TEPA) between India and the European Free Trade Association (EFTA) member countries (Iceland, Liechtenstein, Norway, and Switzerland) signed on 10 March 2024 has been much talked about. It is particularly notable for its inclusion of a non-binding commitment by the EFTA countries to promote foreign investments in India, with a goal of reaching $100 billion. The first $50 billion is to come over the first 10 years and the rest over the following five years. It also aims to facilitate the generation of million jobs in India from these investments over 15 years. This is important as the country is now facing a slump in inward foreign direct investment (FDI), though this could reverse soon.

While the investment target has grabbed the most attention, an equally important development can be seen in the system for resolving investment-related concerns under the TEPA. The investment chapter of the TEPA (Chapter 7) is meant to promote and facilitate investment into India, moving away from a traditional 'protection' model for foreign investment. The provisions are significant for the international regime for investment governance: they could be a new pathway for attracting investment in the global South.

Background

Under the existing framework, foreign investments are covered by a network of treaties between countries, including bilateral investment treaties (BIT), investment chapters of free trade agreements (FTAs), and national investment laws and contracts. For many years, these agreements were geared solely towards protecting investments, ensuring investors would be compensated if the value or expected profits from it were reduced due to alleged government actions.

A newer generation of investment treaties focus on the promotion and facilitation of foreign investment. This has been accompanied by a shift away from the prevailing system of resolving disputes between foreign investors and their host countries, known as the investor-state dispute settlement (ISDS) mechanism. This mechanism was embedded in investment treaties and allowed foreign investors access to dispute resolution through international arbitration in places outside the country. This is in addition to any legal redress they might have available within the country (such as approaching the courts).

The ISDS mechanism allowed foreign investors to directly sue governments in front of international arbitration tribunals for alleged breach of treaties, such as for acting in a way that resulted in the 'expropriation' of their investment. The ISDS has been much criticised in recent years for its secrecy, for awarding disproportionate compensation to investors, and for undermining climate action and human rights, amongst others. This has led to some countries either opting out or trying to reform the current system through negotiations at the United Nations (UN).

Governments are moving away from treaties that are focused solely on the protection of foreign investment to those promoting and facilitating investment.

In India’s case, the backlash against the ISDS began with the loss in international arbitration against an Australian company, White Industries, in 2011. This was followed by a string of high-profile disputes filed by foreign investors against the Indian government using the ISDS mechanism, such as by Vodafone, Devas, and Cairn Energy. Based on UN data, India has faced at least 19 claims from foreign investors since 2010, with a total value of more than $12 billion. This number could be higher because such claims need not be made public.

India’s investment treaties signed in the 1990s and early 2000s were focused on investment protection, and were invoked by foreign investors to file their ISDS claims. This led the Indian government to review and terminate most of its existing investment treaties, beginning from 2015. At the same time, it engaged with other partners to issue joint statements to clarify the scope and meaning of some contentious provisions in these bilateral investment treaties. The government also came out with a new model bilateral investment treaty in 2015, which would form the basis for India’s future investment treaties. However, this model BIT has not managed to gain much traction with other countries and is said to be already under review.

There has been a noticeable difference in how foreign investment is being considered by countries, especially those in the global South. Bruised by their own experiences with the ISDS mechanism and learning from the experiences of other countries, governments are moving away from treaties that are focused solely on the protection of foreign investment to those promoting and facilitating investment instead. Against this background, the signing of the TEPA is an important milestone since it brings in a new standard for how developing countries could consider promoting foreign investment and realising its benefits.

TEPA and investment

The TEPA’s Chapter 7 on “Investment Promotion and Cooperation” includes eight articles that, amongst others, discuss how countries can attain the stated objectives of promoting investment and generating jobs, and creating a favourable climate for FDI. The cooperation activities proposed include the identification of investment opportunities and key obstacles, the setting up of information channels on investment regulations, developing mechanisms for joint ventures amongst enterprises, facilitating skill development, and technical cooperation and development of institutional partnerships, amongst others. This is to be complemented through the regular organisation of events such as annual high-level meetings with private sector participation, business roundtables, and investment promotion events.

For these purposes, the TEPA also envisages the setting up of a sub-committee on investment promotion and cooperation, or investment sub-committee, and national contact points for facilitating communication. The mandate of the investment sub-committee is laid out in a separate annex, and requires it to generally oversee, review, and monitor the implementation of the chapter, in particular, the achievement of its investment and jobs goals.

This kind of legal commitment for quantified investment is a first for any economic agreement in the world. While the onus for meeting it rests squarely on the investors and the private sectors of the EFTA countries, their governments are expected to make every effort to promote such investments. As the investment target excludes any investment from sovereign wealth funds and portfolio investments (such as in stocks or bonds), this is expected to have a direct economic impact on the ground.

There could, for example, be the setting up and expansion of new business and joint ventures for manufacturing in India. A failure on part of the EFTA countries to fulfil this commitment could result in India taking appropriate remedial measures, such as limiting their preferential treatment for trade in goods and curbing their access to the Indian market.

The measure of its success is, however, subject to India maintaining high economic growth, which has given rise to some feasibility concerns. In footnote 7, the investment goal has been tied to India achieving a gross domestic product (GDP) growth over the next 15 years in line with its annual nominal GDP growth rate of 9.5% over the last two decades. It further anticipates that the full implementation of the TEPA, which requires efforts from all parties, will result in “an outperformance margin on investment of 3 percentage points per year, in addition to the estimated annual FDI increases from the EFTA States based on past growth rates.” While the treaty provisions alone may not be sufficient to guarantee this foreign investment goal being achieved, a good faith effort from all parties to fully implement it, coupled with strong economic growth in India, may result in its eventual realisation.

The use of institutional structures such as joint committees for carrying out consultations and dispute resolution are becoming more common in the new generation investment agreements and FTAs.

Notably, the chapter does not contain any provision on investment protection or dispute resolution. Rather, it includes a detailed procedure to review progress in the achievement of investment and jobs targets, and seeking consultations if these are not met. These targets are subject to adjustment in case of unforeseen circumstances such as “a global pandemic, war, geopolitical disruptions, financial crisis or sustained economic underperformance.”

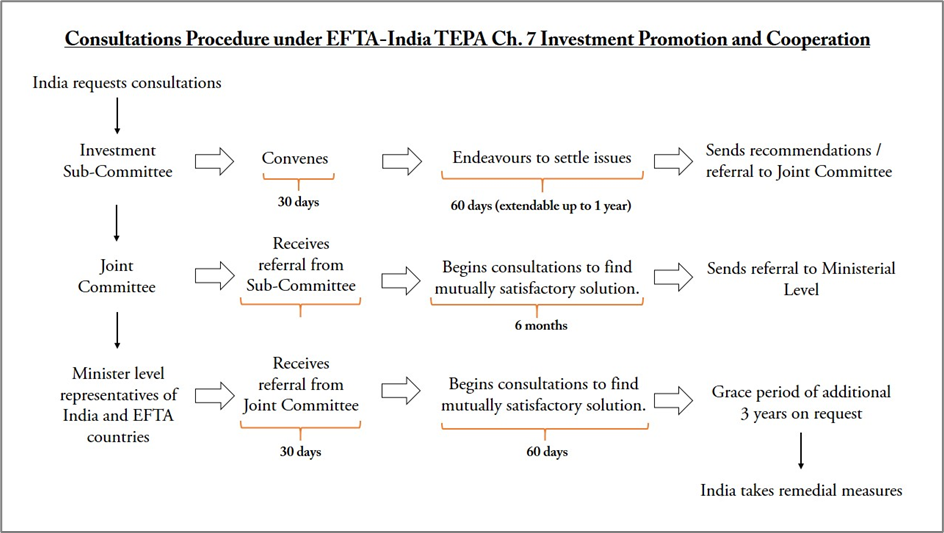

The chapter also excludes any recourse to the state-to-state dispute settlement provisions under Chapter 12 of the TEPA and makes no mention of the ISDS mechanism. Instead, it provides for a three-tier consultation procedure, which includes the investment sub-committee, the joint committee, and the ministerial level committee. It also gives detailed timelines for their convening and coming up with a mutually satisfactory solution (see Figure).

These bodies are composed of government representatives up to the level of ministers. The consultation procedures can only be invoked by India if the investment and jobs targets have not been met after 15 years, and eventual remedial measures by the country may only become applicable after a further five years. To give only one party the ability to unilaterally take such measures is unprecedented.

Figure 1: Consultation Procedure under Chapter 7 of the TEPA

If the investment goals are not met, the remedial measures, which consider temporarily increasing the tariffs on goods coming from the EFTA countries, may not be practicable and could prove difficult to invoke. This kind of cross retaliation is also subject to long consultations under Article 7.8, which will hinder their timely implementation and effectiveness. This could also risk discouraging future investment flows. Nonetheless, during the 15-year period, institutional structures should act to keep the investment goals on-track and prevent any disputes.

Learning from trends

Following India’s negative experiences with the ISDS mechanism, the country’s approach appears to have moved away from relying on standalone BITs. Instead, it appears to be negotiating agreements such as BITs and FTAs with investment promotion and facilitation provisions on a more nuanced, case-by-case basis, with the protection of India’s sovereign interests, especially taxation, being a priority.

Two of the most recent investment treaties that India has signed are with Brazil (2020) and the United Arab Emirates (2024). The treaty with Brazil is largely based on the Brazilian model known as Cooperation and Facilitation Investment Agreement (CFIA), which does not include the ISDS mechanism. India and Brazil are already part of India-Mercosur Preferential Trade Agreement (PTA), which came into force in 2009 (Mercosur is a trading bloc that includes Argentina, Brazil, Paraguay, and Uruguay). There is also interest in both India and Brazil for the expansion of this PTA,with follow-up discussions taking place, including in October 2023.

The new bilateral investment treaty with the UAE came about in the wake of the UAE-India Comprehensive Economic Partnership Agreement (CEPA), which came into force in May 2022. In its investment chapter, the CEPA noted the existence of an earlier 2013 bilateral investment treaty between both countries (which included the ISDS) and agreed to conclude a new agreement by June 2022 to replace it. While the new bilateral investment treaty with the UAE has now been signed, its text has not yet been made public and it is unknown if it includes the ISDS mechanism or not.

The experience from the TEPA shows that providing investment protection at the international level through the ISDS is not a prerequisite to attracting foreign investment. Yet, having an effective investment dispute resolution mechanism remains a pressing need.

The use of institutional structures such as joint committees for carrying out consultations and dispute resolution are becoming more common in the new generation investment agreements and FTAs. While accounting for factors such as the economic size and direction of investment flows with the partner countries, India’s preference for including such institutional elements within treaties is clear.

For instance, in the UAE-India CEPA, the technical council established under the agreement has the promotion and facilitation of trade and investment between both countries as its overall objective. It comprises representatives of both parties and its functions are spelt out for the achievement of such objectives. Thus, on receiving a referral of a specific investment and trade matter by either country, the council provides both countries the opportunity to discuss and amicably resolve the issue.

Similarly, the Brazilian investment agreement also includes the establishment of a joint committee for administration of the treaty and for the state-to-state dispute prevention procedure under the agreement. Any dispute which has not been resolved after consultations at the joint committee level can be submitted to an arbitral tribunal to decide on the obligations of the parties. However, the arbitral tribunal does not have the authority to award any compensation.

Implications

After the conclusion of the TEPA, it is possible that a new investment treaty may be signed between India and the EFTA countries, either bilaterally or as a group, for the protection of foreign investments. For instance, Switzerland currently accounts for the majority of foreign investment in India from the EFTA countries. The Indian government estimates that between 2000 and 2023, investment flows from Switzerland to India amounted to $9.77 billion, while the Swiss National Bank’s estimates from 2021 indicate that approximately 7.4 billion Swiss francs ($8.2 billion) have been invested in India. Considering investments routed through third countries, the International Monetary Fund (IMF) suggests this number may have reached as much as $35 billion by 2021.

These investments were previously covered by a bilateral investment treaty between India and Switzerland, which was signed in 1997 and terminated in 2017. Efforts are under way to sign a new investment treaty and a round of discussions was held in 2023. In an interview, the Swiss state secretary for economic affairs Helene Budliger has said that the EFTA countries hoped to “begin discussions on an investment treaty soon”.

Making greater use of state-to-state mechanisms and amicable methods such as consultations and mediation for resolving investment disputes can provide better outcomes.

The TEPA’s use of joint bodies and a state-to-state dispute resolution mechanism is in line with some recent large FTAs with investment chapters, such as the Regional Comprehensive Economic Partnership (RCEP), which is an FTA amongst 15 Asia-Pacific countries; and the African Continental Free Trade Agreement (AfCFTA), which includes almost all countries on the African continent. Neither agreement includes the ISDS mechanism, though discussions on its possible inclusion in both agreements are still going on. The TEPA’s use of extensive consultation procedures to address possible investment disputes should be a model for similar future agreements.

India has also been engaging in FTA negotiations with the United Kingdom, European Union (EU), Sri Lanka, and Peru. India’s commerce minister has highlighted that India now “goes about FTA negotiations very cautiously […] These are long sustaining agreements and unless we get that on our terms, we don’t rush into closing any FTA negotiation.” For instance, while the EU prefers its own investment court model to be used for resolving investment disputes as part of its FTAs, its impacts and possible trade-offs for India will be carefully evaluated, and the TEPA’s investment provisions could be a useful precedent.

The experience from the TEPA shows that providing investment protection at the international level through the ISDS is not a prerequisite to attracting foreign investment. Yet, having an effective investment dispute resolution mechanism remains a pressing need. This could be addressed, for example, by enhancing the use of local remedies such as domestic arbitration and the judiciary for resolving investment disputes. This could also help increase investor confidence, provide cost-effective and timely dispute resolution, and further strengthen the rule of law. In addition, making greater use of state-to-state mechanisms and amicable methods such as consultations and mediation for resolving investment disputes can provide better outcomes for both foreign investors and countries to promote and facilitate investment for sustainable development.

(1 Swiss franc = $1.10)

Danish is an international lawyer based in Geneva. The views expressed here are personal.