On 9 August, US President Joe Biden signed the CHIPS (Creating Helpful Incentives to Produce Semiconductors for America) Act and rolled out $52 billion worth of government subsidies and incentives for the semiconductor industry to boost manufacturing within the country. In February, the European Union (EU) proposed the European Chips Act with an aim to increase the market share of semiconductors made within the EU 20% from the current 9%. Japan, South Korea, China, and Taiwan, countries that currently dominate this global trade, have also lined up plans to increase their share in the business of chip making.

In December last year, India announced its own plan: an ambitious $10 billion government package of incentives and subsidies for domestic manufacture of chips.

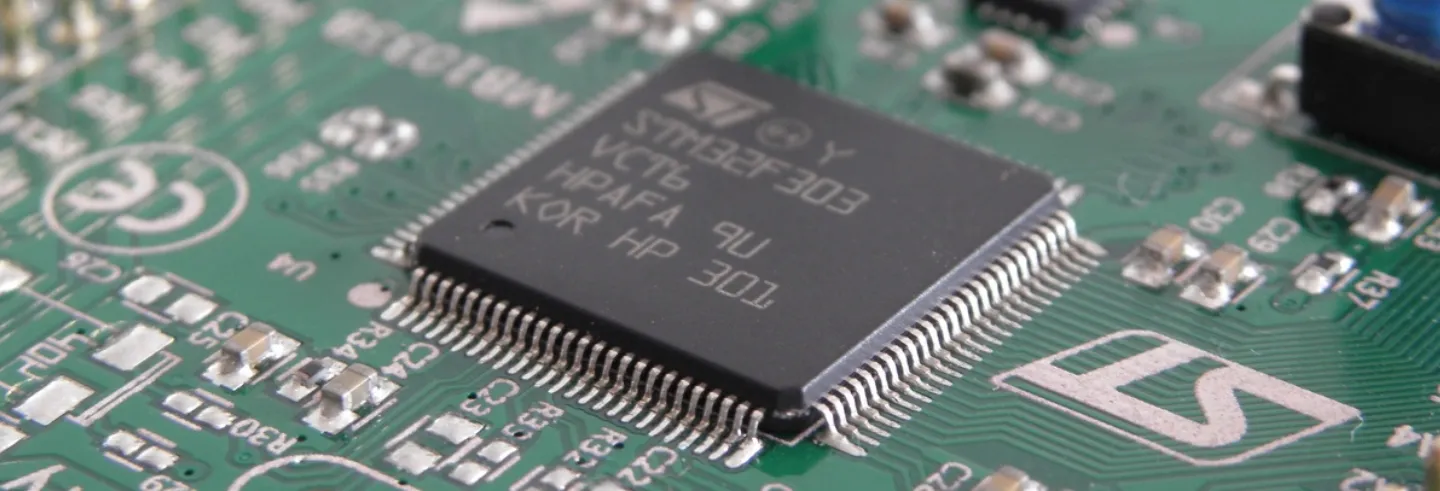

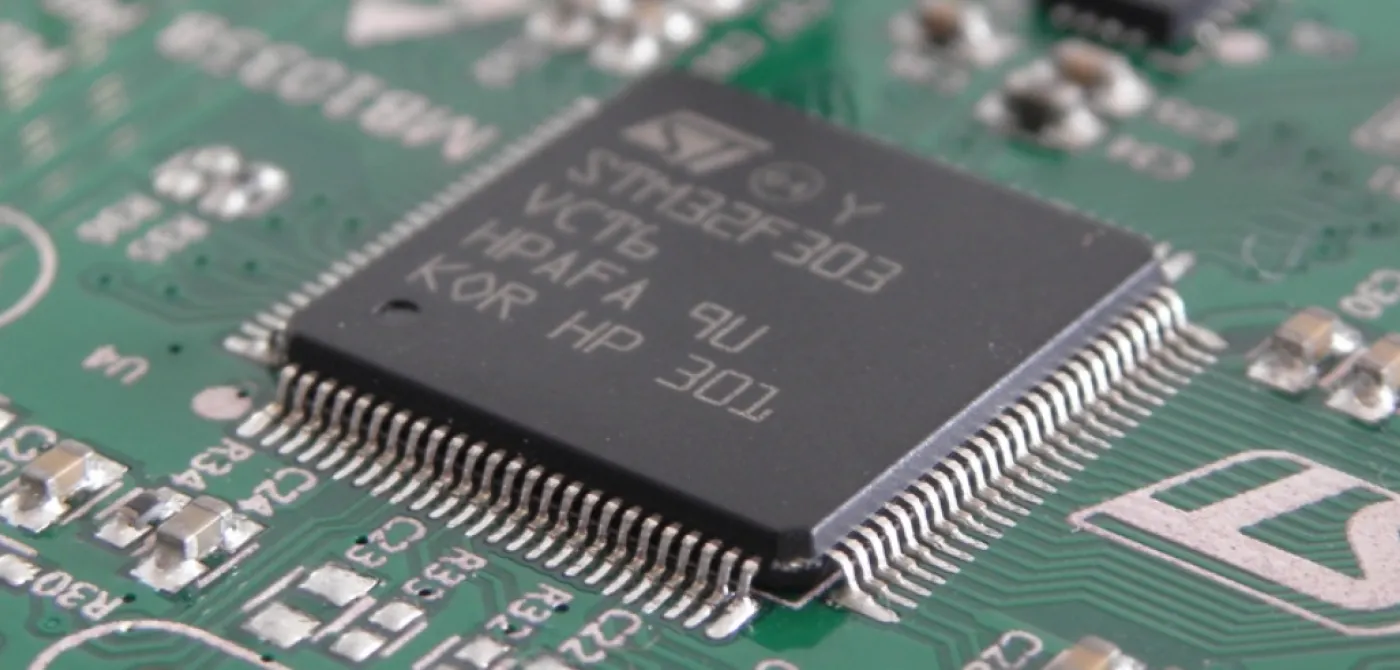

Semiconductors or microchips are miniature circuits that make all things electronic work. They are manufactured in factories that are called foundries and shipped to customers across the globe to use in everything from mobile phones to computers. But what explains this sudden rush for “chip nationalism” and how does India’s chip nationalism fare vis-à-vis that of the rest?

The rise of chips is intertwined with the recent triumph of electronics engineering. For instance, fuel gauges have changed from mechanical devices to a chip-based display in the car. Manual devices that measure blood pressure have given way to battery-powered, chip-enabled systems that not only measure a person’s blood pressure but also store it as a data set. This victory of electronics also coincided with the emergence of a post-Soviet-Union globalised world, which views global trade and commerce as a strong bulwark against all ills.

For the first time, the global nature of chip manufacturing is exposed to a world order that is no more global.

Companies like Taiwan Semiconductor Manufacturing Company (TSMC), which began in 1987, scaled up their manufacturing prowess and successfully harnessed the growing demand for chips. In doing so they built supply sources that spanned the globe. Their chip foundries are finishing kitchens for components and material sourced from all over.

In many cases, several supply bases are monopoly sources. So much so there are more than 50 “choke points” in chip manufacturing. Choke points are defined as activities for which more than 60% of the inputs come from a single source. Globalisation offered good tailwinds for such a business model to thrive. No one minded the likes of TSMC driving the model because of the cost advantages the arrangement offered upstream.

Such a globally integrated supply chain of an incredibly complex manufacturing process emerged from a liberal world order and countries from South Africa to Mexico built stakes in it. For instance, while 40% of all chips manufactured in the world are made either by TSMC or United Microelectronics Corporation (UMC) – both Taiwanese companies – 80% of the valves that go inside the gas cylinders that are used to make these chips come from a single source based in Luxembourg.

Covid-19 disruptions and the war in Ukraine have brought out the criticality of chips in everything from space exploration to driving cars. For the first time, the global nature of chip manufacturing has been open to a world order that is no more global. The US-China confrontation has brought the crucial role of Taiwan in the chip scenario to the surface. It is difficult to believe that the present hawkish stance of China over Taiwan has nothing to do with chips.

The environmental impact notwithstanding, suppliers and sources that are spread all over the world converge at foundries that are optimised for costs and efficiency. Differently put, a globalised world and the set-up of the chip industry feed into one another. If globalisation played a very important role in the growth of this industry, what will be its direction in the multipolar world that is fast emerging now?

The chip packages announced by major world powers with the intent to pursue chip nationalism are an antithesis to globalisation. Can one country make all the components and secure raw material sources in an industry that has been built around and is part of globalisation? If so, at what cost? Chip nationalism is a bold but uncharted attempt to turn the industry into a geopolitical tool in the hope of nudging participants to choose between a US-led and China-led coalition and everyone in between. Even China and the US may not have the answer to what will it cost to pull this off and whether they will succeed. China, for instance, has allocated $220 billion both in public and private capital to the effort but with underwhelming results.

Should India pursue chip manufacturing by rolling out incentives or is there a smarter alternative to this global game that everyone seems to be rushing into blindfolded?

Chip nationalism is a silent war that everyone is pursuing but no one will win because a stable globalised world of trade is an essential pre-condition for the chip industry, argues a recent Nikkei Asia article.

The second question pertains to the demand trajectory for chips going forward. In the last six months, leading chip manufacturers such as Samsung, TSMC, AMC, Nvidia, Intel, and SK Hynix have all begun realising that the chips trade has peaked and the double-digit growth that the industry enjoyed for the last two decades may already be a thing of the past. They all sound cautious about new investments while analysts who track the industry have begun to assign single-digit growth for the industry as the new normal in the foreseeable future. In this context, the plans of the major chip powers may well turn out to be instances of chasing a shrinking pie.

Both these questions pose a crucial question for India: should it pursue chip manufacturing by rolling out incentives or is there a smarter alternative to this global game that everyone else seems to be rushing into blindfolded? If with $220 billion China is still figuring out the answer and another $100 billion of war chest is waiting to be deployed between the EU and the US, what makes India’s $10 billion stand out in a maturing industry?

Chip foundries are not sites of high direct employment. On the contrary, they are extensive users of robotics set-ups and have a voracious appetite for electricity and water. They are not a high multiplier for local industries, unlike, say, in automobiles, because most of the components and raw materials are imported and in many cases from near monopoly sources that are spread all over the world.

The assumption that Indian foundries will entice component and raw material sources to set up shop here, as it happened in the case of auto components, may be misplaced. Unlike automobiles, chips are now recognised as a crucial bargaining point in the emerging multipolar world. Any country or source that is a critical player in the chip value chain intends to hold on to its advantage or further consolidate it for leverage. Moreover, major powers like the US will use all their tools to entice such monopolistic sources in the hope of creating consortiums and supplier blocs.

For instance, it took no more than two days for Mitsubishi Chemicals to announce its plan to triple the manufacturing of pure grade hydrogen peroxide – a critical raw material in chip manufacturing – in the US after the CHIPS Act came into force, signifying how closely intertwined geopolitics is with the commerce of chips.

India’s interest will be better served if it ... picks areas that emphasise its strengths such as chip design and testing or as a supplier of critical components...

India’s current plan to in-source foundries relies on a simplistic calculation of the balance of trade, which it intends to pursue in isolation, or at least that is what can be inferred from the limited information on the subject available in the public domain. Chip manufacturing in the new world order is unlike garment manufacturing, which can be encouraged through incentives alone. If one world power is ready to attack a country and another is set to build exclusive clubs for the sake of chip security, the simplistic intent of India and the size of its war chest pale in comparison to how the other players are approaching the issue.

The opportunity cost for India to invest $10 billion through subsidies in foundries over investments in healthcare, jobs, education, and climate resilience is immense. Is India ready to play this game? Should India sit at this high stake table in which the other parties are far ahead on human development indicators and are ready to play it blind for the foreseeable future?

It will take at least a decade before we can conclusively establish the success or failure of India’s push into chip manufacturing. At this time, we also do not know even how to define success. Is it in terms of creating jobs, or emerging as a dominant chip manufacturing base, or having to import less? Or is it being a part of a winning coalition or championing a non-aligned alternative for chip manufacturing? India’s plan looks underwhelming any which way we look at it.

A foundry is not the only route for India to attain influence in the semi-conductor industry, but it surely is a risky strategy for the country. India’s interest will be better served if it re-evaluates its role in the semiconductor value chain and picks areas that emphasise its strengths such as chip design and testing or as a supplier of critical components and raw material such as fluoropolymers. It could also reorient public sector companies such as National Aluminium Company Ltd (NALCO) for rare earth coalitions and explorations.

Going strong on positions of strength will not only give India the necessary leverage but also ease the pressure on the government to offer incentives that carry a high opportunity cost. In chasing the foundry route, India is ignoring its own strengths. For instance, an ambitious US-led Minerals and Security Partnership (MSP) to secure supply chains of critical minerals for chips and other industries, aimed at reducing dependence on China, was recently announced. The MSP includes Australia, Canada, Finland, France, Germany, Japan, South Korea, Sweden, the UK and the EU but not India. The government of India has expressed its concern about being left out, but this post-facto reaction to such an important announcement show that the country is still figuring out the rules of this game.

India’s strengths in knowledge, specialised manufacturing, service-led ecosystems, and a huge domestic market can be repackaged into a smart hand to secure our unique position in the chip industry. This is an alternative worth exploring while others figure out where to make their chips. But the lack of debate in Indian public discourse on microchips and everything that concerns them is disconcerting.

Ankur Bisen is with Technopak Advisors, and the author of 'Wasted: The Messy Story of Sanitation in India, A Manifesto for Change' (Macmillan; 2019). The author is on Twitter: @AnkurBisen1