Background

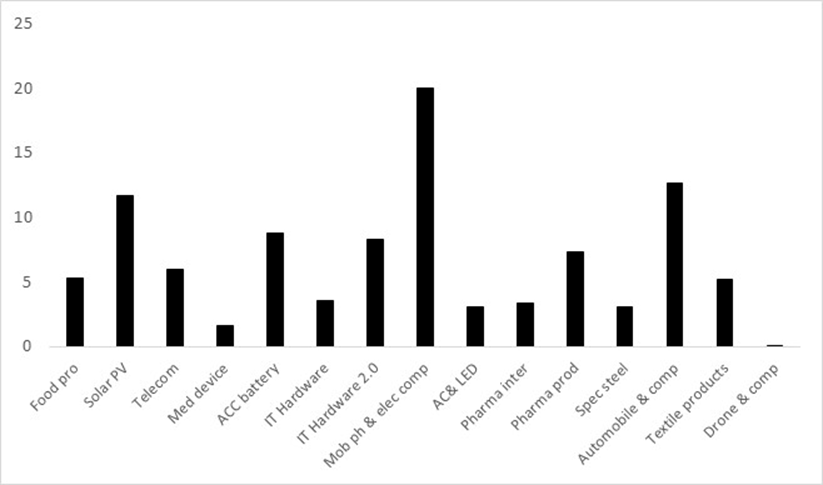

Make in India, a flagship initiative of the government that was launched on 25 September 2014, had modest outcomes (Nagaraj 2019). To improve these, the production linked incentive (PLI) scheme—a proactive policy to strengthen strategically important industries (Dhar 2024)—was launched in March 2020 for three industries. It was extended to 14 major sectors in 2021, taking the incentive outlay to more than Rs. 2 lakh crore (Dhar 2024). This was probably a reflection of the government’s faith that the scheme would increase the share of manufacturing in the country’s output. Figure 1 shows the share of the incentive outlays to each of these sectors.

Figure 1: PLI Scheme Incentive Outlay Share across Sectors (Percentage)

Mobile phones and specified electronic components led the share of incentive outlays and was one of the initial sectors in which the PLI scheme was implemented in 2020-21, or fiscal year (FY) 21, and it should end in FY 26. Two recent articles have noted the inadequacy (Iyer 2024) and lack of real impact (Chauhan et al. 2023) of the PLI scheme on mobile manufacturing. However, the government recently announced that the PLI scheme in mobiles had surpassed its targets.

These differing opinions can only be settled through a thorough review that evaluates the PLI scheme’s impact on value addition in industry, employment generation, net subsidy burden, and net exports. Until such data becomes available for a comprehensive study this analysis offers a preliminary assessment by examining selected aspects of the scheme’s impact. Specifically, it looks at overall production and trade figures, the characteristics of firms participating in the PLI scheme, and how their production compares with non-PLI firms.

PLI in Mobile Manufacturing

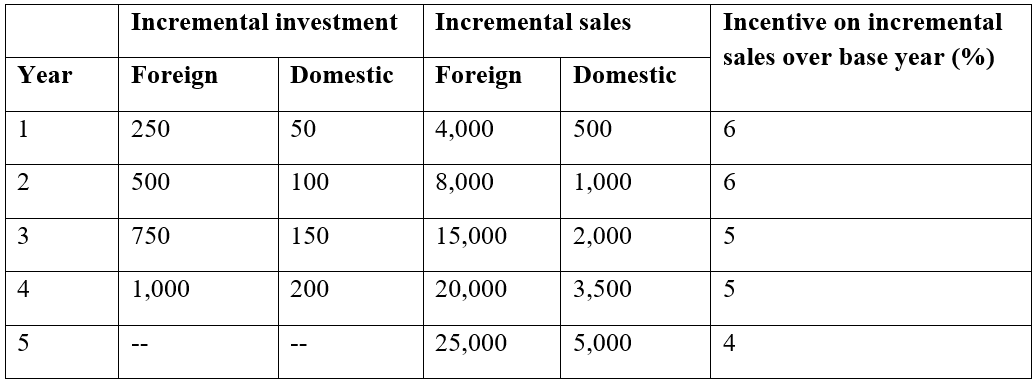

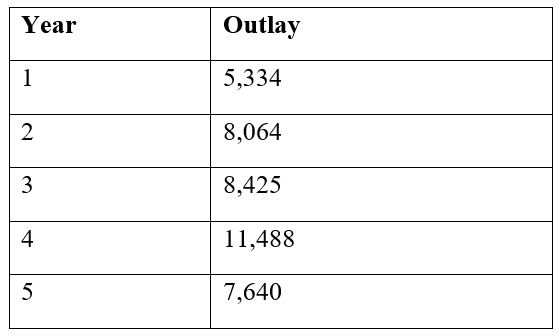

On 1 April 2020, the Ministry of Electronics and Information Technology launched the PLI scheme. This five-year programme incentivises incremental sales of mobile phones and their specified electronic components, aiming to boost both foreign and domestic manufacturing in India. Eligible companies received incentives on incremental sales over the 2019-20 base year—6% for the first two years, 5% for the next two, and 4% for the final year (subject to ceilings). To qualify, foreign firms needed to have mobile phone sales exceeding Rs. 10,000 crore in the base year, while domestic firms needed sales of over Rs. 100 crore. Only selected firms that met the specified thresholds for both incremental investment and incremental sales (Table 1) were eligible to receive the incentives.

Table 1: Investment and Sales Thresholds in PLI Scheme (Rs. crore)

These incentives were in addition to the exemption of import duty for capital equipment introduced in September 2018 and schemes available across numerous states in India (Iyer 2020a). The year-wise planned incentive outlay of the scheme (Table 2) reflected the expected increase in domestic production and sales of mobile phones and specified electronic components.

Table 2: Year-wise Planned Incentive Outlay of PLI Scheme (Rs. crore)

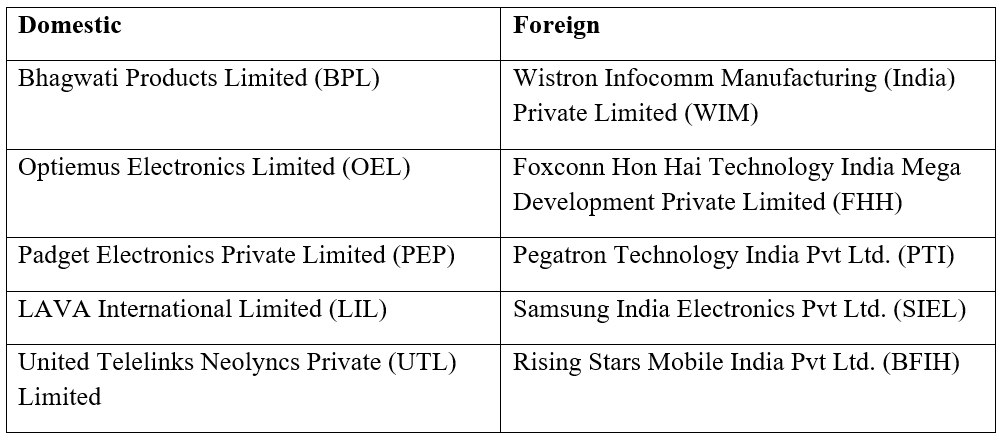

Sixteen companies were selected, of which 10 were mobile phone manufacturers—five foreign and five domestic (Table 3). The remaining six firms were approved under the “specified electronic components” segment.

Table 3: Mobile Phone Firms Selected Under PLI Scheme

Each firm was given the option of choosing any five consecutive years—Apple chose 2021-22 to 2025-26 while Samsung preferred 2020-21 to 2024-25.

Mobile Production and Trade

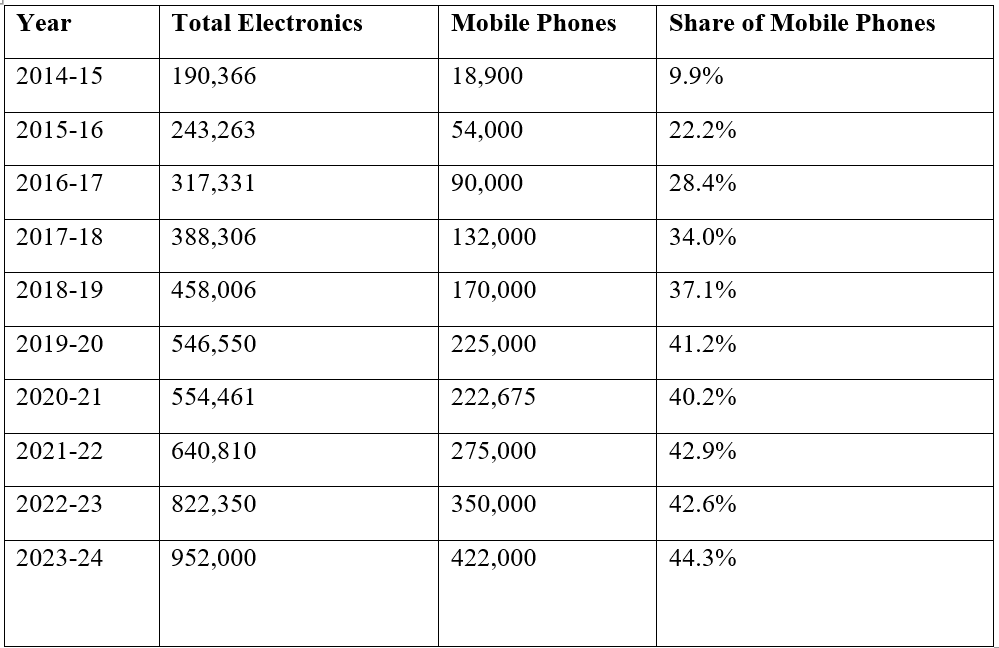

The India Cellular and Electronics Association (ICEA) points out that manufacturing mobiles in India with PLI scheme incentives is not as competitive manufacturing in China or Vietnam (2020). From FY 15 to FY 20, mobile phone production increased more than 10 times. However, compared to FY20 (PLI base year), in FY 24, production increased only by 90% (Table 4), a significant contribution of which was by non-PLI firms.

Among the firms participating in the PLI scheme that increased production substantially were Apple’s contract manufacturers and Samsung. The quest for a higher market share in India may have been the added incentive for Apple, while for Samsung the India-South Korea Comprehensive Economic Partnership Agreement (CEPA) may have played a role.

Table 4: Total Electronics and Mobile Phone Production in India (Rs. crore)

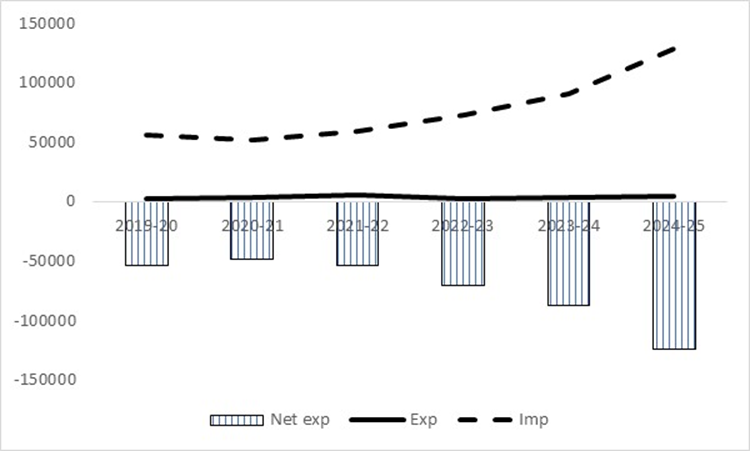

For the PLI period FY 20 to FY 24, mobile production increased by 90%, but its share in total electronics output increased only by 3%. It is possible that the PLI scheme in telecom and networking products and in LEDs may have contributed to the overall total electronics production, thereby muting the contribution of mobile phones. The impact of the PLI scheme on trade of mobile phones can be seen in Figure 2.

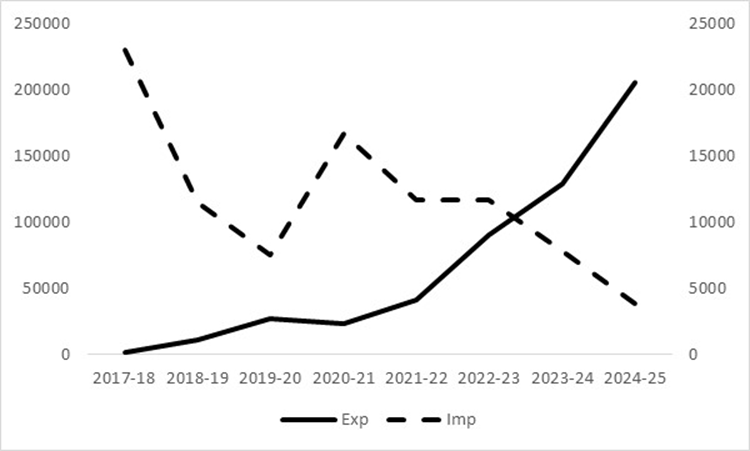

Figure 2: Exports and Imports of Mobile Phones (Rs. crore)

Much of the incremental production under the PLI scheme was expected to serve export markets (Iyer 2020b) and this seems to have happened—exports as a share of total production increased from 12.1% in FY 20 (PLI base year) to 31% in FY 24. Imports highlight the impact of Covid-19 on domestic production—they more than doubled in FY 21 before falling by 30% in FY 22. In nominal terms, FY24 imports are higher than those in FY20, while FY25 sees a drop of over 50% due to increased local assembly. As a result, imports as a share of production saw a marginal decline from 3.32% in FY 20 to 1.84% in FY 24.

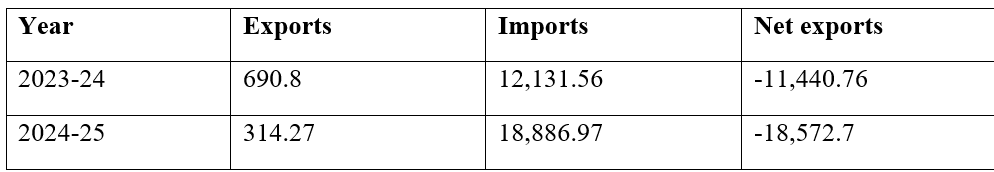

Figure 3 shows the exports, imports, and net exports of mobile parts. Imports of parts have almost doubled during this period, and negative net exports clearly indicate lack of domestic production of mobile parts.

Figure 3: Exports, Imports, and Net Exports of Mobile Parts (Rs. crore)

Display modules for mobile phones, which account for 16% of the bill of materials (Pathak et al. 2016), have also seen increasing imports in FY 24 and FY 25, implying lack of local manufacturing capabilities for display components (Table 5).

Table 5: Exports, Imports, and Net Exports of Display Panels used in Mobile Phones (Rs. crore)

The evidence above supports the inference that the PLI scheme has incentivised assembly but failed to increase value addition.

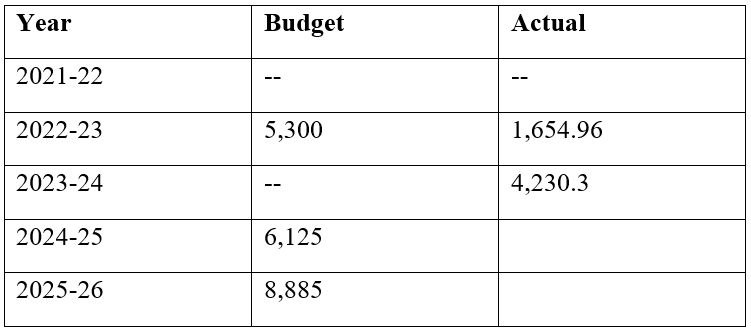

Table 6 shows the budgeted and actual disbursed incentives through the PLI scheme. The budgeted outlay for five years of the PLI scheme is 50% of the planned outlay (Table 2), while the actual disbursed incentive for the first three years is only 27% of the corresponding planned outlay.

Table 6: Budgeted and Actual Incentives Disbursed through PLI Scheme (Rs. crore)

The vast difference between planned and actual output expansion supports Dhar’s (2024) argument that the “scheme is saddled with a surfeit of rules and regulations that affect its pace of implementation because it can get stuck in a regulatory quagmire”. It also highlights how policy planners underestimate the practical roadblocks manufacturers face when trying to increase production.

Performance of Firms

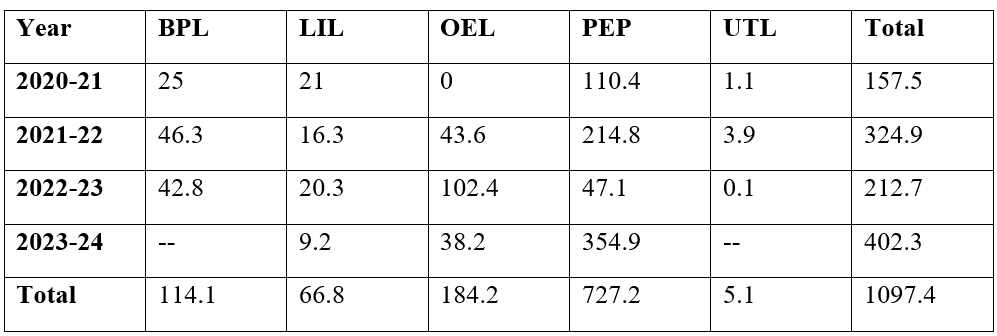

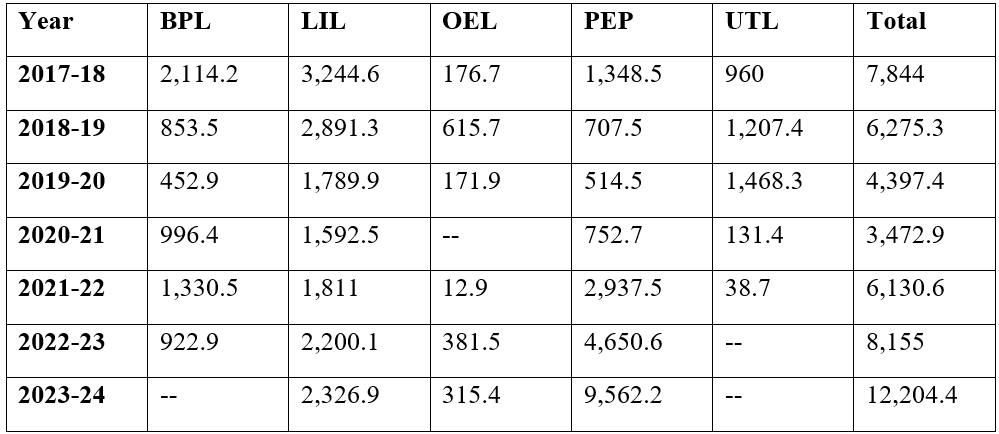

Table 7 shows the investment made by the selected domestic firms. Two firms can satisfy the investment threshold (Table 1), and among them, one has done exceedingly well. The remaining three have struggled to bring in the required investment. Between FY 21 and FY 24, total investment by these selected firms was more than Rs. 1,000 crore, indicating the creation of some domestic capabilities.

Table 7: Gross Fixed Assets Additions by PLI Domestic Firms (Rs. crore)

Table 8 details the mobile sales (FY 18 to FY 24) of PLI domestic firms. PEP not only invested exceedingly well but also experienced an exponential increase in sales, accounting for almost four-fifths of total sales in FY 24. This firm crossed the incremental sales threshold for all but one year. The remaining firms have not only struggled to cross the incremental sales threshold but also to repeat their best performance during the period.

Table 8: Mobile Phone Sales of PLI Domestic Firms (Rs. crore)

Tables 7 and 8 make it clear that only PEP makes the cut on both incremental investment and sales threshold—four fifths of the selected domestic firms lack the capability to take advantage of the PLI scheme.

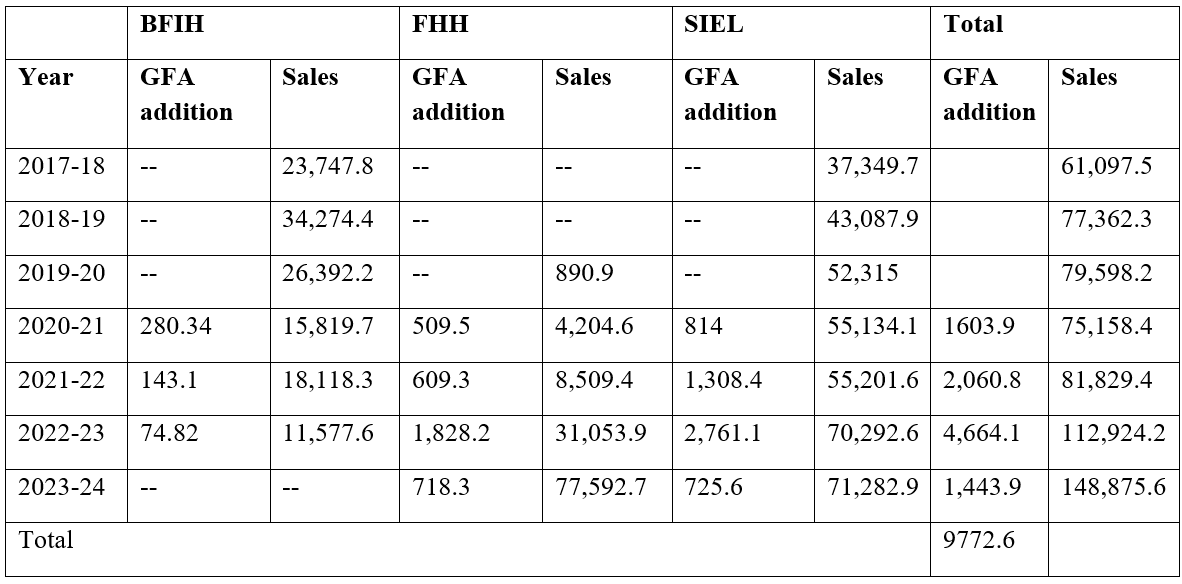

Table 9 shows the investment and sales of three of the five foreign firms selected for the PLI scheme. Data for two foreign firms—WIM and PTI—is not available. It has been reported that these two units together produce around 7.2 to 8.6 million iPhones a year (Achar and Chakraborty 2025). In the last fiscal, Tata Electronics bought out WIM and acquired a controlling stake in PTI.

Table 9: Gross Fixed Assets Addition and Mobile Phone Sales of PLI Foreign Firms (Rs. crore)

Only two firms, FHH and SIEL, have met the investment requirements. However, SIEL might not clear the sales threshold. From FY21 to FY24, the three foreign firms collectively invested nearly nine times more than the five domestic firms. Their total sales between FY18 and FY24 were also 13 times greater than those of the domestic PLI firms. This indicates that only foreign firms are achieving significant scale. For domestic firms to compete, they must focus on extensive R&D to customise phones and generate substantial demand across diverse sub-markets (Iyer 2020a).

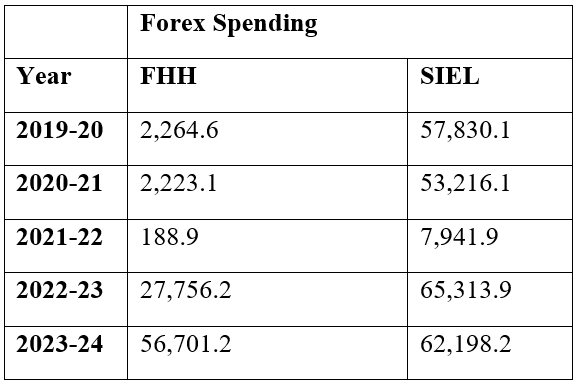

A look at the increasing forex spending (Table 10) of two foreign firms supports the earlier inference of import dependency and lower value addition. In the case of WIM and PTI, Achar and Chakraborty (2025) state that they are in a high volume, low margin business with high labour attrition (WIM has around 20,000 employees).

Table 10: Forex Spending by PLI Foreign Firms (Rs. crore)

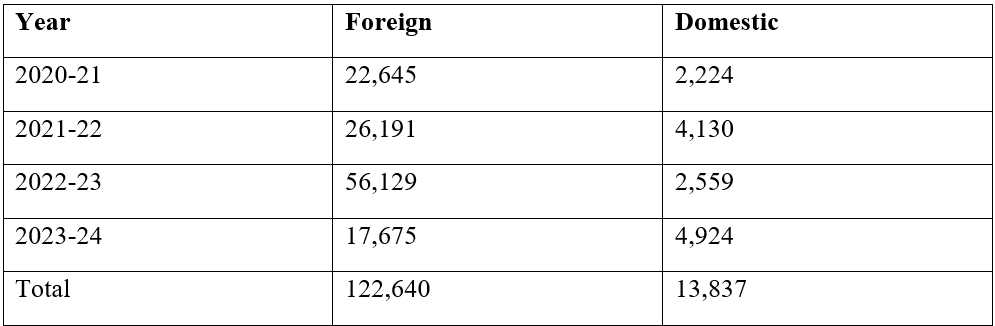

Employment Generation

Using unit level Annual Survey of Industries data, Iyer (2020a) estimates that in 2017-18, the average fixed asset per person employed for a mobile phone manufacturing unit was Rs 6.63 lakh. Using this estimate and the gross fixed assets additions by PLI firms, Table 11 presents the direct employment generated by the three foreign and five domestic PLI persons.

Table 11: Estimate of Direct Employment Generated

Through the four years, the eight PLI firms have generated 136,477 direct jobs. If one assumes that 50% of the actual disbursed amount (Table 6) was given to the above PLI firms, then Rs 2.15 lakh is the amount spent by the government to generate one direct assembly job.

Mobile Phone Sales

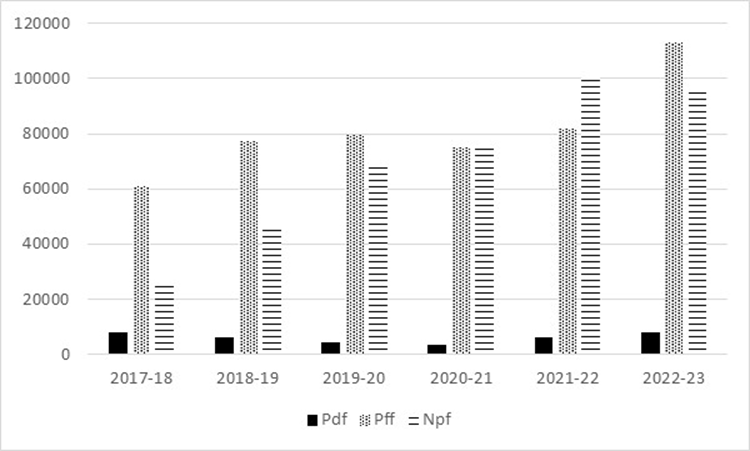

Figure 4 shows the mobile phone sales of eight non-PLI firms (of which six are foreign), and five domestic and three foreign PLI firms. The share of non-PLI firms increased from 28% in FY 18 to 53% in FY 22, but dropped to 44% in FY 23.

Figure 4: Mobile Phone Sales (Rs. crore)

In FY 19 and FY 20, non-PLI firms had the highest sales growth rate. However, government support seems to have shifted the momentum in favour of PLI firms. The highest sales growth in FY 22 was for domestic firms and that for FY 23 was for foreign PLI firms. The impact of this shift in momentum on the Indian mobile phone market is currently playing out.

Conclusions

The PLI scheme added to the range of incentives available for mobile phone firms to manufacture in India. A preliminary analysis of the scheme shows that there been an increase in domestic production of mobile phones and its exports. However, the increase in production as a share of overall electronics production is not commensurate with the support being offered. Foreign firms selected under the PLI scheme have utilised the opportunity to transfer their assembly operations in the country but are yet to start component manufacture in the country.

Four fifths of the domestic PLI firms have not been able to step up their pace, thereby questioning the use of output linked incentives to support and promote domestic firms.

Once the PLI scheme ends, it is an open question if these foreign firms will continue their assembly operations here. Non-PLI firms have also meaningfully contributed to increasing production but seem to be losing momentum, which may not be benign for the Indian mobile phone market.

Four fifths of the domestic PLI firms have not been able to step up their pace, thereby questioning the use of output linked incentives to support and promote domestic firms. Policy support for domestic firms may have to factor in their capabilities and come up with a tailor-made solution—such as, for example, support development of capabilities for customising phones and focus on research and development (R&D).

Chidambaran G. Iyer is an Associate Professor at the Centre for Development Studies (CDS), Thiruvananthapuram.