Introduction

India needs more than $10 trillion to achieve net zero emissions by 2070 (Saha 2023). Currently, India’s climate finance primarily comes from development finance institutions (DFIs, including multilateral and bilateral development finance institutions), commercial banks and financial institutions, public sector undertakings (PSUs), and the budgets of the union and state governments.

However, traditional funding sources alone are insufficient, leading to an estimated investment gap of $3.5 trillion, with around $1.4 trillion expected to come from external sources (Saha 2023). In addition, these constraints affect multiple channels of public finance. DFIs face resource limitations and competing priorities. Loan support from multilateral development banks (MDBs) is unsustainable in the long run. Central and state governments, as well as public sector undertakings (PSUs), are also constrained by limited resources and high debt profiles (Tyagi and Baid 2024). Financial support from the private sector and financial institutions, in the form of various financial instruments, thus assumes critical importance to fund this investment gap.

Transition finance refers to investment into hard-to-abate and traditionally “brown” industries (such as steel, cement, power, heavy industry, and aviation).

Within this context, India faces several challenges in accessing finance for decarbonisation, especially in the hard-to-abate sectors such as steel, cement, chemicals, aluminium, and heavy transport. These industries are responsible for nearly 40% of global CO₂ emissions, and in India, cement and steel alone contribute over 10% of India’s total greenhouse gas (GHG) emissions (CEA 2024). Moving these sectors towards low-carbon pathways will require massive capital infusion, and this is where transition finance comes into the picture.

Transition Finance

Transition finance refers to investment into hard-to-abate and traditionally “brown” industries (such as steel, cement, power, heavy industry, and aviation). These industries cannot be green in the short-term, mostly due to lack of economically and technologically feasible green alternatives. Transition finance aims to contribute towards making them “greener”, if not fully green.

However, financial instruments for transition finance are currently in the nascent stage. At the end of 2024, the issue of transition bonds totalled around $32.5 billion (Environmental Finance 2024). In India, no transition bonds have been issued so far, with activity limited to consultations and early interest from hard-to-abate sectors.

Just Transition Finance

These early consultations, however, have recognised that while India’s hard-to-abate industries work on transitioning, the process cannot focus on emissions alone. It must also ensure a just transition, one that protects workers and communities affected by transition towards a low-carbon economy.

Just transition refers to a shift towards a low-carbon economy that is fair, inclusive, and equitable, ensuring that workers, communities, and regions dependent on carbon-intensive industries (such as hard-to-abate industries) are not left behind.

Why just transition?

Transition finance is likely to cause the transitioning out of thermal plants and mines in the coming decades, exposing workers and communities to significant social risks. A study by the Council on Energy, Environment and Water (CEEW), the Natural Resources Defence Council (NRDC), and Skill Council for Green Jobs (SCGJ) estimates that India could lose around 110,000 direct coal-mining jobs by 2030 when solar and wind become more affordable than coal-powered alternatives (Tyagi et al. 2023). These disruptions extend to women and marginalised groups, who often lose informal safety nets and become more vulnerable, especially where access to land rights and social welfare is already limited.

A just transition enables private investors to integrate both environmental and social aspects into the transition to a low-carbon economy. It allows for social risks to be minimised/mitigated, social opportunities to be promoted, and calls for a people-centric and decentralised approach to achieving climate change-related goals.

Sustainability-Linked Bonds

However, achieving a just transition in hard-to-abate industries that balances environmental goals with social equity requires significant financing. This is where sustainability-linked bonds (SLBs) can play a pivotal role.

According to the International Capital Market Association (ICMA), sustainability-linked bonds are particularly suited to financing a just transition (Pfaff et al. 2024). They are a type of debt security (essentially a loan from investors) whose financial terms are tied to a company’s sustainability performance.

In India, the market for sustainability-linked bonds is still emerging, with only a handful of corporations pioneering their use to tie financial terms to sustainability performance.

The sustainability performance is measured through goals, which, in turn, are measured through key performance indicators (KPIs). The indicators are specific, measurable metrics used to track progress on sustainability commitments. For example, key performance indicators may include reducing carbon emissions, improving energy efficiency, or increasing women’s participation in leadership roles. Each key performance indicator is paired with a sustainability performance target (SPT), which sets a clear, time-bound milestone, for instance, cutting emissions by 25% by 2030.

These key performance indicators are usually related to sustainable outcomes, focusing on social and environmental aspects. On the achievement of these targets, borrowers are eligible for rebates on interest rates, thereby reducing the cost of financing (Government of India 2023). However, if the issuer fails to meet these key performance indicators, they agree to pay a higher interest rate to bondholders.

Methodology

The International Capital Market Association’s Sustainability-Linked Bond Principles (ICMA SLBP) provides a globally recognised voluntary framework for evaluating the credibility and integrity of the bonds. The key performance indicators of Indian sustainability-linked bonds have been reviewed and benchmarked against categories outlined in the ICMA SLB and KPI Registry. Given the limited number of sustainability-linked bonds issued in India so far (only five have been issued till date), this research has examined all existing issues rather than focusing on a specific timeframe.

Findings

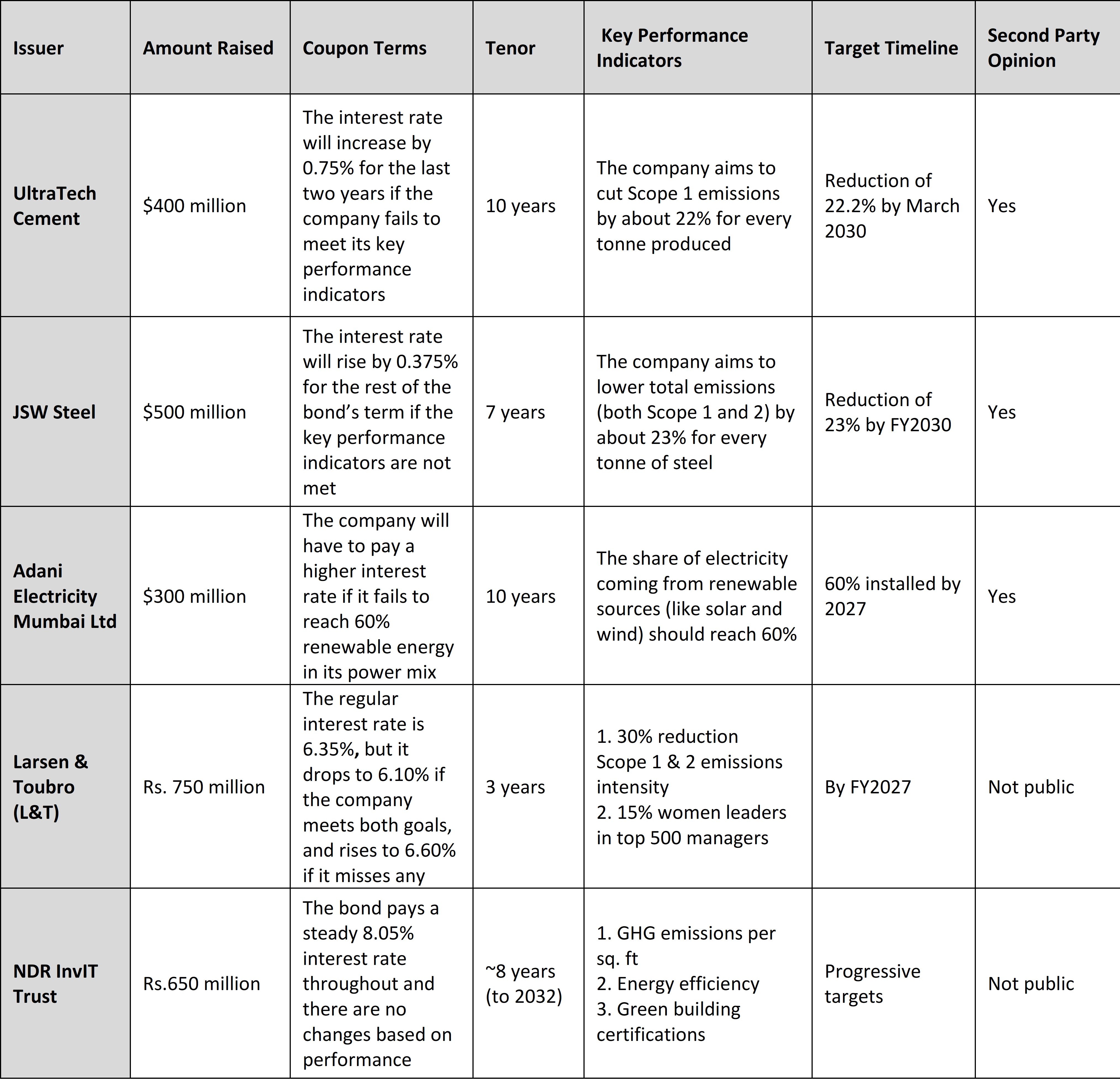

In India, the market for sustainability-linked bonds is still emerging, with only a handful of corporations pioneering their use to tie financial terms to sustainability performance. The table below provides an overview of sustainability-linked bond issues by Indian entities to date, highlighting the amount raised, coupon structures, key performance indicators, timelines, and whether a second party opinion (SPO) was obtained.

A coupon is the interest rate that a bond issuer pays to investors and is essentially the bond’s annual return. Scope 1 emissions are greenhouse gases directly released by a company’s own operations (like fuel burned in its factories). Scope 2 emissions are greenhouse gases released from the electricity or energy the company buys and uses. A second party opinion is an independent review that checks whether a company’s sustainability goals in a bond are credible and aligned with global standards.

Table: General Information on Indian Sustainability-Linked Bonds

As can be seen, the cumulative disclosed finance issued through sustainability-linked bonds in India exceeds $1.2 billion. All these bonds have been issued by private sector companies, with issuers spanning hard-to-abate sectors such as cement (UltraTech), steel (JSW Steel), electricity distribution (Adani Electricity), infrastructure (L&T), and logistics (NDR InvIT Trust).

Of the sustainability-linked bonds, 60% were issued in US dollars. However, there is a visible shift towards issuing in Indian rupees, with Larsen & Toubro and NDR InvIT launching rupee-denominated bonds. But sustainability-linked bonds issued in rupees are significantly smaller than dollar-denominated sustainability-linked bonds, with L&T’s $8.7 million and NDR InvIT’s $7.5 million being a fraction of larger dollar deals such as JSW Steel’s $500 million or UltraTech’s $400 million.

Sustainability-linked bonds in India vary in maturity, though shorter tenors (three to eight years) are preferred. Two of the earliest deals by UltraTech and Adani Electricity have 10-year maturities (2031), while L&T’s three-year sustainability-linked bonds will mature in 2028, and NDR InvIT’s will mature in 2032.

Benchmarking Indian sustainability-linked bonds

The International Capital Market Association’s Sustainability-Linked Bond Principles outlines five core components that ensure the credibility and effectiveness of sustainability-linked bonds. These are as follows:

1. Selection of key performance indicators: requires issuers to choose indicators that are material, measurable, and verifiable, supported by baseline data, historical performance, and a clear rationale for selection.

2. Calibration of sustainability performance targets: involves setting ambitious and time-bound targets aligned with global or national climate goals and disclosing the logic behind these targets.

3. Bond characteristics: ensures that financial features such as coupon step-ups or penalties are clearly linked to the achievement or failure of sustainability performance targets.

4. Reporting: mandates regular updates on key performance indicators progress, with transparent disclosure in public documents.

5. Verification: emphasises the role of independent reviewers through second party opinions to prevent greenwashing (making something seem environmentally friendly through marketing or claims, even when it is not).

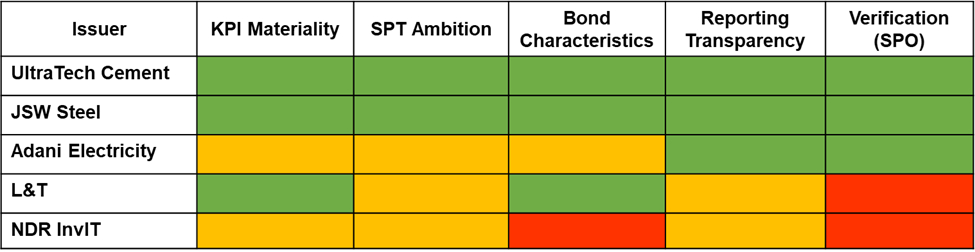

Figure: Heat Map of Indian Sustainability-Linked Bonds Alignment to ICMA SLBP

UltraTech Cement and JSW Steel exhibit strong alignment across all dimensions. Both issuers have selected sector-specific key performance indicators that are material, measurable, and directly tied to their decarbonisation pathways. Their key performance indicators are ambitious, time-bound, and benchmarked. The design of their bond characteristics, wherein coupon step-ups are directly linked to the performance of key performance indicators, ensures accountability and financial consequences for non-compliance.

Further, both companies maintain robust reporting practices, with clear disclosures on the progress of key performance indicators, which are supported by second party opinions. This reduces the risk of greenwashing (when a company makes something look environmentally friendly even though it is not).

This research goes a step further by assessing how, if at all, social aspects are reflected within the Indian sustainability-linked bonds landscape.

In contrast, Adani Electricity displays a moderate level of alignment. While its key performance indicators are relevant and measurable, there is limited information regarding the calibration of its sustainability performance targets. Its bond characteristics are less transparent in terms of how penalties or incentives are structured. Although the company provides some level of reporting, it lacks the depth and rigour of the disclosures made by UltraTech and JSW Steel, resulting in moderate transparency.

Larsen & Toubro (L&T) and NDR InvIT Trust, meanwhile, reveal gaps in alignment, particularly in the areas of verification and reporting. Neither issuer has publicly disclosed a second party opinion. Additionally, their reporting practices lack sufficient detail or frequency to meet the transparency expectations of the International Capital Market Association’s framework.

As a tool for just transition

While the International Capital Market Association’s Sustainability-Linked Bond Principles framework does not require issuers to include social dimensions in their key performance indicators selection, advancing a just transition demands precisely that. This research therefore goes a step further by assessing how, if at all, social aspects are reflected within the Indian sustainability-linked bonds landscape.

So far, L&T’s inclusion of a social key performance indicator—targeting 15% women leaders in its top 500 managers by FY 2027—is the only instance where a non-environmental dimension has been explicitly integrated. Other issuers focus exclusively on environmental indicators such as reducing GHG emissions per square foot, improving energy efficiency, or achieving green building certifications.

Overall, while Indian sustainability-linked bonds align structurally with the International Capital Market Association’s framework, they fall short of embodying the principles of a just transition, which requires the integration of environmental performance with social equity and community well-being.

Discussion

With only five sustainability-linked bonds issued in the Indian markets so far, the findings show that they are still at an early stage in their evolution and that their potential as a tool to advance just transition remains underutilised. While these instruments broadly adhere to the International Capital Market Association’s environmental requirements, particularly in selecting measurable and sector-specific key performance indicators, the broader social dimensions of just transition are either absent or marginally addressed.

First, India needs a transition finance taxonomy that defines what constitutes a “credible transition” and establishes clear standards for both environmental and social key performance indicators.

Another area of concern is the fragmentation and opacity of disclosures. While UltraTech Cement and JSW Steel have set ambitious key performance indicators and engaged third-party verifiers, others such as L&T and NDR InvIT Trust provide limited or no publicly available second party opinions. This lack of transparency reduces investor confidence and leaves room for greenwashing.

Finally, the relatively small size of Indian rupee-denominated sustainability-linked bonds compared to US dollar issues indicates that the domestic market for sustainability-linked instruments is still shallow. The limited participation of Indian institutional investors, combined with a lack of awareness and standardised benchmarks for sustainability-linked bonds, may be slowing adoption.

Recommendations

First, India needs a transition finance taxonomy that defines what constitutes a “credible transition” and establishes clear standards for both environmental and social key performance indicators. It should ensure that hard-to-abate sectors have a roadmap for incremental improvements towards a just transition.

Second, regulatory authorities like the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) could mandate, or at the least incentivise, the inclusion of social key performance indicators alongside environmental metrics. For example, step-down coupon mechanisms could reward issuers who meet both emission reduction and social inclusion goals. The government could also provide tax benefits for sustainability-linked bonds that incorporate comprehensive just transition measures.

Third, to build credibility and avoid greenwashing, independent third-party verification should be made mandatory.

India’s micro, small, and medium enterprises (MSME) sector employs millions of people and includes many small industries that emit significant carbon but have little access to sustainability finance. Because awareness and expertise around sustainability-linked bonds are still low, these businesses are largely left out. The government could change this by supporting pooled sustainability-linked bonds (where several MSMEs raise funds together) or by setting up a credit guarantee fund so that the government or banks share part of the risk if these businesses fail to meet their sustainability targets.

India’s path to net zero cannot be built on environmental ambition alone; it must also be fair and inclusive. Sustainability-linked bonds offer a promising way to align finance with both climate and social goals, encouraging industries to cut emissions while supporting workers and communities in transition.

Anshula Tiwari is a consultant working on education, skilling, corporate social responsibility, and climate-related research.