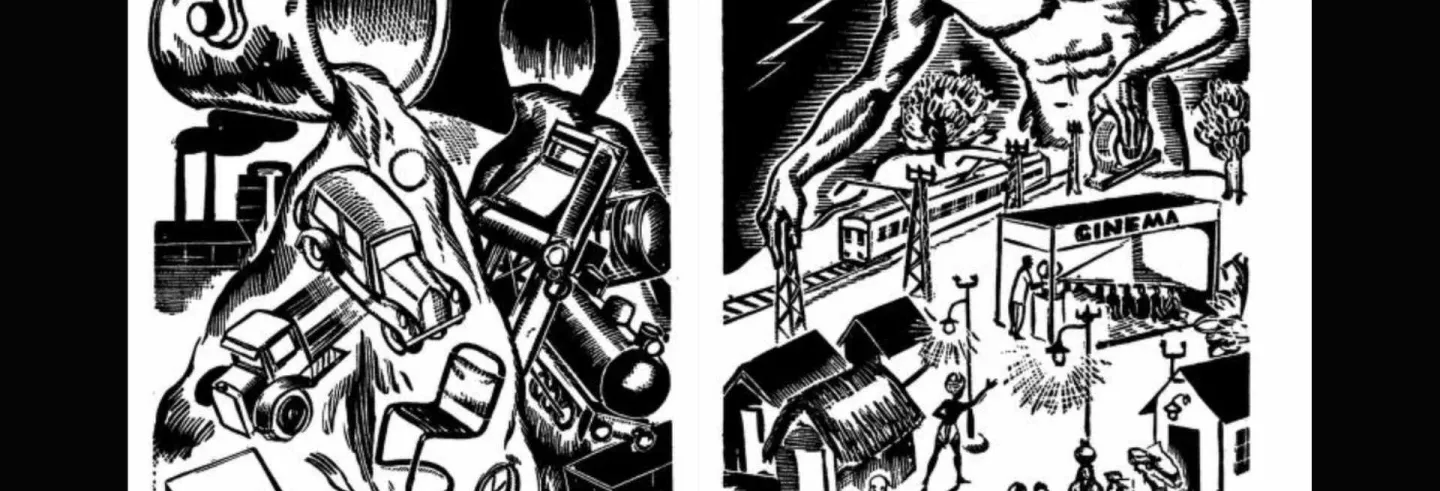

In 1942, the famed Austrian economist Joseph Schumpeter coined the phrase “creative destruction” to describe a fundamental aspect of capitalism. He defined it as “the process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.”

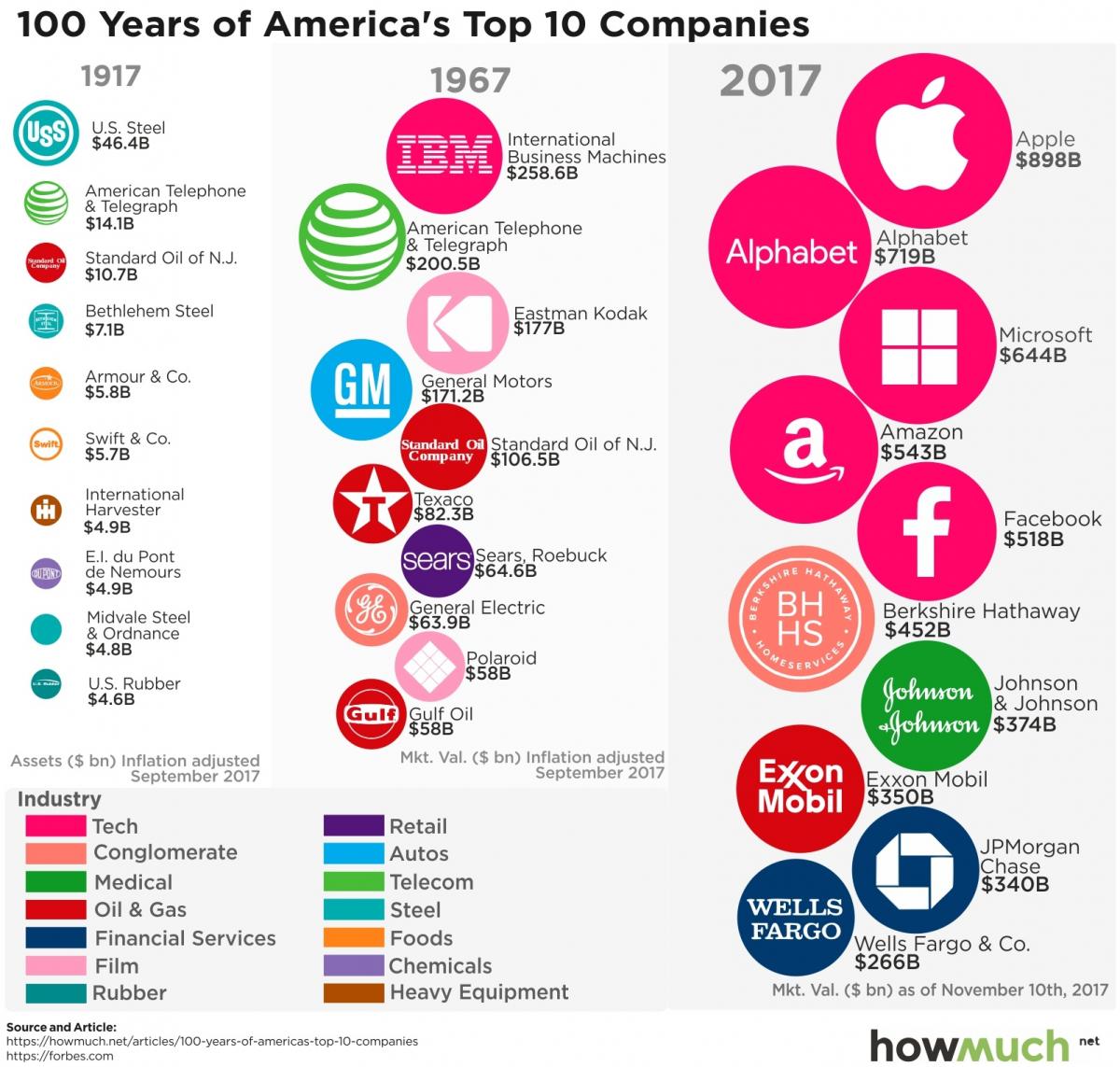

The periodic rise and fall of large corporations in North America and western Europe seem to confirm Schumpeter’s insight. Consider the dramatic changes in the corporate hierarchy in the United States. From 1917 to 2017, only Standard Oil and its successor Exxon consistently make the top 10 (and that run may be over in the wake of the COVID-19 pandemic). There is also considerable sectoral variation, with heavy industry giving way to consumer products and information technology.

Now contrast this ranking with India’s. Despite post-liberalization 'churn', the likes of Tata and Birla (large, diversified conglomerates, most of them family-run) have not disappeared. They also continue to be involved in industry alongside service-oriented and consumer-facing businesses, the old and new coexisting side by side. Since the liberalisation of the economy in the 1990s, in “an ever-expanding list of sectors […] the top one or two companies account for 80% or more of the profits generated,” a trend that has quickened in the last five years. Faced with this “unprecedented concentration of power in at least seven core sectors in corporate India,” the Competition Commission of India (CCI) in January began investigations into whether there was “abuse of dominance,” the Indian Express reported.

India is hardly an outlier here. Both a high degree of concentration and diversification through conglomerates are common throughout Asia, Africa, and Latin America (Austin et. al. 2017). Is this a cautionary tale of the failure of “creative destruction” or an inspiring story of entrepreneurial resilience? Might Schumpeter have met his match in the ‘emerging markets’? Or could India have taken a different path?

Any explanation of how corporations survive and thrive over time must be sensitive to historical context, specifically to those moments of crisis and realignment when alternatives appear possible. As income inequality and corporate concentration are on the rise again, not just in India but around the world, the difficult question of precisely what economic, social, and political roles big business should play is becoming unavoidable.

There is still much to learn from previous attempts to answer this question and to regulate big business. In the case of India, the period from the early 1950s to the late 1970s is crucial, when the state used primarily bureaucratic and legal policy tools to try combat the concentration of economic power and create an even playing field. But it failed to undo the head start gained by certain business groups during the colonial period and ended up exacerbating monopolistic tendencies.

The trend toward greater concentration can only be reversed by taking a holistic view of India’s corporate landscape in a comparative framework, recovering indigenous intellectual and political legacies of anti-monopolism while remaining attentive to shifting global developments. While the latest investigation into economic concentration in India is a welcome initiative, its sector-by-sector approach fails to grapple with the ties between companies across sectors and potentially repeats similar flawed approaches in the past.

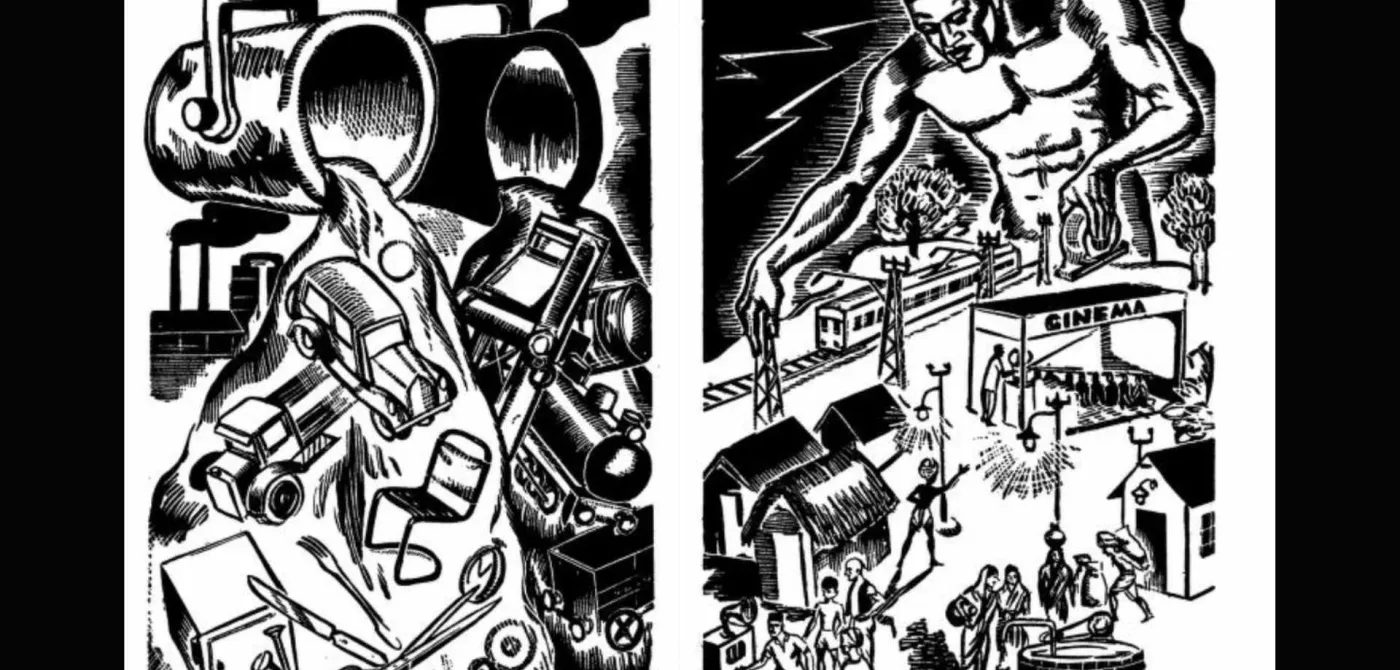

The 1950s: Colonial legacies and new beginning

As independence dawned, India was forced to reckon with the unevenness of the colonial economy. In the arena of corporate governance, the main concern was the managing agency system, used by both Indian and expatriate British firms. Under this system, ownership and control of companies were concentrated in the hands of a few promoter individuals or families, enabling investment in new enterprises at low risk. However, shareholders of individual companies were often rendered powerless and agents were free to siphon off profits without adequate oversight.

Once established, business groups assumed the characteristics of monopolies, crushing their rivals and resting on their laurels when it came to new investment.

The result was a constellation of family-run conglomerates, some more efficient, productive, and transparent than others. Many scholars view this system as a natural and even desirable response to “institutional voids,” including capital scarcity and a weak state. After all, Indian business groups were not so different from the Japanese zaibatsu, the Korean chaebol, or the Latin American grupos económicos (Goswami 2016, Austin et. al. 2017, Roy 2018). Others condemn the managing agency as a uniquely Indian manifestation of a speculative bania (trader) mindset, which discouraged innovation and risk-taking. Once established, business groups assumed the characteristics of monopolies, crushing their rivals and resting on their laurels when it came to new investment (Tyabji 2015).

Whatever one’s perspective on the benefits and drawbacks of the system, it is clear this was far from a free and competitive market. In 1944, two years after Schumpeter put forward his definition of creative destruction, India’s leading capitalists authored an ambitious blueprint for rapid economic development known as the Bombay Plan. In their research notes, the Plan’s authors (many of them associated with the Tata group) tried to assess where India stood in relation to the rest of the world. They wrote:

“Capitalist enterprise in India is comparatively of recent origin. But it inherits all the features which are associated with its development in the Western world […] Concentration of the control and direction of industry in the hands of a small group of individuals is also in evidence.” (Tata Sons 1944)

Conducting one of the first back-of-the-envelope calculations of the problem, Tata statisticians assisting in the preparation of the Bombay plan found that 850 individuals held 2,000 company directorships, 70 held 1,000, and just 10 held 300. But they saw no cause for alarm, arguing that such “combination” was merely “the latest phase of the development of capitalist enterprise,” as evidenced by conglomerates like General Electric in the US and Vickers and Unilever in the UK. On the other hand, widely accepted remedies like nationalization, price controls, and licencing only worked in “industrially well developed” countries (Tata Sons 1944). Since the Indian economy needed to expand, above all else, it was best to proceed cautiously.

These uncertainties and the competing pressures of balancing economic growth and social justice were reflected in the Constitution of newly independent India. The Directive Principles of the Constitution called for ensuring “that the operation of the economic system does not result in the concentration of wealth and means of production to the common detriment.” This was an aspiration, if not quite a mandate — for the principles were legally unenforceable. But it provided a strong basis for the regulation of the private sector in India. Throughout the 1950s, as the Five-Year Plans came into effect, the state occupied the ‘commanding heights’ of the economy, particularly in heavy industry, and created a robust infrastructure of long-term financing. The rising tide of growth lifted the capitalists’ boats as well.

The Nehruvian state, which committed itself to build a ‘mixed economy’, promised socialism while reinforcing capitalism [… and] failed to bring about a “wider diffusion of economic power.”

But by the end of the decade, far from reducing concentration, controls and licences had only increased it. The Nehruvian state, which committed itself to build a ‘mixed economy’, promised socialism while reinforcing capitalism. This contradiction is rarely taken seriously these days. Depending on one’s political views, the so-called ‘Licence Raj’ was either an obvious example of failing to properly regulate the private sector or of regulating it too much. Regardless, through a combination of strategies, groups had not only maintained but consolidated their position at the top of the corporate ladder. By 1958, Tata and Birla held “nearly one-fifth of the gross capital stock of all non-government public companies.” Clearly, Nehruvian planning had failed to bring about a “wider diffusion of economic power” (Hazari 1966, 17-19).

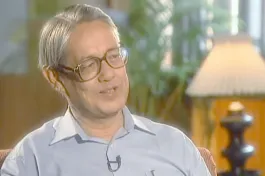

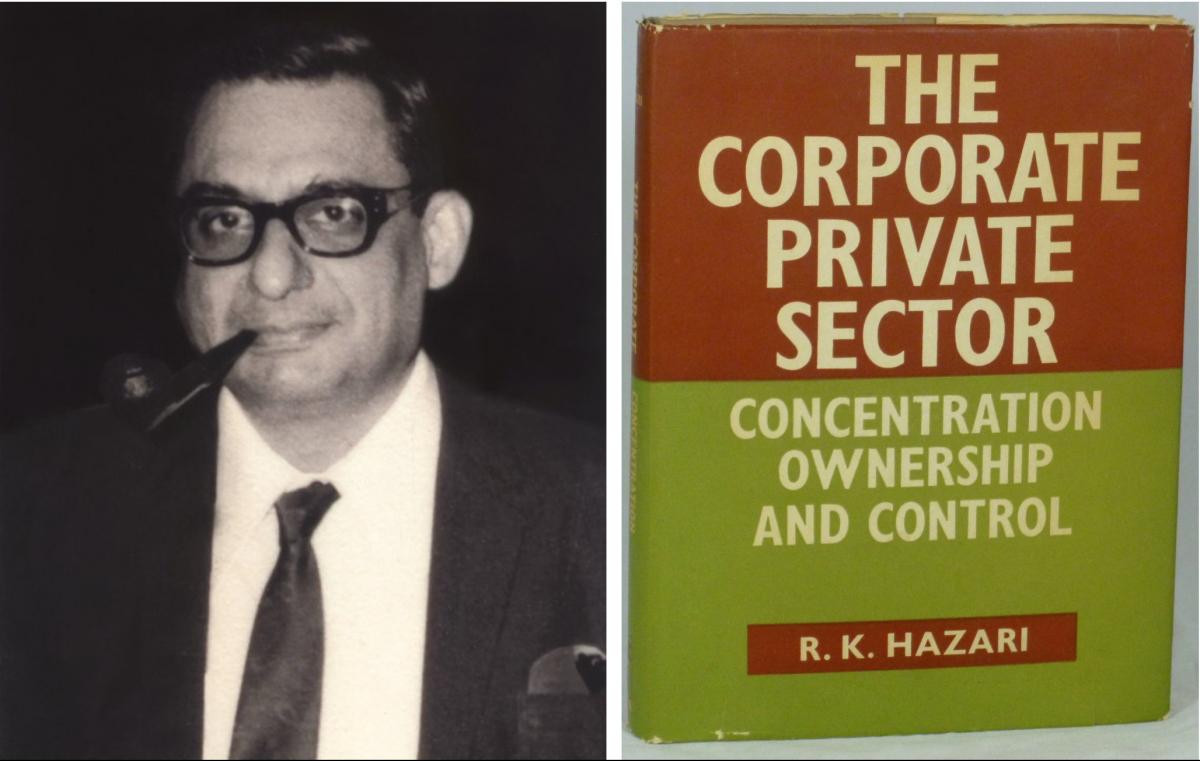

So found a young economist named R. K. Hazari, whose ground-breaking research would have a profound impact on academic and political debates about Indian capitalism in the post-independence years.

The 1960s: The Licence Raj on trial

Hazari was born in Punjab in 1932 and educated in Lahore and Bombay, becoming professor of industrial economics at the University of Bombay in 1964. He was a consultant to India's Planning Commission between 1964 and 1967; and later would become the youngest deputy governor of the Reserve Bank of India. In a landmark study, The Structure of the Corporate Private Sector (1966), Hazari carefully mapped out the nation’s corporate landscape for the first (and perhaps only) time. Using newly available data from disclosures under the Companies Act, passed in 1956, Hazari set out to measure “the proportion of corporate private assets controlled by twenty large and medium sized groups in 1951 and 1958.”

These business groups were more than just managing agencies by another name. In India, they could be defined as “units which are subject to the decision-making power of a common authority,” whether directly or indirectly through an array of crossholdings, proxies, and subsidiaries. To uncover their secrets, Hazari believed it was necessary to “pierce through the elaborate façade which obscures the location of the decision-making powers which control corporate activity.” (Hazari 1966, 3-13)

Hazari interpreted these findings in a global and comparative frame. The situation in India was fundamentally different from, say, the Gilded Age in the US […]: “Concentration in India is far from synonymous with monopoly in a particular industry.”

Hazari found substantial differences between how the largest groups were structured. Each could be roughly divided into an ‘Inner Complex’ and an ‘Outer Complex’, depending on the degree of control exercised. The Tata companies were more vertically integrated, held together by trusts, individuals, and institutional shareholders (banks and insurance companies). The Birla complex was far more confusing. Hazari could find no single controlling interest, not even “a solar system in which each planet has its own satellites,” but a series of “circular chains of investment which return to their starting points.” (Hazari 1966, 47-58)

Much like the Bombay Plan statisticians two decades before, Hazari interpreted these findings in a global and comparative frame. The situation in India was fundamentally different from, say, the Gilded Age in the US. Tata and Birla were not Rockefeller or Carnegie, cornering a particular sector or commodity:

Each of the twenty Complexes is occupationally diversified. The larger the Complex, the more diversified it generally tends to be. This is clear from the industry-wise distribution of the assets of all Complexes. Consequently, concentration in India is far from synonymous with monopoly in a particular industry. (Hazari 1966, 305)

Indeed, the prevailing government policy of restricting licences by sector was misguided because it would have been more appropriate for a classic monopoly scenario. But in India:

We are not suffering from the evils of monopoly in the conventional sense of the term. The common text-book evils of combinations in restraint of trade, like collusion in fixing prices, allocation of markets and restriction of output, are of little relevance in a sellers’ market which is expanding rapidly.” (Hazari 1966, 359)

Pivoting to a strategy of breaking up or taking over business groups would be both economically “suicidal” and “legally impossible,” according to Hazari. It would kill the very geese laying the golden eggs of industrial productivity (he had high praise for Tata in this respect). Large-scale nationalization in France or the UK (the best precedents) had only been attempted on a company or sectoral basis. Moreover, it was impossible to know with certainty which companies were part of groups and highly diversified groups like Birla would undoubtedly deploy their ingenuity to evade regulation, always staying one step ahead of the law.

In Hazari’s view, a “positive” approach held greater chances of success than the purely “negative” impulse to restrict and regulate.

What solutions did Hazari propose?

First and foremost, he encouraged the growth of the public sector as a “countervailing force” in the short run and the build-up of “medium” groups through discriminatory industrial finance over the long term. In Hazari’s view, a “positive” approach held greater chances of success than the purely “negative” impulse to restrict and regulate.

The other side of the coin was to attack the mechanisms that allowed for the consolidation of groups, such as trusts and holding companies. In this respect, he anticipated the problem of passive institutional shareholders that continues to bedevil corporate governance even in the most advanced economies.

Hazari’s study laid the groundwork for a series of commissions of inquiry, culminating in the passage of the Monopolies and Restrictive Trade Practices (MRTP) Act in 1969. Yet his work was also contested from both the left and the right. Writing in the Economic & Political Weekly, the Marxist political economist Amiya Bagchi (1967) seized on the contradiction of praising some big groups like Tata for contributing to growth while condemning others. Why not tackle the root of the problem, namely the very existence of the private sector?

Using a metaphor with uncanny relevance today, Bagchi observed:

“There is a group of socialists who believe that they can attack monopoly as only a skirmish before mounting the attack on private control of people’s livelihood, but they suddenly find that they are enmeshed in the skirmish, as the disease of oligopolistic concentration spreads throughout the economy and proves to be a stronger virus than old-fashioned pure competition.” (Bagchi 1967, 1614)

On the other side of the political spectrum, Dahyabhai Patel, a leader of the pro-business Swatantra Party (and Sardar Patel’s son), questioned Hazari’s empirical data and exclusive focus on the private sector. Pro-business Congress MP R. K. Bhuwalka insisted that “concentration of wealth is a necessary feature” of a mixed economy and that Hazari himself had written “that even monopolists in India must be allowed to expand further, otherwise growth of the economy would be retarded.”

The issue of concentration became individualised and moralised, a masala drama with varying heroes and villains depending on one’s politics.

Hazari’s exposés of the byzantine structure of the Birla group became a public scandal, overshadowing his measured conclusions about the system as a whole. Shortly after the 1967 elections, the Congress Parliamentary Party grew bitterly divided over allegations that ministers were in the pocket of the Birlas. Hazari was caught in the crossfire, as unnamed experts from the Planning Commission and industrial development ministry accused him of conducting investigations in an “immature and unscientific manner.” Discrepancies between the number of companies attributed to the group (270 in Hazari’s report vs. 151 according to the Monopolies Inquiry Commission) were taken as evidence of politically motivated bad faith.

Much like the relationship between Prime Minister Narendra Modi and the Adani and the Ambani business groups today, Birla’s proximity to then-ruling Congress party presented an easy target for partisan critique while obscuring the need for root-and-branch reforms. The issue of concentration became individualised and moralised, a masala drama with varying heroes and villains depending on one’s politics. Then and now, the state chased private investment in high-profile projects (the essence of the ‘Gujarat model’) and enabled corruption (whether of the ‘petty’ or ‘grand’ type) for the sake of growth (Jaffrelot 2019). Yet the dynamics of mass parliamentary democracy ensure that such issues only capture public attention through scandalous revelations, from Mundhra to 2G.

The 1970s: Crisis and churn

While in later years Hazari was keen to distance himself from the ‘negative’ MRTP regime enacted in his name, beneath the surface the government did change course and adopt more ‘positive’ measures. Small and medium firms were increasingly promoted in the domestic market through industrial finance and state patronage, without disturbing the dominant position of the leading conglomerates (Das Gupta 2016). Likewise, the establishment of the Santa Cruz Export Processing Zone (EPZ) and the Kandla Free Trade Zone (FTZ) followed Hazari’s suggestion to start producing for export.

The abolition of managing agencies, bank and coal nationalization, and the twin oil shocks of 1973-74 and 1978-79 pushed many older and inefficient groups out of business, leaving the path clear for well-resourced groups like Tata and Birla to take advantage after liberalization — joined by upstarts like Reliance and Jindal (Rajakumar and Henley 2007, Mazumdar 2012).

If the past is any guide, today’s ‘churn’ is merely a prelude to continued concentration in the future.

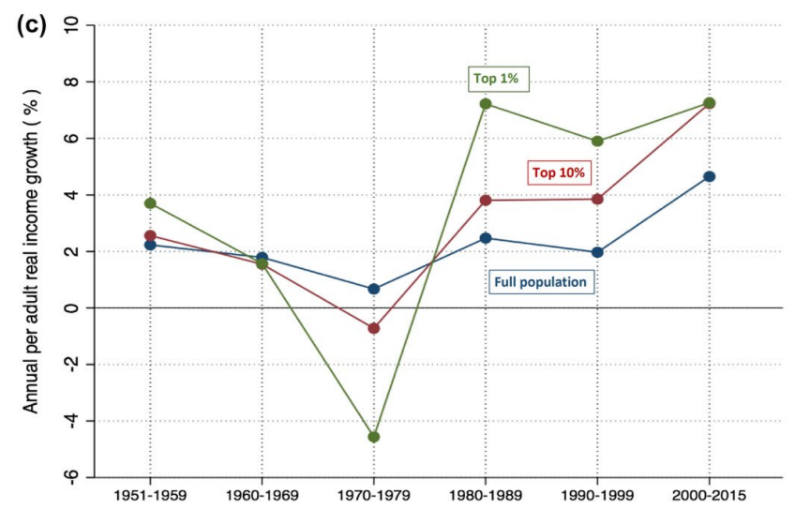

The 1970s, then, were a decade of ‘churn’. In an influential paper, Lucas Chancel and Thomas Piketty argue that progressive taxation, nationalisation, and a strong public sector disproportionately weakened the top 1%, leading to a reduction in income inequality. But this did not necessarily translate into a corresponding decrease in concentration. The most draconian anti-monopoly legislation might have had the opposite effect in practice. Swaminathan S. A. Aiyar of the Cato Institute critiques the Piketty thesis by pointing out that high tax rates incentivised capitalists to conceal their true assets and profits, which were kept off the books.

The state’s regulatory cupboard was empty by the end of the decade. Foreshadowing the CCI’s present-day investigation, the Sachar Committee on Companies and MRTP Acts (1978) focused on consumer rights and rigid definitions of market power and avoided substantive company law reform. Proposals to ban inter-corporate investment or to increase worker participation through equity sharing or seats on boards went nowhere. The subsequent euphoria of rapid growth masked enduring structural problems in the corporate sector.

Conclusions

Looking ahead, India may be entering another period of protracted economic crisis, with the impact of the Covid-19 pandemic exacerbating an ongoing slowdown. It is worth remembering that India’s last official recession before the current one took place in 1980, following the oil shocks of the Seventies. Once again, many second-order groups have recently fallen on hard times while leaving the top of the hierarchy undisturbed. If the past is any guide, today’s ‘churn’ is merely a prelude to continued concentration in the future.

In retrospect, the crisis of the Seventies was a missed opportunity for curbing monopolies — whether the remedy was either doubling down on regulation (Piketty) or encouraging true entrepreneurship (Aiyar). The ‘crony capitalist’ dispensation of the present, decried on the left and some segments of the right, can be traced back to this moment. There were no systematic efforts to actively promote competition beyond more liberalization and more growth. Despite a stronger constitutional basis in the Directive Principles, India did not develop an anti-trust legal tradition comparable to that of the US, which saw the break-up of many diversified conglomerates such as Ling-Temco-Vought (LTV) in the 1980s.

Corporate governance is more than a side-show to the big macroeconomic picture. Debating the proper relationships between companies, shareholders, governments, and citizens is imperative in a democratic society.

On the other hand, the outsized influence of the Big Tech giants and their expansion into other sectors of the economy in the US and globally might eventually lead to convergence on the Indian model. Will Amazon, Apple, and Google retain their dominance over the long term in the style of Tata, Birla, and Reliance — finally laying the spectre of Schumpeter’s “creative destruction” to rest?

Given these uncertainties, the Hazari report is more than a historical curiosity. It shows the merits of a concerted industrial policy of promoting small-to-medium enterprise (difficult to achieve these days when trust between the state and private sector is low) and the challenges of restrictive legal regulation (likewise difficult without adequate enforcement).

Above all, the lesson is that corporate governance is more than a side-show to the big macroeconomic picture. Debating the proper relationships between companies, shareholders, governments, and citizens is imperative in a democratic society. It is not enough to leave this matter to the experts and hope for the best. Everyone should ask themselves: what kind of corporations do we want? And how will we get them?