Several key Indian agricultural commodities are now marked by high inflation, shrinking surpluses, and trade restrictions. Since January 2022, barring a few months, India’s food inflation at the retail level has stayed above the Reserve Bank of India’s (RBI) comfort threshold of 4%.

In October 2023, the production estimates of several crops, including pigeon pea, chickpea, wheat, sugarcane, and cotton, were revised downwards compared to previous years, mostly on account of erratic rains, higher than normal temperatures, and pest attacks. As a result, India has had to restrict export of wheat, wheat flour, rice (raw rice, parboiled rice) and sugar, and impose a minimum export price (MEP) on its basmati rice exports. In 2021-22, India became the world’s second largest exporter of sugar, but since then exports have been restricted following lower yields and rising domestic demand. The country’s dependence on imported edible oils and pulses reached its highest ever levels in 2023.

And then there is the other side.

India’s dependence on crude oil imports has been deepening over the years (it was 87% in 2022–23) and global crude oil prices subject the country to volatile price shocks. An increased use of ethanol is likely to reduce India’s crude oil dependence and save more than US$4 billion annually. Reducing both emissions and the reliance on fossil fuels are two of the key drivers behind India’s fuel ethanol policy. The key feedstocks for producing ethanol in the country are sugarcane, rice, and maize.

So, the key question is if the country should prioritise achieving energy security or food security. It is moot whether India should divert crops such as rice, maize, and sugarcane for fuel production or use them to first meet food and feed demands. The position may not be as binary in the case of sugarcane, where sugar is generated as a by-product, but diverting maize and rice for ethanol production directly competes with their food and feed requirements.

The 2018 policy had set a deadline of achieving 20% blending of petrol with ethanol by 2030. However, in 2022, encouraged by the rapid progress of its ethanol programme, the government advanced the target to 2025-26.

This essay presents key findings from the authors’ recently released report, “Ethanol Blending of Petrol in India: An Assessment of Raw Material Availability” (Arcus Policy Research, 2023). The report assesses whether India can produce enough ethanol to meet its target of 20% blending of petrol with ethanol (E20) by 2025–26.

The E20 target

India’s strategy on fuel blending with ethanol is detailed in two documents – the National Policy on Biofuels (NPB) announced by the Ministry of Petroleum and Natural Gas in June 2018 (along with its amendment of June 2022) and the “Roadmap for Ethanol Blending in India 2020–25” released by the NITI Aayog and the petroleum ministry. The 2018 policy had set a deadline of achieving E20 by 2030. However, in 2022, encouraged by the rapid progress of its ethanol (for fuel blending) programme, the government advanced the target to 2025–26.

The NITI Aayog roadmap estimates that India will need about 13.5 billion litres of ethanol annually by 2025–26. Of this, about 10.16 billion litres will go towards meeting the fuel-blending mandate of E20 and the remaining will meet “other uses” in industries such as alcohol and pharmaceuticals. This ethanol is to be produced from two types of feedstock – sugarcane and food grains (mainly rice and maize).

Of the E20 requirement of 10.16 billion litres, 54% is to come from sugarcane-based derivatives and the remaining from grains. Within grains, the NITI Aayog roadmap does not detail the specific quantity of rice or maize. For non-fuel blending or 'other uses', the contribution of ethanol from sugarcane and grains is expected to be 1.34 billion litres (40%) and 2 billion litres (60%) respectively. Overall, the ethanol requirement will come equally from sugarcane and grain-based feedstocks.

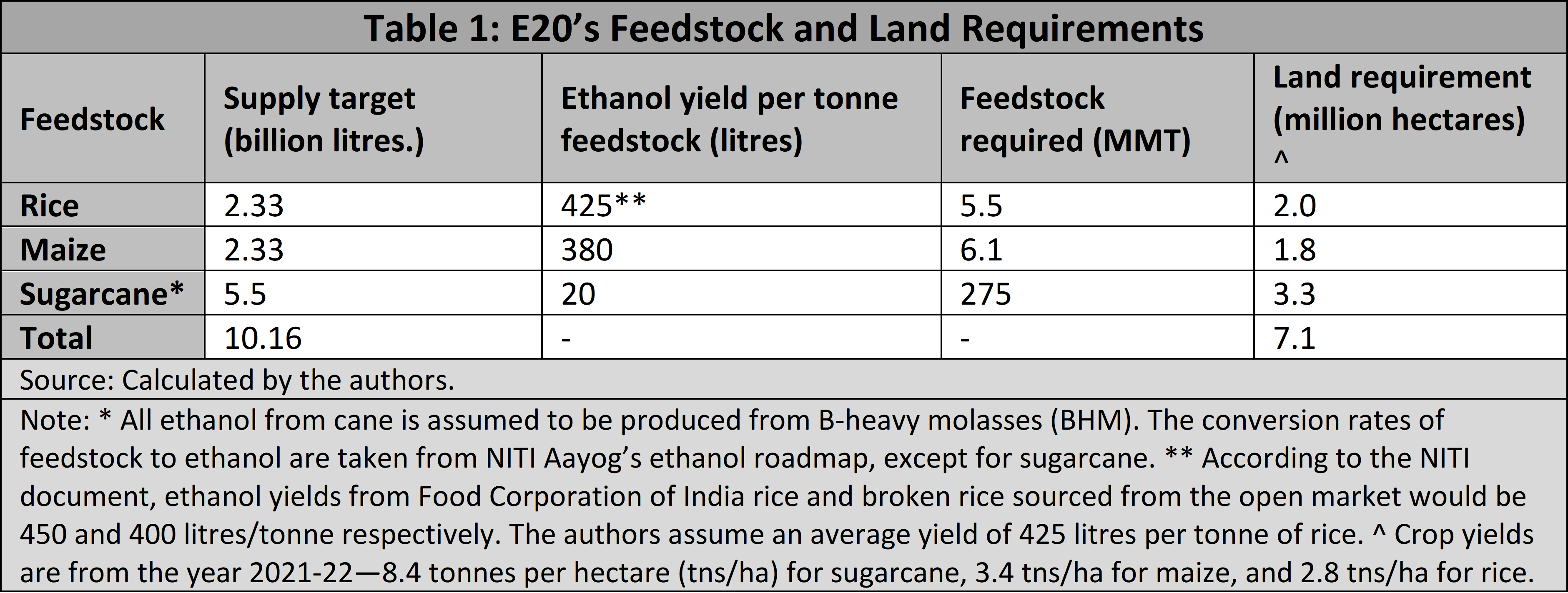

Production of one litre of ethanol requires about 2.3 kg of rice, or 2.6 kg of maize, or 50 kg of sugarcane. Using these conversion factors and the NITI Aayog roadmap, we estimate that India will need about 275 million metric tonnes (MMT) of sugarcane, 1As ethanol can be produced as a by-product of sugar manufacturing, the requirement of 275 MMT of cane cannot be exclusively attributed to ethanol. However, that is not the case with rice and maize. 6.1 MMT of maize, and about 5.5 MMT of rice to reach E20 by 2025–26 (Table 1). To meet these crop needs, India will need about 7.1 million hectares of cropped area, roughly 3% of the country’s gross cropped area.

After ascertaining these crop requirements, we map them with crop supply and demand (SND) statements (referred to as commodity balance sheets) to estimate if adequate surpluses can be made available for meeting E20 needs.

Projections

A crop’s balance sheet looks at its supply and demand pattern. Future trends are projected based on a) historical data and b) possible scenarios of future supply and demand. We assume that each of the three crops will be used first for meeting the food, feed, and stocking needs of the country, and only the residue or excess will be made available for the production of ethanol and/or exports. Calculations will certainly be different if the country prioritises ethanol over other needs such as feed or exports.

To estimate the future availability of sugarcane, we consider sugar and ethanol recovery rates, wastages along the value-chain (Nabcons 2022), diversion of sugarcane for uses other than sugar/ethanol or for export, and the desired buffer stock of sugar at the beginning of the sugar year (October to September).

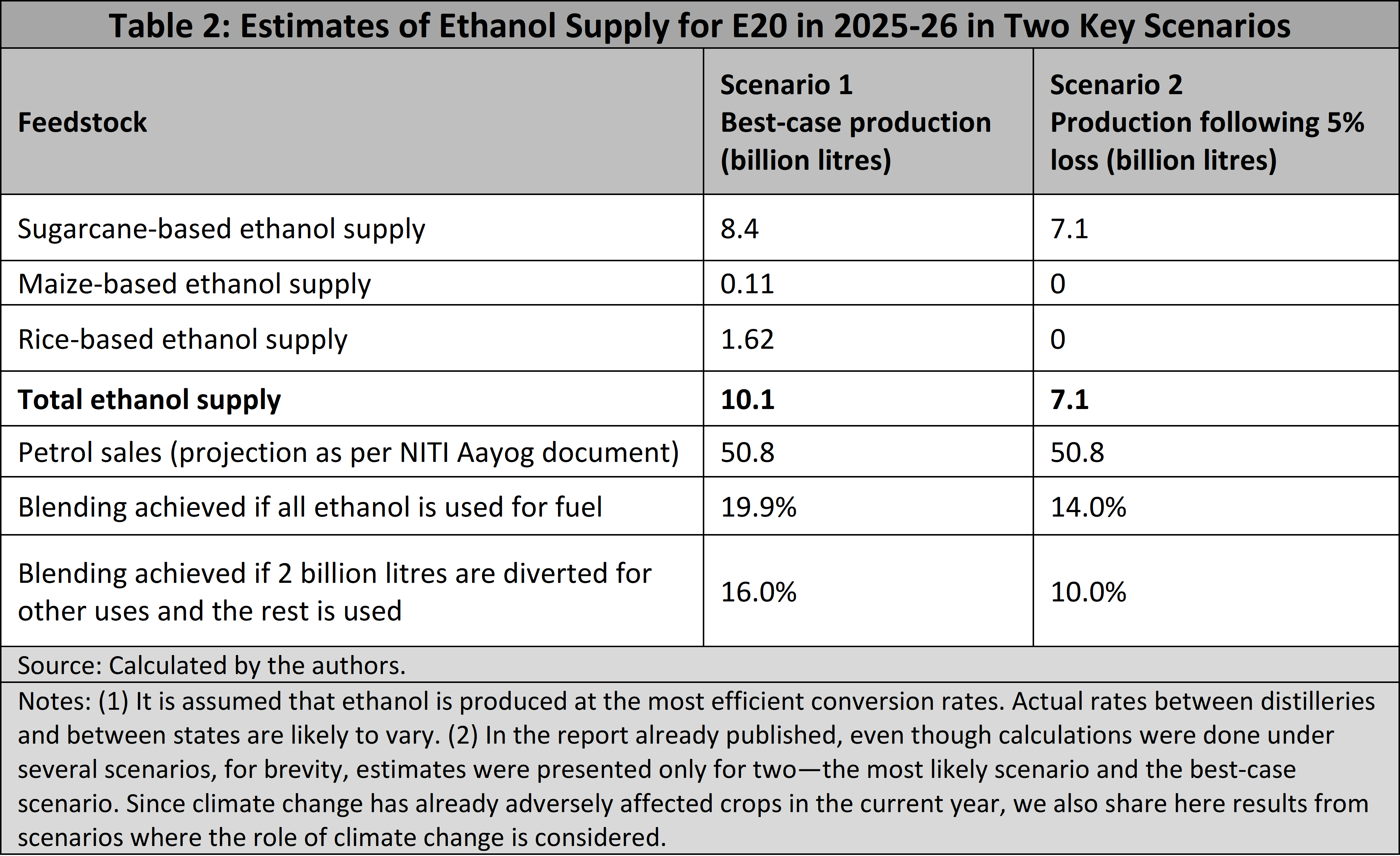

Considering various scenarios and projections, and estimating the possible supplies of feedstocks, our estimates suggest that India can produce 6.2 billion to 10.1 billion litres of ethanol by 2025-26.

The availability of sugarcane is projected under four scenarios. Two relate to the supply side and other two simulate the demand side. On the supply side, one scenario is (a) business-as-usual where we assume historical trends to continue in future, and the other, (b) a 5% drop in crop yields due to climate uncertainties or any other factors. On the demand side, there is (a) an extrapolation based on past consumption data, and (b) estimates based on discussions with the sugar industry.

The supply side scenarios for rice are the same as in the case of sugarcane. Demand scenarios are based on the extrapolation of the National Sample Survey Organisation’s 2011-12 household consumption expenditure data and NITI Aayog’s estimates for consumption. While the supply side scenarios for maize are the same as in sugarcane and rice, the demand side has an additional scenario. More than 50% of maize is consumed by the feed industry in India. Via regression, we peg maize future demand to poultry/livestock sector output growth.

Considering various scenarios and projections, and estimating the possible supplies of feedstocks, our estimates suggest that India can produce between 6.2 billion and 10.1 billion litres of ethanol by 2025–26. We present the results from two of the several scenarios projected by us (Table 2).

Our estimates suggest that if the entire ethanol production is used for fuel blending, a blending rate of 20% can be achieved by 2025–26. However, since ethanol is also required by other industries/users and this is growing at a fast pace, we assess that part of the 10.1 billion litres of ethanol will be diverted for use by these users, pulling down the country’s effective rate of fuel-blending.

The way ahead

When the National Policy on Biofuels was launched in 2018, India’s average ethanol blending rate with petrol was 2%. By ethanol supply year (ESY) 2022–23, the blending rate reached 12%. For ESY 2023–24, while the target is to achieve a 15% rate of blending, it appears unlikely to be achieved because of smaller cane and rice crops.

In 2023, the monsoon rains were 6 % below the normal, mainly because of El Niño conditions in the Pacific Ocean. More than half of India’s gross cropped area depends on these monsoon rains. As per the government’s first advance estimate, the kharif rice crop size has fallen by 4 MMT and the sugarcane crop is smaller by about 55 MMT. This implies that amongst the studied scenarios of supply, the one with lower supplies on account of yield shocks may already be emerging as more accurate. In response to smaller size of crops in the last two years, the government capped the export of sugar at 6 million tonnes and imposed restrictions on rice exports.

Sugarcane and rice were in surplus when the biofuels policy was announced. Since then, erratic temperatures and rains have affected these crops in 2022 and 2023. Therefore, the availability of feedstock for ethanol blending is also under threat.

The competition for feedstock crops between industries is on the rise. In the case of sugar, mills wanting to export more due to remunerative global prices compete with oil marketing companies, which seek more ethanol for fuel blending. In the case of maize, the competition is fierce as diverse industries – such as poultry, alcohol, and starch – need greater amounts of the crop. In the case of rice, the trade-off is between meeting its food, export, and ethanol needs.

The strategy of using water-guzzling crops such as sugarcane and rice to produce ethanol as a green fuel seems misguided. Other than the production itself that is highly water-intensive, the processing of sugarcane in mills also requires huge amounts of water. As such, before deciding on the use of such crops to produce green fuel, it is important that a comprehensive impact study on emissions and resource use across the crops’ life cycle be conducted.

Climate change is destabilising crop yields. The unpredictablity of yields makes projecting future supplies tricky. With huge investments in distillation capacities by oil marketing companies, ensuring a sustainable supply of adequate crop surpluses seems unachievable, at least by 2025–26.

In September 2023, India, the US, the United Arab Emirates, and Brazil launched the Global Biofuel Alliance. The countries agreed to provide financial and technical support to national programmes to promote the sustainable production and use of biofuels.

Alternative feedstocks for ethanol production, including second generation bioethanol technology to produce ethanol, are required. In September 2023, India, the US, the United Arab Emirates, and Brazil launched the Global Biofuel Alliance. The countries agreed to provide financial and technical support to national programmes to promote the sustainable production and use of biofuels. One of the significant contributions of the alliance could be to develop and offer technically feasible and economically viable technology to its members, which can be used to produce ethanol from agricultural waste.

Can greater investments in public transportation take some burden off the fuel requirements of the country? This in turn would reduce the ethanol requirement, easing pressures on the E20 mandate.

Conclusions

Given its rapidly growing population and the persistent threat of climate change, food and nutritional security must remain top priorities for India. The country is losing not just crop yields but also its arable land to volatile climatic events and the pressure of urbanisation and industrialisation. It therefore needs a strategic land use plan.

While the focus should be on prioritising the cultivable area for food, identifying pockets of land for crops-for-fuel could be a good starting point to achieving both food and energy security. Another aspect that may need further research is subsidies, such as for fertilisers and seeds used to produce crops for fuel versus those used to grow food. Importantly, India will need to consider and determine if crops meant for fuel production should get the same level of support as crops meant for consumption as food.

Shweta Saini is the chief executive officer at Arcus Policy Research, New Delhi. Pulkit Khatri is an economist at Arcus. Siraj Hussain was India's agriculture secretary.