Indian dairy is one of the most important segments within agriculture; it is also the fastest growing segment. In a sector that is otherwise widely acknowledged as being in a crisis, dairy has often provided the rare happy news, growing routinely in real terms at over 5% per annum in recent years. It accounts for two-thirds of the value of output in the livestock sector that, in turns, accounts for a quarter of the country’s agricultural GDP. Dairy has therefore become an obvious focal point for the government’s goal to double farmers’ incomes by 2022.

Dairy is vital to rural livelihoods. There are an estimated 75 million dairy farmers in the country 1 Estimates vary depending on the definition used. The 70th Round of the National Sample Survey’s Situation Assessment of Agricultural Households, for example, estimates that there are 56.56 million households involved in animal husbandry in 2012-13, almost 63% of all agricultural household. This ranges from 17.7% in Arunachal Pradesh to 95.2% in Punjab. , a number larger than the entire population of countries such as the UK, France, Italy or Thailand. It is especially important for women (who account for over 60% of the days devoted to animal rearing 2 This figure is based on a 7-day recall of activities, from the National Sample Survey, 68th Round, Employment-Unemployment Survey, 2011-12. ) and those with little land for whom it is an overwhelmingly important source of income. Dairy supply chains have historically also generated substantial employment opportunities. The dairy sector is arguably one of the most complex in the economy, connecting animals, crops, water and humans in a tangled and fragile web.

This article attempts to trace the trajectory of Indian dairy since Independence and to present the challenges currently faced by the sector. That this article comes at a time when India has chosen to walk away from the Regional Comprehensive Economic Partnership (RCEP) offers us an opportunity to reflect on where we are and where we are headed

1. The Beginnings: Amul and Operation Flood

The White Revolution or Operation Flood, based on the Anand model of cooperative dairying that preceded it, is often regarded as one of the most successful examples of Indian innovation in the 20th century. It transformed the dairy landscape of India, with positive material consequences for a large number of farmers across the country.

There was nothing fortuitous about the dairy revolution in India. Led by the dogged efforts of the triumvirate of Tribhuvandas Patel, H.M. Dalaya and Verghese Kurien, the team of Anand in Gujarat brought together complementary talents and strengths to tackle a local problem – of middlemen in the milk supply chain that was, at that time, controlled by a single large dairy.

The success of Amul is an example of an effort that brought together institutional, technical and market innovation, with tons of political will, all reined in for a larger shared purpose.

Patel’s empathy and connect with the farmers prompted and enabled him to organize them into a cooperative in the best sense of the word. Kurien’s book “I too had a Dream“ reveals the full measure of Patel’s colossal contributions. Dalaya brought in expertise in dairy technology; his adaptation of modern technology to local contexts was the bulwark of Amul’s early success. For example, the ability to make milk powder from buffalo milk was at that time regarded as impossible. Working with farmers who mostly reared buffaloes meant that the ability to make powder from buffalo milk was crucial – enabling Amul to smoothen supplies that are seasonal to service demand that is not. 3 Milk is typically converted to powder in the flush season, when supply is plentiful and is reconstituted into liquid milk in the lean season when supply dries up. Kurien’s unique capabilities as manager, strategist, lobbyist and paver of paths shaped the trajectory of Amul’s growth.

The dairy cooperative movement in India also owes much to Sardar Patel’s political capital and stewardship, as to Morarji Desai’s, whose commitment to Amul, and to cooperatives, more generally, seems too much to expect from politicians today. The success of Amul is an example of an effort that brought together institutional, technical and market innovation, with tons of political will, all reined in for a larger shared purpose. It is also worth remembering that this home-grown intervention, with inspiration and learning from several other dairy producing countries, was nurtured in a context where Indian dairy was sheltered from global competition.

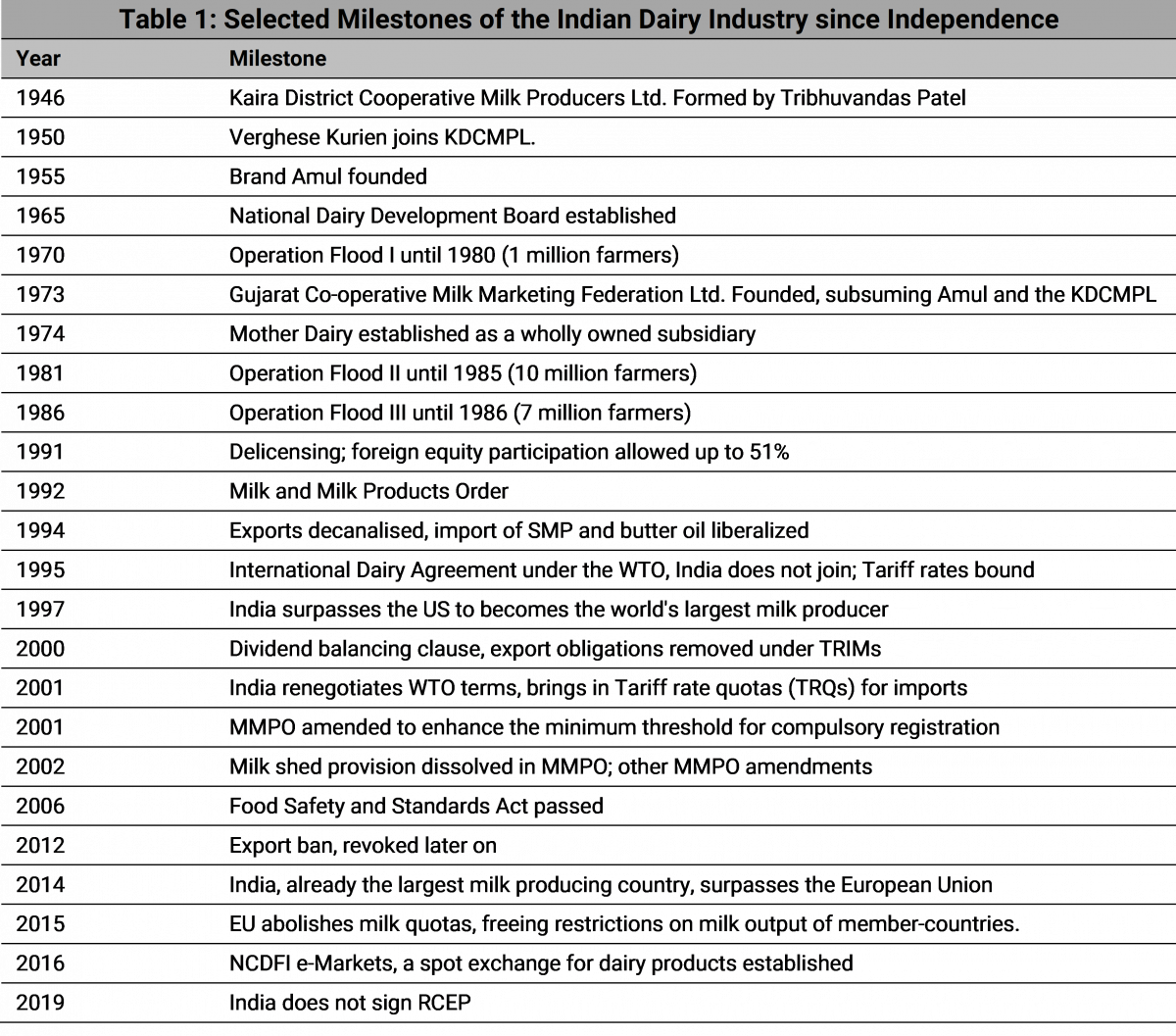

In an incident now well-known, in 1964 the then Prime Minister Lal Bahadur Shastri, on a visit to Anand to inaugurate a cattle feed plant, chose to spend a night in the village, unknown to all but a few. His goal was to fathom the ingredients of Amul and to see if these could be replicated in other parts of the country. His visit led to the establishment of the National Dairy Development Board in 1965 (Table 1).

Since then, up until 1996, three phases of Operation Flood – it is said that Kurien himself chose this name for its dramatic register – were implemented with the goal of reaching around 18 million farmers, a significant proportion of whom were women and the functionally landless.

We know Kurien’s many contributions in rather general terms. However, perhaps his single most crucial contribution was his ingenious use of food aid under Operation Flood. At that time, India was offered food aid in the form of milk powder and butter oil by the then European Community. Its sale in areas where local milk producers served consumers would have spelt disaster for them. Instead, Kurien urged the Government to direct food aid to urban centres where demand outstripped supply and to use the proceeds of such sale to build milk-processing capacity in production centres as part of a National Milk Grid. In one act, Kurien achieved three things. He reconfigured markets ensuring that milk in the form of aid did not undermine local dairy producers, ensured that consumers in milk-deficient regions got access to milk at reasonable rates, while generating scarce funds for investment.

Operation Flood’s impacts on poverty alleviation are somewhat well-researched. Remarkably, since its founding, both Amul and the National Dairy Development Board (NDDB) have evolved with the Indian consumer. As consumer diets changed, first gradually, then rapidly, Indian dairy cooperatives have kept pace, with offerings of processed products, butter, ghee, cream, sweets, chocolate and ice cream, with innovations in last mile delivery. Importantly, the cooperatives have also responded to the evolving needs of the farmer, expanding the range of input services and development activities upstream, including cattle feed, breeding, artificial insemination services, animal health and nutrition.

More generally. Amul was also perhaps a pioneer in prioritizing food safety at a time when these concerns were less well articulated. Amul is often credited with altering consumer perceptions that fresh milk purchased directly from milk vendors was safer than those that came in packets. Further, in its choice of sticking to HTST (High Temperature Short Time pasteurization) technology to pasteurize milk over the more expensive UHT (Ultra High Temperature pasteurization), Amul ensured that milk was affordable. 4 The Amul approach is often contrasted with the choices made by dairies in Pakistan, for example, that focussed overwhelmingly on UHT. UHT (heating raw milk to 135 degrees for 2-5 seconds) has a longer shelf life unrefrigerated but is more expensive. HTST (High-temperature short time) that heats milk to 75 degrees for 15 seconds produces milk that needs refrigeration and is more perishable but less expensive.

By the time Operation Flood ended in 1996, India had a thriving dairy sector. The Gujarat Cooperative Milk Marketing Federation (GCMMF), which subsumed 18 cooperatives, including the original one in Kaira district, had become the largest dairy processor, a position it still holds without the slightest threat. With an expansion of domestic milk production, India ceased to be dependent on imports, attained self-sufficiency and was competitive enough to export in some years (Figure 1).

The White Revolution, however, had its share of critics, many of whom were in turn criticised for their criticisms. There was scepticism, for example, that the cooperative model would not succeed in other contexts. That this was indeed the case —attributed variously to political interference, cultural differences, caste issues and so on — remains one of the more disappointing aspects of Operation Flood. Another criticism levelled against Operation Flood is that it increased the burden on women, who are disproportionately involved in the care of dairy animals. Indeed, women’s role in dairy today remains distressingly invisible, frustrating our understanding of what commercial dairy implies for their well-being.

Early critics were also concerned that with organized institutions procuring milk virtually at the doorstep with dairy farmers preferred to sell milk for cash rather than consume it themselves, leading to economic prosperity at the expense of their own nutrition. Flagship surveys, of the now defunct National Nutrition Monitoring Bureau (NNMB) in select states, as well as the nationwide National Sample Survey on consumption expenditure, note that growth in per capita and per household intake/consumption of milk have not been quite as impressive as the growth in per capita availability of milk (Figure 2). A bulk of the growth in consumption has come from those already consuming milk, from the relatively richer households and in the form of processed products. Kurien, while acknowledging that this could be a problem, maintained that as long as dairy producers earned cash, they would allocate it to what they deemed best, perhaps even to more nutritious food overall. 5 One of the few rigorous studies on this issue is by Alderman, H. (1987). Cooperative dairy development in Karnataka, India: An assessment , Volume 64, International Food Policy Research Institute, which suggests that this relationship is complex.

Field studies, even today, invariably show that as soon as marketing channels develop, households tend to sell rather than consume milk, especially where milk consumption is not popular. In the context of widespread malnutrition and the apparent links between stature and consumption of milk protein, this important issue remains unaddressed, one that we will return to later.

The dairy revolution in India was built around milk from buffaloes rather than cows. Where cows were the norm, the keystone of the Indian dairy revolution was crossing indigenous (zebu) and exotic breeds, especially of the Jersey, Holstein-Friesian (HF). This is especially true in states such as Tamil Nadu and Kerala, where early foreign bilateral cooperation in dairy development introduced non-native breeds, which are less hardy and need quality feed but which yield more milk and thus higher returns. Experts note that the higher returns to the exotic cross-breeds came not so much because of the breeds but because of the better quality of feed they were provided. Indeed, this is one of the more contentious issues today: cross-breeding has crowded out indigenous breeds that in fact are more suited to the range of climatic conditions in India.

2. After the Flood: The private sector emerges and with it, mergers and acquisitions

In 1991, as Operation Flood was in its third and last phase, India embarked on broad-based economic reforms. Although agriculture remained largely out of the purview, industrial licensing in dairy was abolished and private players could now set up their own dairies. Foreign equity was permitted up to 51 per cent in milk products that did not include malted products. This led to some chaos – unregulated dairies mushroomed delivering adulterated and contaminated milk. Order was restored in 1992 through a licencing system under the Milk and Milk Products Order (MMPO) that would allow some degree of oversight and regulation. The concept of milk sheds ensured that each dairy could source their milk from dedicated areas. Periodic amendments raised the threshold for registration and in 2002 the MMPO was amended to dismantle the concept of milk sheds.

In reality though, it is uncommon, then as now, to see private organized players competing for milk supplies in the same village, even if they operate in the same geographies. In 2000, under Trade Related Investment Measures (TRIMS) agreement of the World Trade Organization (WTO) that liberalized cross-border investments, obligations by firms to offset repatriation of dividends on foreign investment via equivalent export earnings were also abolished, allowing more freedom to the private sector.

These changes led to a dramatic rise in processing capacity propelled by a growth in the number of relatively large private players (Figure 3).

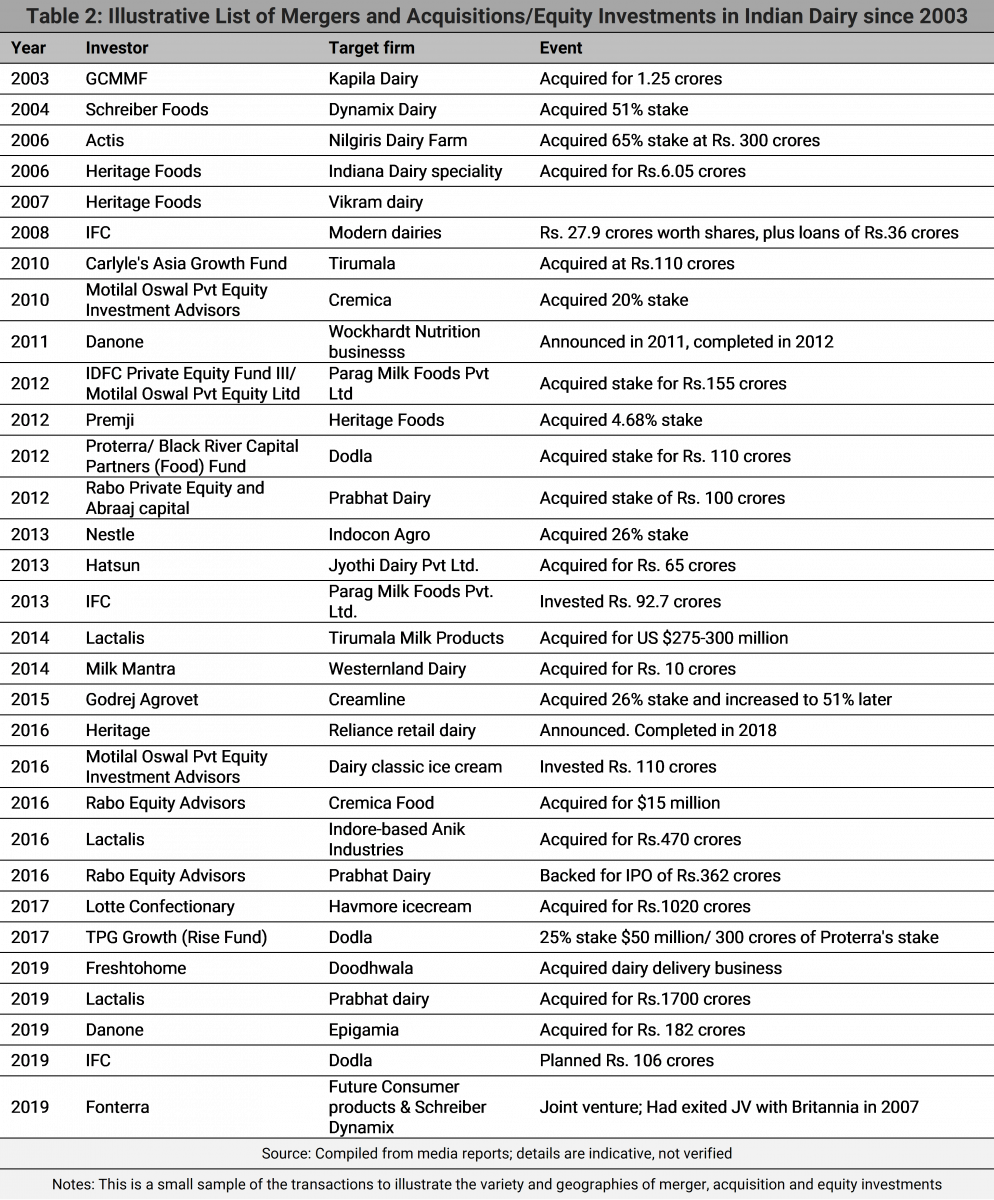

This has not, however, come at the expense of the cooperative sector, which has also been growing, capitalizing on the strong institutional advantages from the early years. Since 2000, the industry has been very dynamic with a large number mergers and acquisitions among private players (Table 2). Several dairy firms have sought to expand their geographic footprint by acquiring small local dairies and consolidating capacity. This has typically involved buying out existing dairy plants with capacities of 50,000-75,000 litres per day (LPD), for Rs.30-35 crores. To put this in perspective, the larger private sector dairies have a processing capacity of around 1-2 million LPD. Amul’s is 36 million LPD. Other firms have sought capital from equity firms and other foreign and domestic players.

There is now strong competition between dairy firms, less in procurement and more on the marketing front. Even multinational firms with deep pockets, like Danone and Fonterra have reportedly found it challenging to price products in the face of a competitive and fragmented market, choosing to exit, before re-entering in 2019 in different avatars. But such competition in retail markets does not always augur well for dairy farmers. Even in 1970, Kurien worried that cooperatives would begin to compete with one another, the reason that cooperatives in districts across Gujarat were consolidated into the GCMMF. When, after his time, Mother Dairy entered into several joint ventures with the private sector, he lamented that this would undermine the very cooperatives that it was supposed to nurture. These fears have indeed come to pass.

Several observers have pointed out, for example, that dairy cooperatives such as Amul, now quite a different entity from the early days, themselves `behave like multinationals’, undercutting competitors’ prices by dumping excess stocks accumulated in one milk procurement area in the retail market of another. In 2015, when Amul, offloaded its excess SMP stocks from Gujarat in Andhra Pradesh, it offered milk at a retail price that was Rs.4/litre (close to 10%) cheaper. This was of course beneficial to consumers, but eventually, those procuring milk were forced to pass on a part of this reduction to farmers to be able to compete. Similar impacts were reported in the informal sector as well.

Several observers have pointed out...that dairy cooperatives such as Amul ... themselves `behave like multinationals’, undercutting competitors’ prices

Growing competition also has conflicting impacts on food safety, a chronic problem with milk in India. Although, on the one hand, one would expect competition to prompt the industry to ramp up quality, it can also have perverse impacts. It is not uncommon for people along the supply chain to adulterate milk (with water, urea, detergent, synthetic milk, and so on) to earn from volumes what they have lost in terms of margins. A 2019 FSSAI report on the analysis of milk samples reassures us that the milk we consume is “largely” safe and that the problem of contamination (in the form of feed-linked Afflatoxin M1 and antibiotic residues) might be more serious than the problem of adulteration. While 93% of the samples were deemed fit for human consumption, 41% had failed on at least one quality parameter. Our interviews with several key players in the organized dairy industry suggest that they take food safety very seriously, at the milking stage and beyond, especially following the discovery of adulteration in Chinese milk powder. At the same time, our field studies in Andhra Pradesh and the Punjab suggest that inspections of farmers for hygiene and safety are rare and the adoption of clean milk production practices is spotty, at best.

3. A Dairy Industry with Indian Characteristics

Indian dairy today is very different from what it was when Operation Flood was underway. Yet, the legacy of a smallholder-based dairy industry that was at the heart of the cooperative movement continues, even if bereft of its cooperative spirit. India is the world’s largest producer of milk, with some of the world’s smallest producers; its dairy industry is as large as its dairy firms are small. Only around 22% of all milk produced is processed by the organized sector and a bulk of its milk comes from buffaloes and not cows. Most of the milk is consumed in liquid form or khoa, channa and paneer, all highly perishable. All these endow Indian dairy with enormous complexity and some uniqueness.

Structure of the dairy industry

Despite the rapid growth of the private organized sector, the unorganized sector is large, robust and thriving, and until recently interacted little with the organized sector. In many parts of the country, local milk traders offer milk at competitive prices and of generally good quality to consumers, while matching prices offered by the organized sector to farmers. Field surveys suggest that the milk procurement in the village by local dudhiyas who sell milk door-to-door or to local restaurants and sweet shops, maintain long-term relationships with both the farmers and their end-consumers. These relationships are governed by high levels of trust and in many instances also involve support through informal financing and credit-based transactions. Today, several informal agents or private buyers have emerged alongside dudhiyas, and help aggregate supplies for private sector dairies.

As for the private organized sector, it is hard to meet a procurement officer in a large dairy firm who has not cut his/her teeth at NDDB replicating the milk procurement model from Amul in new and different contexts. Many private dairies maintain a network of fairly local milk chilling plants and run milk routes that aggregate the milk supplied by small dairy farmers. The largest dairy companies typically procure anywhere between 2.5 and 3 lakh farmers each day, each pouring in an average of 3-6 litres per day. A crucial difference, of course, is that the notion of shared prosperity, an intrinsic component of cooperatives, is absent in the private organized sector.

However, they also utilize multiple modes of procurement – including their own dairy farms and through agents or brokers. While some firms rely overwhelmingly on direct sourcing, others procure only a quarter or so of their requirement of raw milk this way. Several also have their own large-scale dairy farms and in addition procure from contractors or private buyers. Some, not all, of these agents are equipped with milk testers and analyzers that check for adulteration and fat content at collection points. Several also have inter-firm arrangements in the form of annual contracts for sourcing raw and pasteurized milk from other dairies with contracts downstream to supply to fast food restaurant chains and manufacturers of processed foods, including other dairies. The networks for sourcing and inter-firm supply of milk today are as complex as they come, straddling the formal and informal sector.

Like Amul, many of the private dairy firms work closely with their farmers, extending advice on feed, veterinary, artificial insemination services to ensure that expansion of milk supply comes from productivity increases. Several are in the process or have already digitized the process of procurement, making milk traceable from the point of milking to its transformation into dairy products at large-scale processing facilities. Many are poised to rely on data analytics and sophisticated technologies to manage small holder-sourced milk production.

Yet, Indian dairy firms, unlike and with the exception of Amul, remain small. It is instructive that no Indian dairy company figures in the top 20 global list that Rabobank reliably produces each year, on the basis of annual turnover of milk sales. The GCMMF continues to be the largest Indian dairy organization, ranked just below the top 20 firms. If one excludes Amul. Nestle, the top firm in the list has a sales value higher by several hundred-fold relative to other large private dairy companies in India. Annual reports of the largest private dairy firms suggest that their turnover is only 7-10% of the global 19th and 20th ranked firms.

Smallholder dairy: Exit, entry and consolidation in dairy farming

The asymmetry among dairy farmers is just as stark. A bulk of India’s dairy farmers own 2-4 heads of cattle. On average, a dairy operation in New Zealand and Australia has over 300, over 100 in the US and between 30-50 in many countries in the EU. Across most of the world, there is evidence of consolidation, of a steep decline in small dairy operations and an increase in the largest operations. 6 In the US, for example, where large farms (of over 1000 animals) are crowding out small farms, its share having trebled between 1992 and 2006. For example, China, which is among the largest dairy importers in the world, has seen the emergence of mega-farms, the most sensational example of which is the Mudanjiang Mega dairy farm, that reportedly covers an area as large Portugal and aims to house a 100,000 animals, reared indoors.

The trends in India are less clear. On the one hand, many field studies report small farmers exiting dairy altogether, especially in areas where there have been repeated droughts and climatic stress or where margins were squeezed by increasing fodder prices and milk prices for producers that do not grow as fast. In Andhra Pradesh, for example, we found large clusters where farmers had sold all their dairy animals, unable to cope with water and fodder constraints. Even in Punjab, we found that, between 2008 and 2015, among the set of farmers we surveyed, more households stopped dairy operations than those who started operations and the average herd size decreased from 3.9 to 3.4 in 2015. In many semi-arid areas, in southern and central India, a shift to smaller ruminants is palpable.

It appears that the future growth in Indian dairy will come from new geographies.

At the same time, there are several examples where dairy has emerged as a new source of livelihood. In peri-urban Bangalore, among 400 farmers we interviewed as part of another survey in 2005 and 2015, by 2015 several had now taken up dairying as a new activity, sometimes as standalone operations and sometimes integrated with the cropping system that also provides fodder. As farmland was converted to non-farm uses, and commuting to work in the city became more common, farmers were turning to small-scale dairying to augment their incomes, while growing their own fodder.

At the other end we also see the emergence of a new class of large dairy farmers. In peri-urban Hyderabad, several new farmers, who had quit jobs in the IT industry in the early 2000s and started large modern farms with 200-300 dairy animals. Not many have survived, but this is likely to be one strand of growth in dairy, where modern dairy farms driven by technology, both in managing herds and mechanization of operations, are bound to grow. It is already not uncommon to see traditional dairy farmers operating with large herds although with limited mechanization. In the Punjab for instance, these farmers allocate land to grow fodder, instead of traditional crops such as rice and wheat.

It appears that the future growth in Indian dairy will come from new geographies. Dairy has been growing rapidly in Andhra Pradesh, Madhya Pradesh, Rajasthan in particular, with Bihar and Karnataka following suit. While in some parts, such as eastern India, these are likely to be smallholder dairy systems, there are also emerging clusters of technology-driven large-scale mechanized dairy operations.

4. Challenges for Indian dairy

Indian dairy firms are cautiously optimistic about their prospects: this is a sector that is poised for an extended period of growth. That growth is expected to come from more value-added products. Annual reports of several dairy companies declare that while their milk sales have increased by around 8-10% in recent years, the sales of yoghurt, flavoured milk and ghee have grown twice as fast. Demand for UHT milk is seen as another area of rapid growth. Most firms do not see exports as key to their growth, despite some exports in some years. Many firms however do mention both sourcing and retailing as key challenges, given that it is now a crowded field. While some welcome foreign participation in investments, virtually all fear cheap imports. Virtually all of them identify productivity as a problem. Milk yields in India are a fraction of that in the major dairy producers of the world, albeit with significant variation across states and dairy operation typologies. Indian dairy faces at least three major challenges today.

Global markets

Recent discussions on RCEP highlight the retreat of the WTO as a space for coordinating trade policy and the increasing role of free trade agreements. What does this imply for India? The Food and Agricultural Organization (FAO) estimates global milk production to be 840 million tonnes in 2018. Only about 9% of this, 75.6 million tonnes (in milk equivalent) is traded globally. India produces 176.32 million tonnes, but is a small and marginal player in the world market given that what is produced is largely consumed domestically. Trade is therefore not of obvious importance, nor an impediment, to Indian dairy at the moment. 7 That said, events in the global markets and the dynamism of mergers and acquisitions internationally should be in the line of vision for Indian policy-makers. For example, China, the largest importer of milk, has begun investing in large-scale dairy, while also acquiring interests abroad. In 2019, for example, the Chinese firm Yi Li acquired the 82-year old dairy New Zealand cooperative, Westland Cooperative Dairy Company Ltd.

[T]here are legitimate concerns that given the highly fragmented dairy sector, marginal farmers ... would be hit the hardest by imports that are cheaper, especially from New Zealand...

Research on Indian dairy suggests too that it is reasonably competitive. For years, producer prices have reigned lower than world market prices, with consumers paying less than the reference or world price. This suggests that on average the Indian dairy farmer is taxed and the Indian consumer implicitly subsidized. While this would suggest that there is no cause for concern from global trade, there are legitimate concerns that given the highly fragmented dairy sector, marginal farmers in the informal, unorganized sector would be hit the hardest by imports that are cheaper, especially from New Zealand as the latter seeks new markets with China’s imports plateauing.

Even in the organized segment, if industry is forced to drop retail prices to be competitive, there is no guarantee that these losses would not be passed on to the farmer. For those with less than 0.01 ha of land, 75.6 % of their income is from animal husbandry, decreasing progressively as landholding increases, to 7.4% for those with over 10 hectares of land. 8 These are based on the National Sample Survey, 2012-13, 70th Round. The consequences for the poorer dairy farmers would be catastrophic. As for the consumers, there is no reason a-priori to expect large benefits to Indian consumers from freeing imports, even though milk prices have been rising rapidly, especially since the mid-2000s. It is unlikely that imported milk will makes its way to the poorest consumers, say in rural areas, which, as things stand, are poorly served by private enterprise.

For now, as under Operation Flood, India continues to shelter domestic producers from imports using Tarriff Rate Quotas for Skimmed Milk Powder. 9 In early 2017, import of upto 10000 tonnes was permitted at a tariff of 15%, with an above-quota tariff of 60%, it was 15000 tonnes at 0% and an above-quota tariff of 40% for butter oil. It has also used export bans (as in 2012) to curb domestic milk price rise, in the interest of consumers. Currently, as of 2019, India’s average applied tariff is 34.8%, less than its commitment under the WTO of around 63.8%. There is little justification for a shift in regime.

The Productivity Problem

A more serious challenge comes from constraints to productivity. Amul and Operation Flood did succeed to a large extent in modernizing smallholder dairy operations. This involves paying careful attention to breeds and to feeding practices. With this comes careful management of animals. Typically, this involves artificial insemination to induce pregnancy, privileging female calves, culling of most male calves, separating newborn calves from their mothers, and culling unproductive female adults who have “dried up”. The Livestock Census from 2019 confirms several markers of continuing commercialization of Indian dairy. First, the use of animals for dairy has grown, while the use of animals as draught has declined steeply. Second, the expansion of dairy animals is driven largely by the growing share of cross-bred and exotic breeds, relative to indigenous/non-descript breeds, with the former increasing twice as fast (by 26.9% since 2012) as the latter (by 10%). Third, there is an increase in the proportion of in-milk females relative to dry ones, suggestive of wide, even if uneven, use of artificial insemination.

However, not all smallholder dairy farmers operate this way and productivity of Indian dairy animals remains low. In fact, many studies point out that it has not always been clear why Indian households keep milch cattle. Keeping a couple of cows or buffaloes is a way of life for many and signals superior social status. For others, it caters to modest household needs for milk. Many, especially in semi-arid tropics, often keep livestock as savings, to be able to sell them during times of need. In a recent survey, we found an entire village in semi-arid Andhra Pradesh where most bought cattle when they were dry and sold them for a tidy profit when they were in milk. Among many tribes in Odisha, for example, we found communities do not milk cattle, deeming that it was the calf that had exclusive rights to it.

Thus, not all those who own dairy animals, including pastoralists, can be counted as dairy farmers in the narrow sense of profit-maximizing entrepreneurs. This implies that for several households, scientific feeding practices, seeking health and immunization for their animals is hardly a priority. There is a continued dependence on pastures and grazing, as opposed to stall-feeding or providing balanced nutrient feed (BNF). Nor is there access to finance on reasonable terms to support higher investments or insurance to cushion shocks. This dependence on grazing renders smallholders vulnerable. Caught between fodder, water scarcity (due to climatic pressures), loss of pastures, high feed prices, smaller landholdings that force choices between growing food and feed, labour shortages, high wages and milk prices that do not keep pace with costs, dairying is challenging. 10 The Government of India estimates that the country faces a net deficit of 61.1% green fodder, 21.9% dry crop residues and 64% concentrate feeds. Some regions face a larger deficit than others. Perhaps reflecting this price for fodder has risen substantially in recent years. For the period spanning our two field surveys 2008 to 2015 in the Punjab, for example, whereas milk prices rose 1.87 times in constant prices (2004-05), fodder price increased 2.59 times. It is not surprising therefore, that dairy farmers do not often share the optimism of those in the industry.

Slaughter ban laws and their `enforcement’

Perhaps the greater challenge, one that farmers remain reluctant to articulate, are the restrictions on slaughter of cattle, an issue on which Kurien had strong views. Culling of animals is an intrinsic, if unpalatable, part of modern dairy, where dry “spent” cows are eventually sent to slaughterhouses. What has historically been a routine operation in dairy management is today a perilous one. Farmers fearing the consequences of transporting cattle are increasingly abandoning spent cattle. It is typical for dairy farmers to sell aging cows that give lower yields to poorer dairy farmers who maintain and milk these for lower returns before selling these to slaughter-houses. The Indian meat industry relies mainly on culled animals; rearing animals specifically for meat is rare. This system has fallen apart in some key dairy states. Apart from the significant crop losses on account of freely roaming cattle, reported at 10-25% in farmer interviews, the loss from sale of older cattle and the lost income from dairying for those who buy from other dairy farmers are significant. If dairy is an engine of rural growth and poverty alleviation, this major internal contradiction in policy needs to be addressed urgently.

5. New context, old concerns: The imperative of supporting smallholder dairy

Operation Flood holds lessons for dairy policy today. Although Indian dairy faces a very different set of constraints today, the central concern remains the same: how does one nurture smallholder dairy? The growth of the private sector has so far been inclusive of smallholders, but without the element of what is referred to today as “shared prosperity”. While greater experts have a wish list for what Indian dairy requires from governments, I invite consideration to some key policies that focuses on one aspect of the legacy of Operation Flood: its commitment to smallholder dairy, especially in the face of private sector driven supply chains and climate change.

Dairy cooperatives today thrive in only five or six states. Even amidst the failure of cooperatives, new forms of collective enterprise such as Dairy Producer Companies and dairy-focussed Farmer Producer Organizations have already emerged in the past decade. Some have been nurtured by NDDB, NABARD, some by Corporate Social Responsibility or non-governmental organizations and others entirely independently. There are also several examples of collective dairy farming — of farmers sharing communal milking facilities and feeding stalls. This is an area where the government can direct resources. Leveraging programmes such as the MGNREGA to reclaim both pastures that relieve fodder scarcity and to build low cost community dairy facilities are eminently feasible. There are already several shining examples of the MGNREGA’s role in conjunction with the Department of Animal Husbandry in several states. Further, given that women farmers overwhelmingly manage dairying, the National Rural Livelihoods Mission (NRLM) offers a natural platform to organize women into production and marketing collectives, with links to finance and markets. Technologies exist today to support small and marginal farmers in handling, chilling and transporting milk.

[D] airy presents clear opportunities for policy makers to influence positively the lives of millions of smallholders. However, as one has learnt from the history of Indian policy-making in agriculture, with a lack of the imagination it is easy to accomplish the opposite

As the dairy sector grows, for the smallholder dairy producer to get a share of that growth the state needs to create space in a crowded and competitive market. There are significant opportunities for doing this. Given India’s commitment to reducing stunting amongst children, introducing UHT milk (whose price is likely to come down with growing demand) and milk products from cooperatives and FPOs in school-feeding and maternal and child nutrition programmes can offer predictable and stable markets for a segment of smallholders.

In 2015, Indian dairy saw another remarkable effort, the establishment of a spot exchange for auctioning dairy products. The NCDFI eMarket, established through an agreement between the National Cooperative Dairy Federation, and NCDEX e-Markets Ltd. (NeML). By 2018, as many as 1174 participants participated on the platform, registering trades worth Rs. 479 crores. A large spot exchange that allows transparent trade with genuine participation by farmers would go a long way in strengthening the ability of farmer producer companies, especially those who are involved in alternate agricultures, such as natural, organic farming and free range livestock, to access markets directly.

In short, unlike the formidable challenges in other segments of Indian agriculture, dairy presents clear opportunities for policy makers to influence positively the lives of millions of smallholders. However, as one has learnt from the history of Indian policy-making in agriculture, with a lack of the imagination it is easy to accomplish the opposite. One hopes that the legacy of Operation Flood offers enough resistance.

This essay draws on research done in collaboration with LICOS Centre for Institutions and Economic Performance & Research Group on Development Economics between 2014 and 2018. The views expressed in this article are however the author’s own.