In India, the imperative of adopting an industrial policy has been emphasised after the National Manufacturing Competitiveness Council reported in 2006 that the country’s manufacturing sector was in a crisis. The National Manufacturing Policy, adopted in 2011, had the target of raising the share of manufacturing in gross domestic product (GDP) to 25% within a decade, as did the “Make in India” initiative that came in 2014.

However, proactive policies for strengthening ]strategically important industries were adopted only about a decade and a half later with the launch of the Production-Linked Incentive (PLI) Scheme. This article is an attempt to assess the implementation of the PLI Scheme, which was unveiled in March 2020.

Industrial policy is perceived as explicit government support to specific sectors or companies through direct and indirect incentives, or both. In reality, governments have adopted industrial policies for restructuring struggling sectors and developing new sectors, especially those of strategic importance. It is only the pursuit of neoliberal policies that took this policy instrument out of the toolkits of many governments.

Following the economic downturn of 2008 that exposed the limitations of the market mechanism, industrial policy is back in vogue. The United Nations Conference on Trade and Development (UNCTAD) reported in 2018 that over the previous five years, “at least 84 countries – both developed and developing, accounting for about 90 per cent of global GDP, [had] adopted formal industrial development strategies” (UNCTAD 2018).

Although they never gave up supporting their domestic enterprises while professing market-oriented policies to the rest of the world, the US and the EU have now become the strongest proponents of industrial policy.

While most developing countries have relied on import protection, including quantitative restrictions, in the early phases of their industrialisation, the pursuit of industrial policy in the 21st century involves state support for strengthening domestic manufacturing industries. This is mainly for facilitating technological innovation and bridging productivity gaps. Although they never gave up supporting their domestic enterprises while professing market-oriented policies to the rest of the world, the US and the European Union (EU) have now become the strongest proponents of industrial policy. 1The two most prominent cases are the slew of state support measures that the US and the EU have been providing to their aircraft manufacturing companies, Boeing Company, and Airbus Industries. In 2004, both the US and the EU filed complaints before the World Trade Organisation’s dispute settlement body against each other challenging the state support that they were providing to their respective domestic companies. This dispute is yet unresolved. For details see, WTO (2004a), WTO (2004b).

The American strategy, which has been in the making for several years, has now reached fruition with the announcement of “Bidenomics”, the essence of which is “targeted public investment” for attracting “more private sector investment” (White House 2023). The EU, on the other hand, has adopted a European industrial policy, which “combines regulatory and financial support” for the promotion of industries in the member states (Breton 2023). The more common motivations for supporting the identified sectors and/or companies are to improve productivity, economic growth, and employment generation, though substitution of imports has increasingly become a major objective of industrial policy initiatives in recent years. 2The Biden Administration supported the enactment of the CHIPS Act in 2022 arguing that the country’s “dependence on Taiwan for chips is untenable and unsafe”. For details, see Marlow (2022). The PLI Scheme is also intended to reduce India’s import dependence in 14 identified sectors.

This trend is firmly in place despite that the World Trade Organisation (WTO) rules on subsidies explicitly prohibit the use of government support intended for the “use of domestic over imported goods”. 3Agreement on Subsidies and Countervailing Measures, 1867 U.N.T.S. 14. The interpretation of this provision was provided in the report of the Appellate Body in a dispute brought by Japan against Canada for adopting policies in its renewable energy sector that promoted the use of domestic equipment over imports. The Appellate Body ruled that Canada’s policies were tantamount to “import substitution subsidies”, which were prohibited under the Agreement on Subsidies and Countervailing Measures (ASCM) (WTO 2013).

The PLI Scheme has three major objectives. The first is ensuring that the Indian manufacturing sector creates and nurtures global champions by attracting investments in “areas of core competency and cutting-edge technology”.

It may be argued that the ASCM disciplines could have dissuaded the governments of most WTO member states from using such subsidies for promoting their domestic industries with an intention to replace imports. But with the major economies actively violating the ASCM disciplines, the pursuit of industrial policy is now the new normal.

Essentials of PLI scheme

The PLI Scheme was launched for stimulating the country’s strategically important industries by offering incentives on incremental sales of products manufactured in India. The scheme has three major objectives. One, ensuring that the Indian manufacturing sector creates and nurtures global champions by attracting investments in “areas of core competency and cutting-edge technology” (PIB 2020b). Two, making India an integral part of global supply chains by enhancing efficiencies, creating economies of scale, and enhancing exports. And, three, involving the Micro, Small, and Medium Enterprise (MSME) sector to establish strong backward linkages.

Given that the PLI Scheme was launched as a part of the Atmanirbhar Bharat Abhiyan, one of its important aspects is to incentivise incremental production so as to progressively replace imports, thus making India self-reliant in the industries covered under the scheme. In almost all industries included under the scheme, India has progressively become import dependent, with imports from China accounting for the lion’s share. 4Two industries, pharmaceutical intermediates, especially active pharmaceutical ingredients, and electronics have been most prominent in this regard. For details, see Dhar and Chalapati Rao (2020).

As a broad-based industrial policy that is anchored to the objective of curbing imports the PLI Scheme resonates more with the industrial policies undertaken by developed countries in the 20th century. However, unlike the import substitution policy in the past, which was aimed at expanding the presence of domestic companies by curbing foreign companies, the PLI Scheme invites foreign companies to participate in the strengthening of India’s manufacturing sector alongside Indian companies (Invest India 2023).

The PLI Scheme was initiated with the Union Cabinet taking decisions to incentivise domestic production in three sectors: pharmaceutical intermediates, medical devices, and mobile phones and components (PIB 2020a). Prioritising these sectors for inclusion in the PLI Scheme was not difficult to understand as they had seen consistently rising levels of imports. While imports of active pharmaceutical imports (APIs) had grown steadily over the past two decades, imports of electronic products, especially mobile phones and components, had expanded faster than any other product group since the beginning of the previous decade. There was a growing concern that if imports of electronic products continued to grow as they had, it could potentially destabilise India’s current ac/count balance.

The PLI Scheme was aimed at promoting self-reliance through reducing imports. This objective became clearer in November 2020 when the government dovetailed it with the Atmanirbhar Bharat Abhiyan adopted earlier in the year.

Prioritising the domestic manufacturing of electronic components and semiconductors was a step towards implementing the National Policy on Electronics 2019. It argued that India should position itself as a global hub for Electronics System Design and Manufacturing (ESDM) by encouraging and driving capabilities in the country for developing core components, including chipsets, and creating an enabling environment for the industry to compete globally. The semiconductor segment was initially not included in the PLI Scheme. 5This segment was covered by the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors notified on 1 April 2020. However, since several electronic products used semiconductors, it was included in a subsequent modification of the scheme in 2023.

As mentioned earlier, the PLI Scheme was aimed at promoting self-reliance through reducing imports. This objective became clearer in November 2020 when the government dovetailed it with the Atmanirbhar Bharat Abhiyan adopted earlier in the year. The purview of the scheme was extended to 10 additional industries, a mix of both consumer goods and technology-intensive industries. Textiles, food processing, and white goods industries were brought under the ambit of the scheme, alongside technology-intensive industries such as advanced chemistry cell batteries, telecom, and automobiles and components.

The production of pharmaceutical products was also included in the scheme, thus bringing the entire pharmaceutical industry under it. In September 2021, incentives were also extended to drones and drone components’ manufacturing. The period over which incentives have been offered vary significantly, from 93 years in the case of drones and drone components to 10 years for pharmaceutical intermediates. Incentives for information technology (IT) hardware were initially offered for four years but they have been extended to 10 years with the modification of the scheme in May 2023.

Eligibility conditions

The government has notified detailed guidelines for each industry to provide the wherewithal for the implementation of the PLI Scheme. The conditions laid down are unusually complex and would necessitate close monitoring by the government and its agencies at every level, almost mirroring the “licence control raj” of earlier times. While it is beyond the scope of this paper to describe the rules in detail, some of the more important rules prescribed for a few major sectors are discussed below.

An a priori condition for selecting companies in each industry is whether their global revenues are above the thresholds specified for that industry. The selected companies must meet three sets of conditions to claim the incentives. First, they are required to make the minimum level of investment prescribed for each industry, 6In general, the minimum investment thresholds include spending on research and development (R&D). and to meet a minimum level of sales during the period they receive the incentives. The quantum of incentives will depend on the actual level of sales.

While this stipulation could allow the beneficiaries of the scheme to exploit economies of scale, a failure to produce at adequate levels could result in shortages, which was a major limitation of the licencing system.

Second, companies must provide a plan for domestic value addition. In other words, they must agree to source from domestic suppliers. Third, in most industries, incentives will only be extended to a limited number of producers, a stipulation that is similar to the entry barriers that were imposed by the erstwhile industrial licencing system. While this stipulation could allow the beneficiaries of the scheme to exploit economies of scale, a failure to produce at adequate levels could result in shortages, which was a major limitation of the licencing system (Goyal et al. 1983).

Though the PLI Scheme includes penalties for non-performance, which was also a feature of the licencing system, past experience has shown that enforcement can be a major challenge. The PLI Scheme, thus, introduces a regulatory regime that is as complex as that of the licencing system.

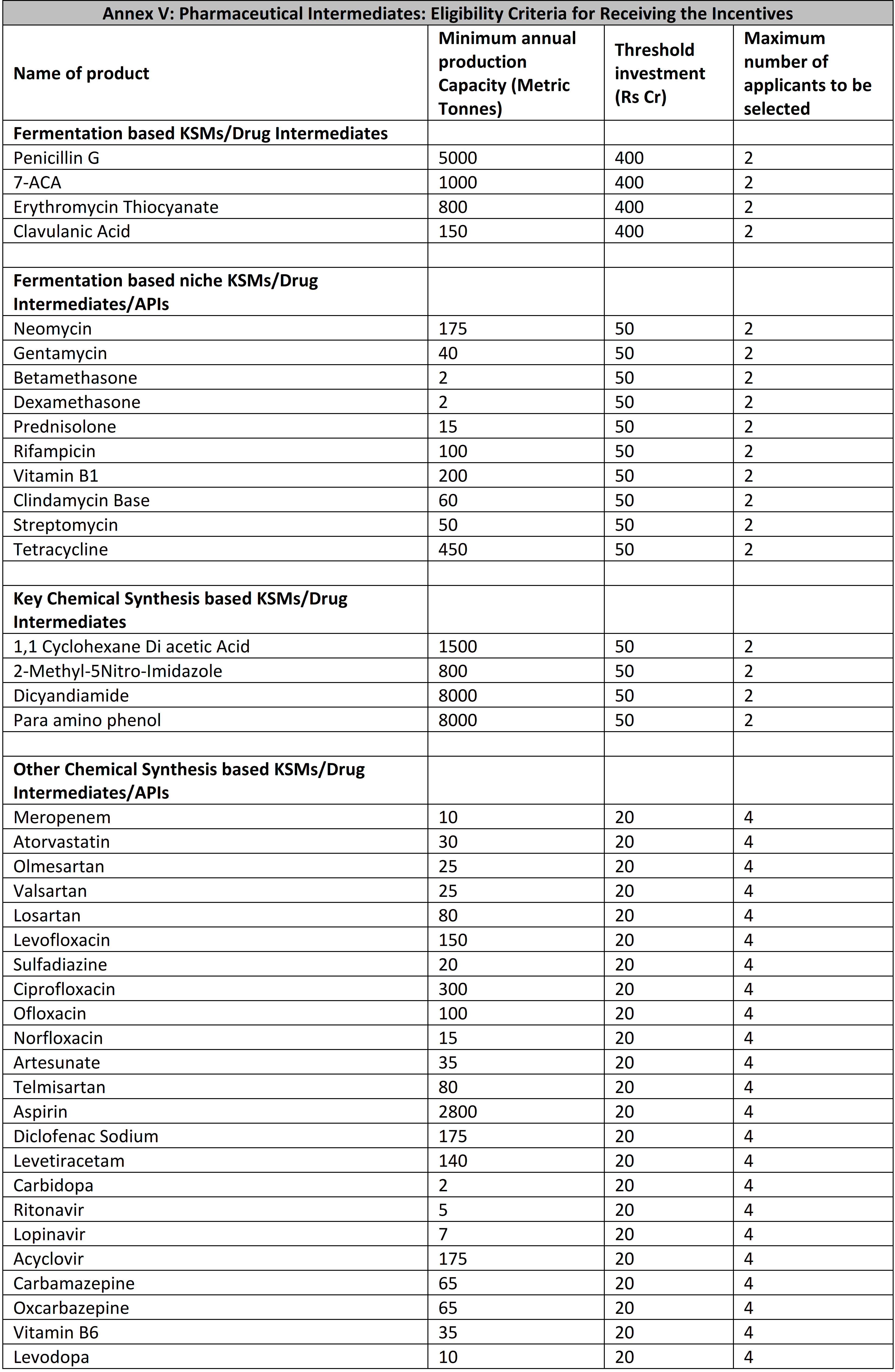

This is evident from the scheme’s guidelines for pharmaceutical intermediates, which clearly shows the connection with the licencing system. The incentives in this industry will be provided for six years for two categories of products: fermentation-based and chemical synthesis-based. Producers in the former category are entitled to a 20% incentive during the first four years, and it declines to 15% and 5% in the last two years. Producers of chemical synthesis-based products are entitled to an incentive of 10% for all the six years.

Though the Finance Minister made a commitment to spend Rs 1.97 lakh crore on the PLI Scheme for five years in 2021, the actual spending and the allocations on the scheme have been considerably smaller.

Manufacturers have to meet two key conditions to be eligible for the incentive. First, they must establish a greenfield project, for which separate records must be maintained. Second, the net worth of the applying entity (including those of its group companies) must not be less than 30% of the total proposed investment. 7The applying entity may be two or more enterprises which, directly or indirectly, are in a position to (i) exercise 26% or more of voting rights in other enterprise; or (ii) appoint more than 50% of members of board of directors in the other enterprise. The investment is the expenditure incurred on new plant, machinery, equipment, and associated utilities, as well as capital expenditure on R&D and product development related to the eligible product. And finally, domestic value addition must be at least 90% in the case of fermentation-based products and at least 70% in the case of chemical synthesis-based products.

The PLI scheme for pharmaceutical intermediates introduces yet another condition specifying the minimum annual production levels that have to be achieved to secure the incentives. This condition is akin to the “minimum economic scale” that was introduced under the licencing system in 1986 for 72 industries (Mani 1995), which resulted in restricting production capacities in the country. The PLI Scheme for pharmaceutical intermediates could experience this problem also because incentives in this industry would be based on “domestic sales” and not “total turnover”, implying that there are no incentives for exports.

Implementation

The PLI Scheme was announced with an outlay of Rs 1.97 lakh crore in November 2020, which increased marginally after drones and drone component manufacturing was brought under its ambit. In her budget speech in 2021, Finance Minister Nirmala Sitharaman announced that the government committed this amount “over five years starting FY 2021-22”. 8The government has made a longer term commitment to support the scheme as its duration for some industries, like pharmaceutical intermediates, are much longer. In May 2023, incentives for the IT hardware industry were extended from the initial period of six years to 10 years. With the addition of “PLI 2.0 for IT Hardware”, the overall outlay of the scheme is now Rs 2.05 lakh crore.

Though the finance minister made a commitment to spend Rs 1.97 lakh crore on the PLI Scheme for five years in 2021, the actual spending and the allocations on the scheme have been considerably smaller. Between 2021-22 and 2023-24, spending and allocations on the scheme were less than Rs12,000 crore, or 6% of the committed spending. This is an indication that the PLI Scheme has made little progress in most industries even three years after it was launched. The only exceptions are the mobile phone and IT hardware industries, which received more than 57% of the budgetary spending/allocations.

[I]f all the 75 companies that have received approvals in the auto component industry are allowed to produce, the fragmentation of production capacities is inevitable.

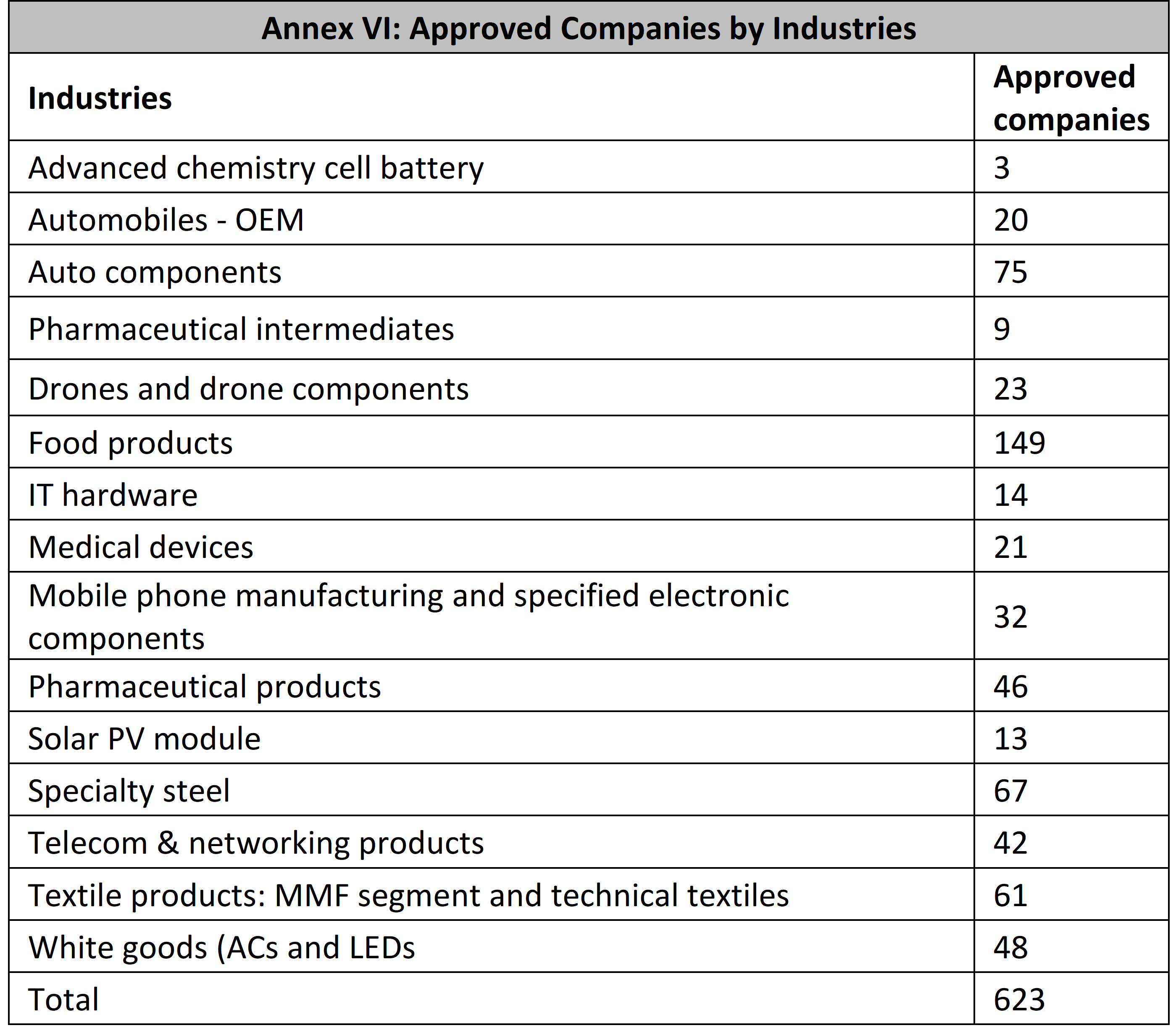

The delay in the implementation of the scheme has been largely because the process of selecting producers in the 14 industries was only completed in 2022. A total of 674 companies have received approvals, the largest in food processing and the least in pharmaceutical intermediates. Besides food processing, the automobile components industry received a large number of approvals, as did textiles.

The exceptionally large number of approvals in these industries raises questions about enhancing efficiencies by exploiting economies of scale. For example, if all the 75 companies that have received approvals in the auto component industry are allowed to produce, the fragmentation of production capacities is inevitable. Realising economies of scale, one of the factors essential for global competitiveness, will be well-nigh impossible.

On the other hand, only nine new producers have received approvals for producing pharmaceutical intermediates under the PLI Scheme, implying that the domestic production of these critical products is unlikely to see a significant expansion until the end of the decade industry (the period for the implementation of the scheme for this industry). Thus, India faces the prospect of a long-term dependence on the China for these critical products, which it can ill afford.

Assessment

The PLI Scheme intended to strengthen a set of strategically important manufacturing industries and to make them globally competitive. This initiative is of immense significance since a stagnating industrial sector has caused at least two structural problems for the Indian economy. One, an inability to provide employment opportunities to address the growing problem of unemployment and underemployment in the country, and two, an inability to free India from being import dependent for critical finished products and intermediates.

When the scheme was announced in 2020, the expectation was that the government would act in earnest to ensure its prompt implementation. However, three years after its launch, its implementation is clearly far less than desirable. The scheme is saddled with a surfeit of rules and regulations that affect its pace of implementation because it can get stuck in a regulatory quagmire. A return of the regulators is least desirable when the urgent need is to promote manufacturing.

The revival of industrial policy has brought greater attention to the development of innovation and technology, or what may broadly be termed “innovation policy”. India’s latest experiment with industry policy ignores this.

A second aspect is the lack of budgetary support. In the first three years of the five-year initiative, the PLI Scheme has received no more than 6% of the promised allocations. The mobile phone and IT hardware industries have received more than half of the total spending/allocations on the scheme during the past three years. There is, however, a question mark over the performance of these industries: their year-on-year output growth has been negative during every month in 2023.

These implementation issues indicate that the PLI Scheme needs a thorough review to move towards realising its objectives. The government’s attempts to revive India’s manufacturing sector, including the “Make in India” initiative, have not delivered. Most importantly, this initiative aimed to raise the share of the manufacturing sector in gross value added from 16% in 2014-15 to 25% by 2022 (PIB 2018). Instead, the share of the sector has declined to below 15%.

The PLI Scheme, the most ambitious of all the initiatives to strengthen India’s major manufacturing industries in the past two decades, threatens to become yet another instance of non-performance. To avoid this, the government has to address the aforementioned weaknesses and also incorporate the learnings from East Asian nations that have successfully implemented industrial policies.

Industrial policy was successfully implemented in the East Asian region because the governments used a combination of policies to “accumulate physical and human capital, allocate this capital to highly productive investments and acquire and master technology to achieve rapid productivity growth” (Page 1994). This enabled the countries to develop what may be termed “technological capabilities” that “allow productive enterprises to utilise equipment and technical information efficiently” (Lall 1996).

The revival of industrial policy has brought greater attention to the development of innovation and technology, or what may broadly be termed “innovation policy”. It has been argued that the “updated forms of industrial policy are less about market interventionism and more on technological innovation, productivity gaps, R&D and vertical specialisation” and that “well-designed industrial policies can improve competitiveness, facilitate the transfer of technologies, build innovative capacities and upgrade targeted economic sectors” (Curtis 2016). India’s latest experiment with industry policy ignores these important elements altogether.

Biswajit Dhar is Distinguished Professor, Centre for Social Development, New Delhi.