1. Introduction

The dollar/Treasury crisis sparked by United States President Donald Trump’s global tariff wars and his administration’s erratic and arbitrary action triggered a crisis in the US dollar and Treasury markets amidst reports of a sell-off of US Treasuries by foreign investors. The dollar has seen its worst performance since 1973, with the Dollar Index declining by 10% against a basket of major currencies. This has alarmed even its close allies in Europe and Asia and reignited global concerns over the long-term viability of the US dollar as a dominant reserve asset. It marks an unusual turn in the global financial markets, where any episode of financial turmoil has typically resulted in a “reverse flow” into US Treasuries.

Although the dollar has been the anchor for the international financial system for many decades, global finance has been characterised by persistent global imbalances, the excessive accumulation of reserves, abrupt reversals of private capital flows, exchange rate volatility, and recurrent financial crises. Global concern over the structural vulnerabilities of US domestic policy and the risks posed by the country’s overweening geopolitical dominance have prompted many to seek safer and more neutral reserve assets that can better serve the requirements of an increasingly multipolar world.

While the Economist declared that “the dollar has no equal”, superior alternatives do exist. Digital innovations and the growing share of the Asian countries in the global economy suggest robust and differently constructed multi-polar reserve assets are possible to replace the dollar-centric system.

2. Dollar’s Dominance and Erosion

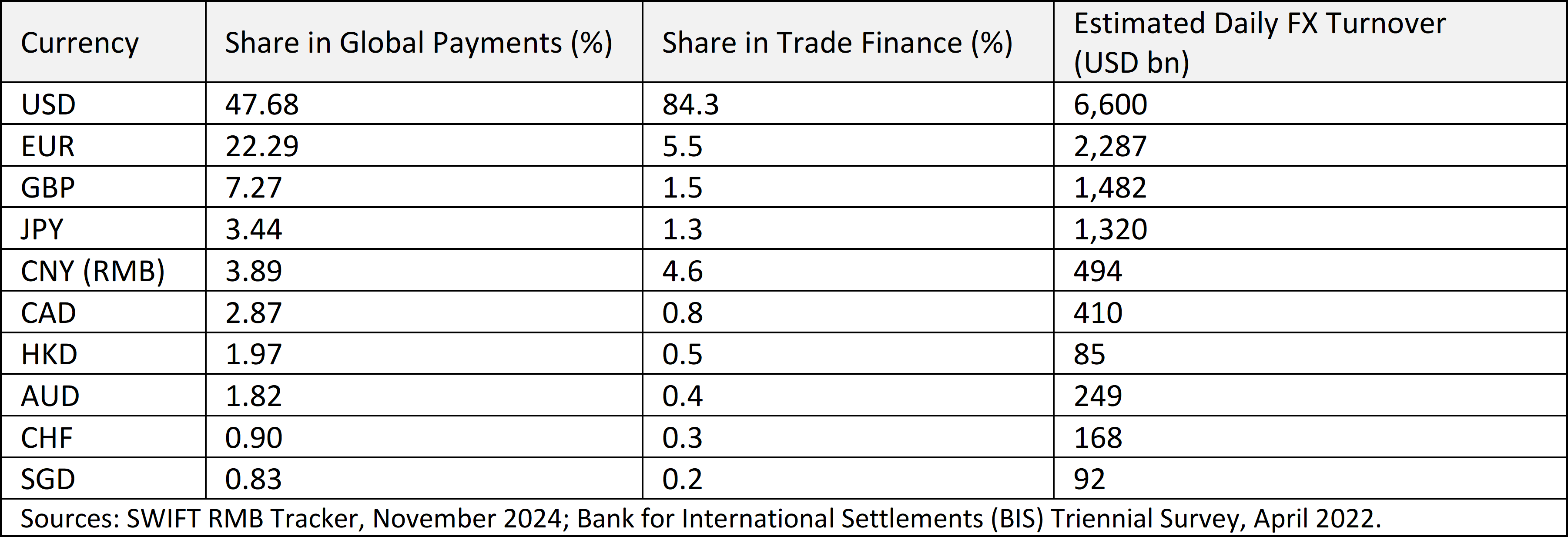

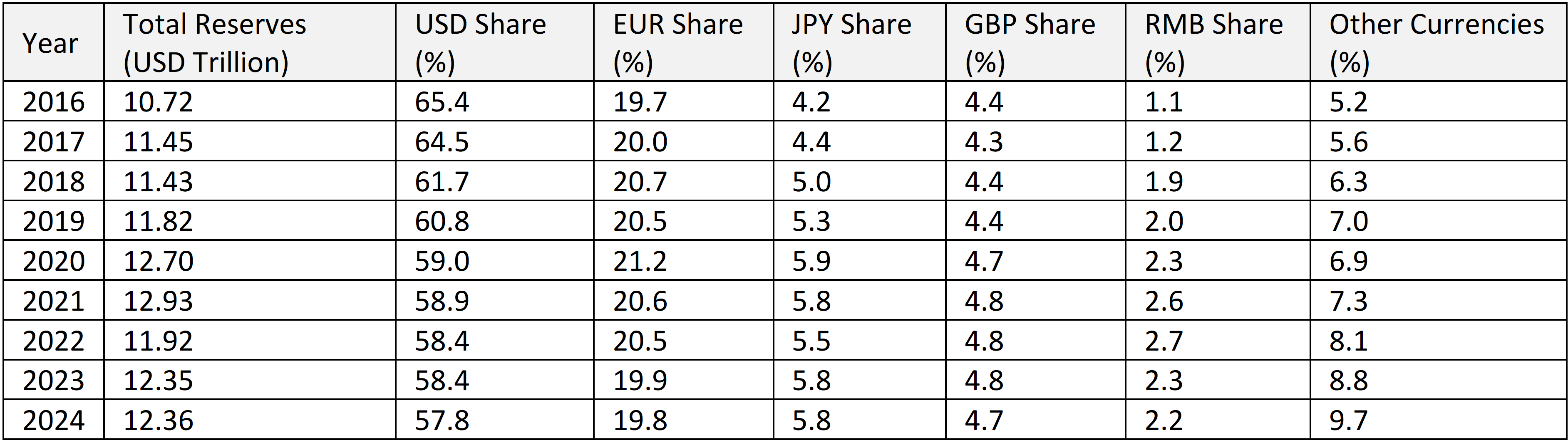

The US dollar remains the dominant currency accounting for 48% of Society for Worldwide Interbank Financial Telecommunication (SWIFT)-Reported Global payments and has a more than 80% share of global trade finance (Table A1.1). Global foreign exchange reserves are largely held in dollar assets, particularly US Treasury securities, though the share of the dollar has declined to around 58% (Table A1.2).

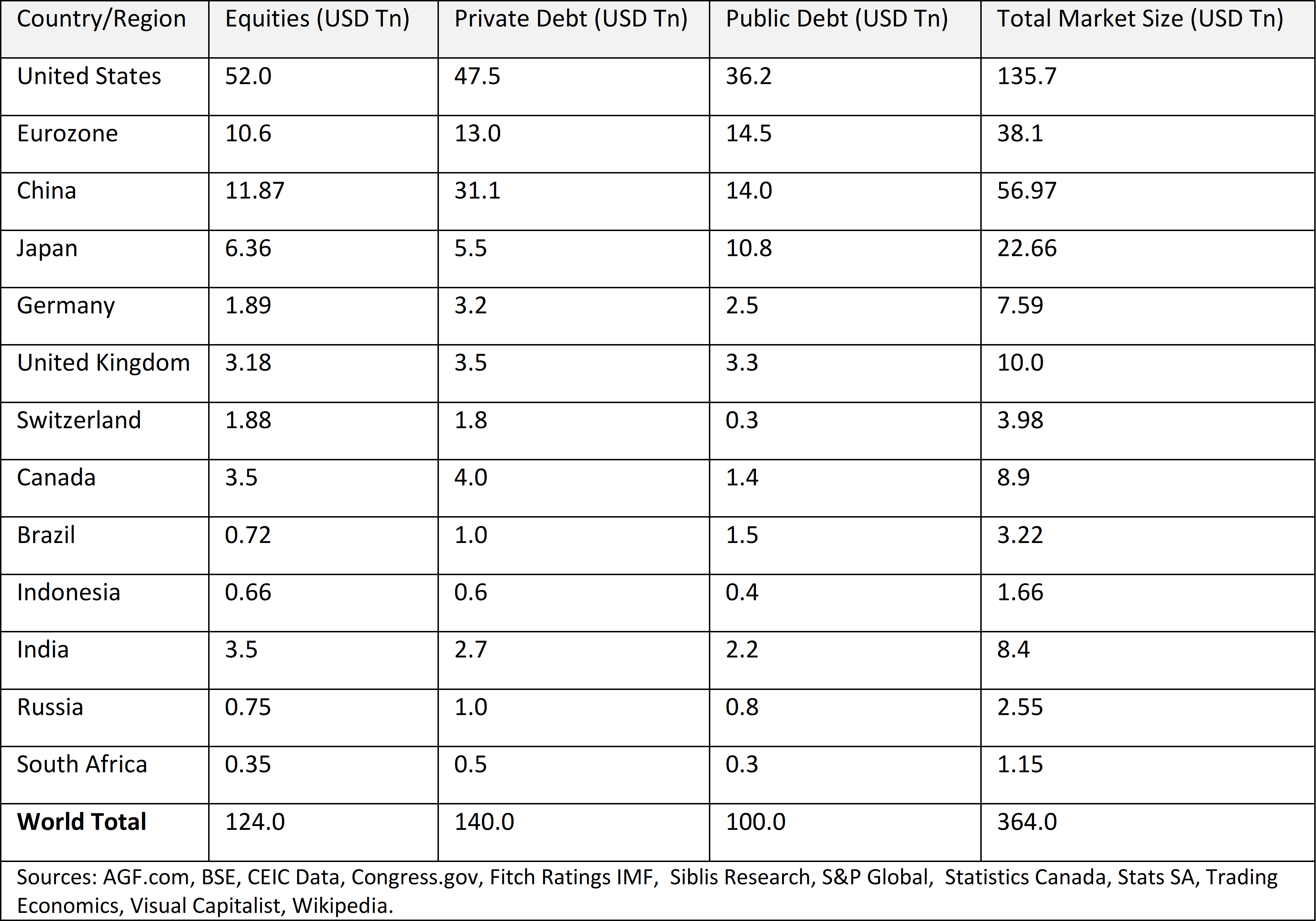

The global financial market totals roughly $364 trillion, and the US dominates with $135 trillion in financial assets, followed by China and the Eurozone.

The dollar’s continued dominance rests on three pillars—(i) the depth and liquidity of the US Treasury market; (ii) the dominant currency paradigm (DCP) in trade invoicing; 1Gopinath et al. (2017) highlight the dollar’s central role in pricing across global supply chains and value-added trade, entrenching its position as the world’s primary reserve and invoicing currency. and (iii) an extensive global dollar funding network anchored by the US Federal Reserve’s swap lines and global settlement infrastructure.

The US financial markets offer unmatched liquidity, and perceived safety. The global financial market totals roughly $364 trillion, and the US dominates with $135 trillion in financial assets, followed by China and the Eurozone (Table A1.3).

Yet each of the pillars has fault lines. The share of reserves has declined steadily, a growing share of global trade is invoiced in euros, Chinese renminbi, Japanese yen, and local currencies, and multi-currency settlements and bilateral swaps are challenging the dollar-centric settlement systems. Dollar centrality is still a fact, but no longer an inevitability.

3. Structural Vulnerabilities

Triffin (1960) foresaw that global demand for liquidity would eventually exceed US gold reserves, rendering the gold-backed fixed exchange rate regime unsustainable. US deficits in the 1960s—driven by the Vietnam War and domestic spending—led to the suspension of dollar-gold convertibility in 1971 and the transition to a floating exchange rate regime in 1973.

Despite the end of the Bretton Woods agreement, the dollar retained its central role as the primary global reserve currency. Oil and key commodities remained dollar-priced, and central banks continued to hold dollars as their principal reserve asset. Many have argued that Triffin’s dilemma persists under floating rates— to supply the world with enough dollars for trade and reserves, the US must run persistent trade deficits, which would, over time, undermine the confidence in the dollar’s value and stability.

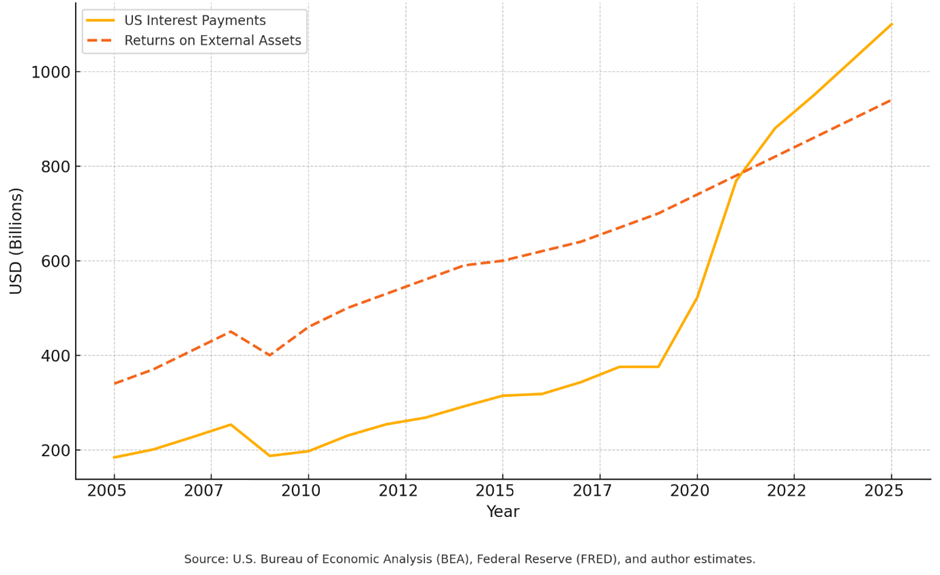

…The cost of sustaining this (dollar) privilege has risen sharply. US interest payments are expected to double from $550 billion in 2020 to $1 trillion in 2025, thereby worsening the fiscal deficit.

The vulnerabilities once tied to gold convertibility now stem from mounting US debt. With deeper global financial integration, soaring US public debt—rising from 60% of gross domestic product (GDP) in 2005 to more than 120% in 2024—has strained its fiscal capacity to supply safe and liquid assets. The dollar as a store of value has done poorly and delivered low returns for the countries investing in US Treasuries

Former French President Valéry Giscard d’Estaing is said to have coined the term “exorbitant privilege” to describe the dollar’s unique role. Gourinchas and Rey (2005) quantified this privilege, showing that the US consistently earns a higher return on its foreign assets than it pays on liabilities. In 2005, this premium amounted to 3.3% of US GDP. However, the cost of sustaining this privilege has risen sharply. US interest payments are expected to double from $550 billion in 2020 to $1 trillion in 2025, 2The US external assets consisting of direct and other investments like loans, credits, derivatives, and official foreign reserves amount to $33.6 trillion compared to its external liabilities amounting to $50 trillion (foreigners claims on the US, including treasuries, direct and portfolio investments, and other investments), leading to a $16 trillion deficit in Net International Investment Position (NIIP) of around $16 trillion. thereby worsening the fiscal deficit (Figure A1.1). The Trump-era tariff wars merely underscore the deeper asymmetries underlying the dollar’s hegemony.

Figure A1.1: US Interest payments and return on external assets (2005 -2025)

4. Weaponisation of the Dollar

The dollar’s hegemony is not merely an economic phenomenon but a powerful tool of geo-political dominance. US control over the global financial system has enabled the dollar’s use as a geopolitical weapon. 3The term “weaponisation of the dollar” does not have a single, definitively attributed origin, but it began gaining prominence in policy and academic discourse since the 2010s, particularly after the US imposed financial sanctions on countries like Iran, Russia, and later China. Zoltan Pozsar, a former US Treasury and International Monetary Fund (IMF) official and strategist at Credit Suisse, popularised the concept in financial circles. Nouriel Roubini and Barry Eichengreen have written about the dollar’s geopolitical role in sanction regimes. Under statutes such as the International Emergency Economic Powers Act (1977), the Global Magnitsky Act (2016), and the Countering America’s Adversaries Through Sanctions Act (CAATSA; 2017), the US can at will freeze assets, block transactions, and impose sanctions on foreign entities.

Dozens of countries—among them Iran, Russia, Venezuela, Cuba, Syria, Afghanistan, and North Korea—have faced asset freezes, exclusion from global financial networks like SWIFT, and sanctions on banking and trade sectors. In response to Russia’s 2014 annexation of Crimea and its 2022 invasion of Ukraine, the US froze $300 billion in Russian central bank assets, along with those of Iran, Afghanistan, and Venezuela. In effect, no country, including its allies and partners, is safe from unilateral US action.

The extraterritorial reach of US sanctions and increasing use of asset freezes have raised concerns about financial sovereignty and the rule of law, and weakened trust in the dollar-based system. The overuse of financial sanctions has sparked a global search for alternatives. An increasing number of countries who have suffered the economic and political consequences of following US diktats now view dollar dependence as a strategic vulnerability, prompting moves toward de-dollarisation, new reserve arrangements, and a parallel financial infrastructure.

5. Alternatives to the Dollar

Despite calls to diversify away from the dollar, its position as a safe haven, based on the safety and liquidity of the US Treasury debt, has remained unchallenged, especially after the government debt crisis in the Eurozone in 2011 significantly diminished the euro’s rival claim (Jeanne 2012). However, the euro is still the dollar’s main competitor, accounting for 20% of global reserves and 22% of international payments (Tables A1.1 and A1.2). It benefits from the Eurozone’s economic size, deep sovereign debt markets, monetary union, and a strong, independent central bank.

However, fiscal fragmentation and the absence of a single, liquid, risk-free asset, comparable to US Treasuries, undermine its reserve status. Recent attempts to integrate the Eurozone’s debt market and issue Eurobonds may strengthen the euro’s position as a supplier of global reserve assets, but its slowing economy and lack of political consensus are major stumbling blocks.

Prior to the euro, the dollar had its rivals. The British Pound Sterling (GBP), the leading international reserve currency from the mid-19th century to the early 20th century, retained a secondary role till the 1970s. Between 1980 and 2000, the Deutsche Mark (DEM) 4The Deutsche Mark’s share of global reserves was 20% by 1990, reflecting Germany’s rising economic power. However, its ascendancy was cut short by the adoption of the euro in 1999. and Japanese Yen (JPY) 5The Plaza Accord of September 1985—when Ronald Reagan’s Treasury Secretary James Baker compelled Japan to revalue the yen against the dollar by nearly 100%—effectively ended the yen’s prospects as a major reserve currency (Rogoff 2025: 31). were both viewed as viable alternatives.

…[F]iscal fragmentation and the absence of a single, liquid, risk-free asset, comparable to US Treasuries, undermine the euro’s reserve status.

The Special Drawing Right (SDR) of the International Monetary Fund (IMF) has been often cited as a potential anchor for the international reserve system (Triffin 1960; Zhiu 2002). However, the SDR is essentially an accounting unit, and in the absence of a market or tradable instruments denominated in SDRs, their utility remains largely symbolic. Moreover, given the dominance of the US in its governance, there is neither a consensus nor the political will to promote such a role for the SDR.

The Chinese Renminbi (RMB) is another potential competitor to the dollar. China’s large economy, deep financial markets, substantial trade surplus, and foreign exchange reserves contribute to its growing stature in the international financial system. After its inclusion in the IMF’s SDR basket in 2016, the renminbi’s share of global foreign exchange reserves grew steadily but has now stabilised around 2%. Geopolitical tensions, capital controls, limited convertibility, and lack of transparency limit its global role as a neutral, global reserve. The renminbi will continue to be an important reserve currency, particularly with the increasing economic and geopolitical convergence of the Global South.

6. Digital Technology

Blockchain and distributed ledger technologies (DLT) are reshaping global finance by offering alternatives to the dollar-centric system, particularly in reserve assets and cross-border payments.

Central banks are actively exploring central bank digital currencies (CBDCs) to modernise payments and reduce reliance on the dollar. Projects such as China’s e-CNY and the European Central Bank’s digital euro aim to boost efficiency and monetary sovereignty. Digital currencies can enable faster, lower-cost cross-border settlements without the need for dollar-based intermediaries.

Digital currencies can enable faster, lower-cost cross-border settlements without the need for dollar-based intermediaries.

Multilateral efforts such as Project mBridge (Bank for International Settlements, People’s Bank of China, and Hong Kong Monetary Authority), Project Mariana, and Project Jura are testing cross-border CBDC platforms for real-time, peer-to-peer currency swaps. These initiatives will likely reduce dependence on the dollar and shift the payment architecture towards multipolarity. As they scale up, they will be credible alternatives to SWIFT.

7. BRICS’ and China’s Systems

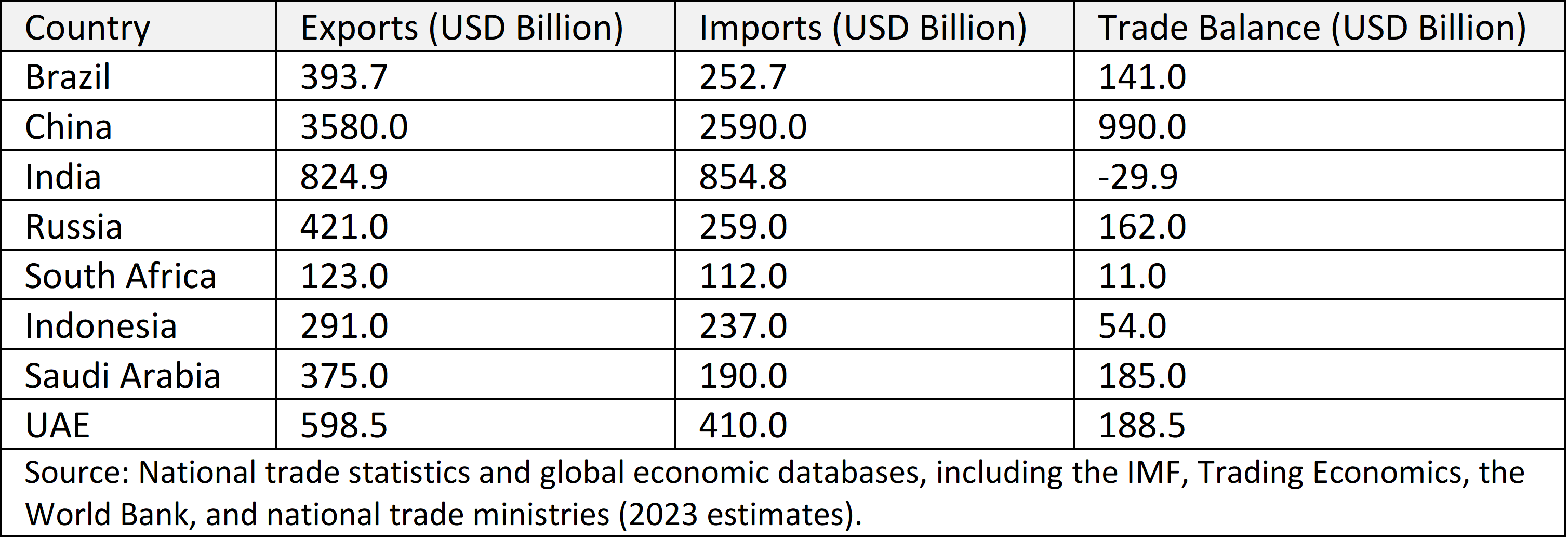

The combined nominal GDP of 11 BRICS countries added up to $30 trillion, around 30% of global GDP in 2024 and 25% of global trade. The intra-BRICS trade of around $1 trillion is still small but growing (Table A1.5). Together, the extended BRICS group represents a substantial 40% of the world’s economy.

The idea of a unified currency for intra -BRICS trade has been floated several times, but is largely theoretical. Enthusiasm has since waned after the Trump administration threatened punitive tariffs. However, the BRICS countries have shifted their focus to alternative payment mechanisms aimed at facilitating trade in their national currencies and advancing gradual “de-dollarisation”. 6The original BRICS countries (Brazil, Russia, India, China, and South Africa) are now increasingly seen as BRICS plus (including Egypt, Ethiopia, Iran, the United Arab Emirates, and Indonesia). Argentina backed out after Javier Milei’s election, while Saudi Arabia has not formally joined, though it has made supportive statements. Initiatives such as the BRICS Cross-Border Payment Initiative (BCBPI), a multi-currency settlement platform, and BRICS Pay, an alternative messaging system to SWIFT, have been designed to enable transactions in local currencies within the bloc.

China’s Cross-Border Interbank Payment System (CIPS) complements this push, processing RMB 123.06 trillion ($17.09 trillion) in 2023 across 1,629 institutions in 119 countries. This payment system enhances the renminbi’s role in global trade and finance while providing a partial alternative to SWIFT.

A viable global reserve asset must be safe, liquid, available in sufficient quantity, and deliver appropriate returns. In addition, the reserve asset must be stable and politically neutral.

Decentralised digital assets like Bitcoin, stablecoins, and theoretical models like the Quantum Reserve Token (QRT) have been proposed as post-dollar reserve instruments. However, they lack institutional credibility, price stability, and legal enforceability—core attributes of a viable reserve asset. Until such challenges are addressed, their adoption for sovereign or reserve use remains unlikely.

8. Search for Alternatives

The Centre for Economic Policy Research (CEPR)’s Reforming the International Monetary System (Farhi et al. 2011) report identified the supply of global liquidity as the central requirement of a stable international financial system. They focus on developing Eurobonds and Yuan bonds supported by cross-currency swap arrangements and operational coordination among central banks to create a pool of reserve assets as alternatives to US Treasuries. These proposals align with the concept of multi-nodal currency hubs described here.

A viable global reserve asset must be safe, liquid, available in sufficient quantity, and deliver appropriate returns. In addition, the reserve asset must be stable (low volatility) and politically neutral. No single currency fully satisfies all these criteria—the US dollar comes closest. However, multi-currency hubs that use a combination of currencies to anchor pooled or common bonds could more than fulfil these requirements. The current developments in digital and CBDC infrastructure make such currency hubs operationally viable, cost effective, and politically neutral.

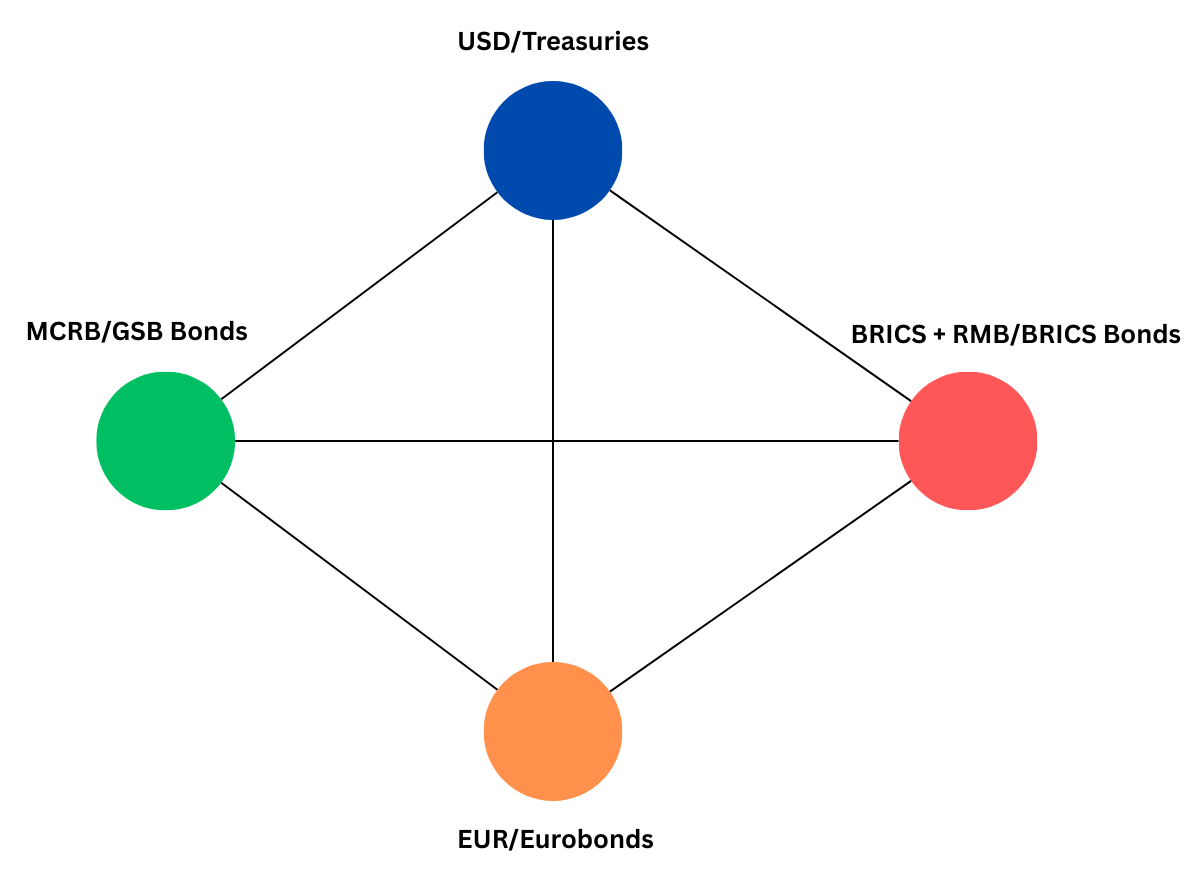

Figure 1 describes a schematic framework for multi-polar reserve currency hubs. At one end lies the dollar hub, anchored by US Treasury bonds; at the other, the euro hub, supported by common Eurobonds (Claessens 2011). The BRICS countries would form a third pole through hypothetical multi-currency debt securities, while a fourth hub—a carefully constructed multi-currency reserve bloc (MCRB)—would consist of a basket of geographically diverse, politically neutral, and macroeconomically stable currencies, including the JPY, CHF, SGD, HKD, and CAD. These hubs will be connected bi-directionally and will be fully interoperable, facilitating multilateral settlements in global trade and transfer of reserve assets between hubs and between countries in multiple ways.

Theoretical and empirical work on the determination of safe assets show common or coordinated issue of bonds has a superior outcome to competitive issuance of reserve assets.

CBDCs and cross-border digital settlement platforms can effectively replace the dollar-centric financial infrastructure by making multi-currency transactions more efficient, transparent, and autonomous. Tokenised bonds in single or composite currencies reduce the amount of liquidity required to trade in reserve assets.

However, global adoption hinges on interoperability, robust governance, and trust in both the technology and issuing authorities. The idea of multi-polar or multi-nodal currency hubs, though novel, has its roots in many studies and proposals cited here (Farhi et al. 2011, Eichengreen 2011, Zhou 2009). Theoretical and empirical work on the determination of safe assets show common or coordinated issue of bonds has a superior outcome to competitive issuance of reserve assets (He et al. 2016; Caballero and Farhi 2013).

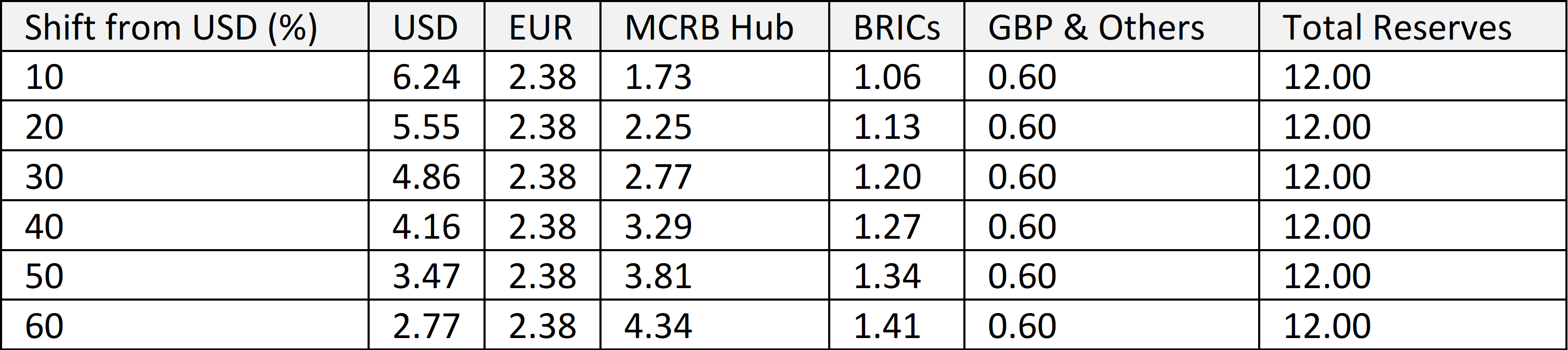

A multi-polar hub architecture would allow multiple combinations—BRICs hub for South-South trading and settlement based on mBridge or CIPS; an MCRB hub that functions as a global reserve assets for global foreign exchange reserves; and the euro and the dollar hubs as alternative reserve assets and currency for global trade. The outcome would be a more balanced and equitable international financial system with a stable safe and liquid pool of global reserves. Table A1.4 shows what a hypothetical rebalancing of reserve shares would look like at different levels of reallocations.

Figure 1: Multi-polar Reserve Currency Hubs

9. Economic and Political Challenges

Politically, multi-polar currency hubs would be an effective counter to the hegemony of the dollar. Many countries in the world, including its European allies, are waking up to the idea that the US is neither a reliable partner nor an upholder of international order.

The Rio declaration of the BRICS Summit in July 2025, although silent on a unified BRICS currency, has a number of key initiatives, such as the BRICS Cross-Border Payments initiative and Contingent Reserve Arrangements (CRA) that converge towards the idea of a BRICS currency hub.

However, many challenges remain. Shifting dollar reserves would be a slow process. A number of major global investor countries—Japan, China, the UK, Switzerland, Saudi Arabia, and the United Arab Emirates (UAE)—as well as major sovereign wealth funds are deeply invested in US markets, which would render rapid unwinding not an easy process. Developing multi-currency hubs requires significant coordination, and although blueprints for such coordination and technology enablers exist, implementing them demands a wholesale rethink of the international financial system, an onerous task at the best of times. The experience of the EU shows that despite a successful monetary and economic union, political and fiscal union is complex. Establishing multi-currency hubs is an act of political will for countries around the world.

The experience of the Japanese Yen, the euro, and the Chinese Renminbi demonstrate the immense challenges in creating a hypothetical MCRB. Japan and Canada are formally a part of the Group of Seven (G7), and under the umbrella of the US. Singapore and Switzerland are small neutral countries, which are heavily susceptible to political pressure. Hong Kong is politically a part of China and effectively under its control. Any move is likely to bring a strong US response accompanied by threats of political and financial sanctions.

…A growing number of nations—including longstanding European and Asian allies—have begun to recognise and resist this unambiguous assertion of power.

The MCRB countries themselves may lack the motivation to take on this role, as costs would be high if subjected to US economic and political pressures. International institutions and organisations, which could play an important coordinating role in the MCRB framework, may be dissuaded for the same reasons.

The BRICS countries, which now include the Middle Eastern and other Asian countries, while willing to go along with various forms of South-South cooperation, would find it hard to resist the US counter measures, given their political ties and dependence on the US. Within the BRICS core, India and China have serious geopolitical differences, and economic ties are also fraught with tension. India has an increasingly greater political and economic stake in maintaining ties with the US, and would find it hard to resist political and diplomatic pressures from it. Countries like Vietnam and Thailand are extremely dependent on trade with the US. Nonetheless, despite these formidable challenges, a coordinated global response can make it possible to redefine the international monetary system.

10. Conclusions

For the past 80 years, the US has leveraged the dollar’s “exorbitant privilege” to secure economic advantages for itself and to exert geopolitical influence—against both its adversaries and its allies. When the dominance of the dollar was challenged by alternative currencies, such as the Japanese Yen or Chinese Renminbi, the US used its political and diplomatic muscle, directly and through international forums, to force these currencies to appreciate against the dollar. Meanwhile, global savings have routinely financed US deficits, effectively subsidising its economy.

Though all US administrations have pursued this strategy, the recent actions of the Trump administration have shaken up the international order in unprecedented ways. Quiet dominance has been replaced by overt coercion. BRICS countries, among others, have been explicitly warned that any serious attempt to challenge the dollar’s supremacy would trigger political and economic retaliation. Yet, a growing number of nations—including longstanding European and Asian allies—have begun to recognise and resist this unambiguous assertion of power.

The proposals described in this article offer a credible, balanced, and practical alternative to the current US dollar-centric system. Unlike single-currency substitutes such as the euro or the Chinese Renminbi, which carry concentrated geopolitical or institutional risks, the idea of currency hubs distributes reserve exposure across a group of politically neutral, economically stable, and globally diverse currencies. Compared to the IMF’s Special Drawing Rights, the hub currencies are market-driven and trade-anchored, offering real liquidity, convertibility, and usage in real-world financial and commercial transactions.

In sum, reserve currency hubs are a unique blend of monetary reliability and geopolitical neutrality, to underpin a multi-polar, resilient international monetary order. As the global economy becomes more fragmented and regionalised, the case for a diversified, neutral reserve asset structure grows stronger. The currency hubs offer a pragmatic path forward.

Note: Author-directed prompts were used in generative AI models (ChatGPT, version 4.0, Perplexity Pro), to provide research inputs, data structuring, and editorial support for this work. All ideas, analyses, and conclusions are my own.

Kaushik Jayaram is a former central banker who worked for many years in an international financial organisation.