1. Introduction

In the run-up to the general elections and against the backdrop of the drubbing that the ruling Bharatiya Janata Party (BJP) received in December 2018 in the state elections in Madhya Pradesh, Chhattisgarh and Rajasthan, there was something surreal about the subsequent announcement of a 10% job reservation for the "economically backward" sections of communities defined by an annual household income of less than Rs 8 lakhs.

Other than being legally contentious, it was an attempt to divide a shrinking cake rather than trying to expand its size.

One no longer hears much about Prime Minister Narendra Modi’s promises of scaling up the Gujarat model for the whole country, one that was supposedly all about creating jobs and unleashing the entrepreneurial spirits left sagging by decades of slow poisoning by the Nehruvian economic model. The bullet trains became the metaphor for a fast track to development, ditching the slow-moving bullock carts moving along roads made uneven by rampant corruption. Quotas, subsidies, and hand-outs were about to be replaced by growth, opportunity, and investment.

The Spell Breaks

With the heavy electoral defeats, not only are bullet trains a receding dream, but the wheels seem to be coming off the bullock carts. Cows are literally roaming the streets, cow-protectors are on a rampage, and Modi increasingly resembles a nervous and unsure magician with all his tricks gone wrong, and none left up his sleeves while the audience turns more and more restless.

After nearly five years in power, the government is still talking about “trailers:” this is clearly some film in the making.

This restlessness is driving the government to the brink of desperation, amply evident in its interim budget for 2019–20. Noting the disenchantment among urban middle-class voters, there was an attempt to “buy” their votes by announcing large income tax exemptions. And for poor farmers, there was an apology of a package, Rs 6,000 per year, which is roughly one-third of the income defined by the poverty line. This does not even attempt to address the serious structural problems facing the rural sector, it is also insultingly low, given the magnitude of the crisis.

Time will tell if this has the desired electoral impact though voters have historically been canny enough to discount desperate financial hand-outs a few months before an election. The Prime Minister, meanwhile, assures the nation that this is only a trailer. After nearly five years in power, the government is still talking about “trailers:” this is clearly some film in the making. It would be prudent not to hold one’s breath for the final spectacle.

What Went Wrong?

To answer this one needs some benchmark to calibrate the economic performance of India under Modi. Public sentiment after all is unreliable and fickle whether on the upswing or downswing of a politician’s stock.

A more reliable indicator is the extent of the gap between the promises and performance that has surprised even those of us who were sceptical about the magic of Modinomics from the beginning. Another possible benchmark is the country’s economic performance in the recent past, before Modi came to power. Yet another one is the performance of other comparable countries over the last four to five years. These are not unrelated yardsticks. After all, it was the economic slowdown and “policy paralysis” of the latter half of the United Progressive Alliance II (UPA) government (2009–14) that drew the restless electorate to the promise of Modinomics.

“Over- promise and under-deliver:” that is a pithy summary of the economic outcome of the last five years.

In the early days of the millennium, N R Narayanamurthy, architect of the Infosys success story, when asked about the secret behind his company’s remarkable wealth creation and resulting adulation among investors, remarked in his trademark pithy style: “Under-promise and over-deliver.” This is the art of setting the expectations bar low and then surprising stakeholders by exceeding the promise. This anecdote is striking in how the exact opposite is true of the tenure of the current government at the helm of our country. “Over-promise and under-deliver:” that is a pithy summary of the economic outcome of the last five years.

2. Warning Signs

The year 2014 was a heady time for dreamers. After a long time, a politician was making economic development the core plank of his election campaign. Not caste or religion, but a simple and powerful promise of making everyone’s lot a bit better and weeding out corruption. In conjuring up that dream, the eloquent phrase “Acche Din” was trotted out, which everyone could immediately relate to. And this betterment would truly be for everyone, as “Sabka Saath, Sabka Vikas” promised. In fact, even aspiring Muslim youth, hitherto left behind, would march ahead holding “a Quran in one hand, a laptop in another”. How could people not get carried away? With dewy eyes, they all rooted for him; from Hindu to Muslim and kisan to crorepati.

It was not that there were no warning signs. The memories of the riots of 2002 still lingered. Whichever way you look at it, this was not a record to boast of for someone running on a plank of good governance. Also, if one looked at the economic record of Gujarat carefully, the vibrant colours of Modi’s Gujarat-model narrative start to fade, revealing grey and dark shades.

While Gujarat is indeed one of the top states in terms of the level and growth rates of per capita income since the early 1990s, three decades of high growth rate have not resulted in significant employment generation or wage growth, or in improvement of development indicators, such as poverty, life expectancy, or infant mortality. The reason is that the state has pursued a model of capital-intensive megaprojects; for example, in 2013, Gujarat’s share of fixed capital of the country was 17.7%, while the share of factory jobs was only 9.8%. More than 90% of the workforce in the industrial sector is employed as casual or contract workers earning low wages and only 6%–7% workers have regular or permanent jobs.

The oasis that Modi promised has revealed itself to be a mirage, and all who had walked hopefully towards it now languish even more parched than they were to begin with.

To top it all, whatever the strengths or weaknesses of the Gujarat model, Modinomics is largely a myth; albeit, a carefully constructed one. While Gujarat’s growth rate was indeed higher than that of the rest of India during Modi’s tenure, that was true through the entire post-liberalisation period, both before and after Modi’s rule. Therefore, to give Narendra Modi all the credit for the positive aspects of Gujarat’s economic performance would be as questionable as blaming him for the negative aspects. At best, he sustained a trend, improved upon a model already in place.

3. Economic Track Record: Promises and Reality

So here we are, nearing the end of Narendra Modi’s five-year term, with all those promises of development having come to naught. The dazzle of unbridled hope has made way for widespread anger and a feeling of being let down. Almost every section of Indian society, except the Hindutva hardliners, seem disenchanted. So much so that even the Prime Minister stays away assiduously these days from any mention of “Acchhe Din.” These words have vanished from his lexicon almost as quickly as the hope of jobs and prosperity did from the eyes of millions of young people across the country. The oasis that Modi promised has revealed itself to be a mirage, and all who had walked hopefully towards it now languish even more parched than they were to begin with.

Even in absolute terms, the economic performance of the last five years would be seen as underwhelming, but benchmarked against the sky-high promises, they almost feel like an insult. An insult that is already triggering the first sparks of retribution as suggested by the December 2018 state election results. Democracy hath no fury than an electorate spurned.

In trying to assess the economic performance of the Modi era, one has to be wary of optics. Since the start of his reign, the Prime Minister has displayed a surprising penchant for packaging and marketing his promise-laden policies. Surprising, because he is otherwise such a shrewd political player who should know that failure to deliver on these promises would have incurred the wrath of the voter when he turned to them at the end of his term for re-election. Perhaps he got carried away with his own eloquence.

Achhe Din?

One of Modi’s main promises was to revive the economy and reverse the economic slowdown in the last years of UPA II. What has been the outcome? We keep hearing about an annual GDP growth rate of above 7%. From the RBI Handbook of Statistics on the Indian Economy for 2017–18 published in September 2018, the average annual growth rate of GDP between 2014–15 and 2017–18 was 6.8%. In December last year the NITI Aayog in a highly unusual move, released revised GDP figures attributed to the Central Statistics Office (CSO) which showed that the average growth rate over the same period was slightly higher (7.3%).

With only months left before the general elections the CSO put out yet another set of revised estimates on 31 January that bumped up the average annual growth rate to 7.7%. Leaving aside the statistical controversy about the measurement of GDP (for example, the latest CSO figures that show a growth rate of 8.2% in the year after demonetisation, a claim that stretches credulity), if one looks at the World Development Indicators dataset of the World Bank, the reality is that in the last 15 years, India’s GDP growth rate has been above 7% in all but five years.

Of course, the jury is out on which GDP numbers will eventually be accepted as the most reliable. However, at least according to the World Bank dataset that is considered one of the most authoritative internationally, India’s growth rate dipped below the 7% level right after the global financial crisis, the last three years of UPA-II (the so-called policy paralysis phase), and in the year after demonetisation.

For a man who promised to unleash India’s economic might on the world stage using the magic of Modinomics, to now boast of an average growth rate that is slightly above 7% according to the World Bank data, slightly below 7% according to the earlier CSO estimates presented in the latest RBI Handbook, and 7.7% according to the latest revised CSO estimates, as a badge of achievement, will not persuade anyone except the most diehard believers. This is especially the case since the average for the previous decade was 7.73% using World Bank data, and even if one were to take the controversial back-series, the UPA-era average decadal growth rate is 6.9%. One does not need to be a statistician to see that there is no noticeable change here, despite the frequent revisions that keep on pushing up the average growth rate during the last few years.

The years refer to fiscal year, for example, 2017 refers to 2017-18. | Source: World Development Indicators, World Bank.

If we use a different benchmark and compare India's growth rate with the average growth rate across the world, the last four years do not stand out (Figure 1). Yes, it is one of the highest growing countries in the world but that was true in the previous decade too. Yes, it is now the highest among Asian countries but that is only because China lost the top spot that it occupied in the two previous decades. The gap between India’s growth rate and the global average growth rate or the South Asian average growth rate has, according to the World Bank database, shrunk, not widened, between 2014 and 2017 compared to what it was in the decade before 2014. In contrast, Bangladesh and Vietnam are the two Asian countries that have in fact improved their relative growth performance with respect to the world average over the last four years compared to the decade before.

However, the debate about GDP growth rates is really a distraction from the various indicators of the enormous distress affecting a majority of the population today. That really is Modi’s biggest failure; the number of people in the country who are worse off after his tenure, which no statistical chicanery about abstract indices like the GDP can hide. Therefore, his economic score card is best assessed through the prism of what it has meant for Indian citizens, rather than through a statistical debate on current and past GDP numbers. Also because that is, presumably, the purpose of all economic policy-making: not to score brownie points in seminars, political debates and editorial columns but to improve the lot of ordinary people, which Modi promised eloquently but failed disastrously in delivering.

Livelihood is the core issue for a majority of the population. There are other salient issues such as health, education, security and dignity, but economic status comes first in the hierarchy of needs and, indeed, those other dimensions of well-being are often a function of one’s position on the economic ladder.

The promises pertaining to livelihood were ambitious: 250 million jobs over 10 years, or 25 million jobs a year. Every year there is an addition to the workforce of an estimated 15 million. If we look at a CMIE series based on household surveys that is available since 2016 but does not go back before that, there was no job creation during 2018. In fact, the number of persons employed declined from 406.7 million in 2017 to 406.2 million in 2018 (with the latest figures released for February 2019 showing a further dip to 400 million). During 2017, 1.8 million jobs were added but that is only 12% of the net addition to the pool of job-seekers, and a mere 7% of the annual job creation figure of 25 million promised by Modi. For 2016 the corresponding figure was 1.4 million.

A smaller sample of jobs data reported by companies, the CMIE’s Prowess dataset, shows an average pace of job growth of 1.9% between 2014 and 2018, which is lower than the average for the decade before 2014.

If we look at data from government sources, then according to the Labour Bureau, the unemployment rate was at 3.7% in 2015–16. A recent press report about an unreleased Labour Bureau report that is being withheld by the Labour and Employment Ministry suggests that in 2016–17, the last year for which this annual Employment-Unemployment survey was carried out, unemployment stood at 3.9%, nearly matching the highest since 2011–12, namely 4% in 2012–13.

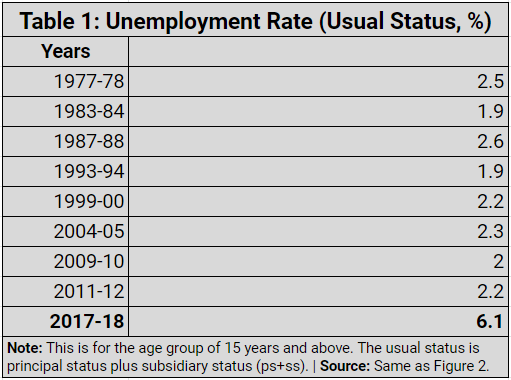

Press reports on the latest National Sample Survey Office (NSSO) survey, which to experts is the most comprehensive one on the labour market in India, presents an even more alarming picture. The unemployment rate was at a four-decade high at 6.1% in 2017–18(Table 1). No wonder that this report too is being withheld by the Government despite having been approved by the National Statistical Commission, and leading to the resignation of two of its members. More alarmingly, nearly one in five rural or urban youth are unemployed, according to this data (Figure 2). This data, coming as it does from official sources, conclusively proves that the Modi government’s track record on employment generation is nothing but an abysmal failure.

Recent anecdotal examples such as 19 million applicants for 63,000 jobs offered by the Indian Railways, or 7,000 applicants for 13 Maharashtra government waiters’ jobs (where 12 graduates were eventually selected) only buttress these figures. In urban and semi-rural India, where approximately 15 million young people are entering the job market every year, this has created an environment of frustration and disillusionment.

The government’s reaction has been to suppress this data at least till the elections are out of the way, but now the truth is out in the open. This has also shaken the international community’s faith in India’s statistical apparatus which may have far-reaching implications.

The problem is far worse, of course, in the agricultural sector that accounts for over half of India’s workforce. Modi’s assurance to Indian farmers had been clear: 50% profit over their cost of production and doubling of farm incomes by 2022. Not only has this not been delivered, the Indian farm sector is crippled by a widespread crisis.

At an average of 2.51% for 2014–17, agricultural growth has been much lower under the Modi government compared to the previous decade (2004-17) when growth averaged 3.7% or the decade before (1994-2004) when the average was 2.88% (Figure 3). It follows from simple mathematics that to double something in eight years, a sustained growth rate of at least 9% is needed. Short of an agricultural revolution this was an absurd promise to start with, and the performance is below par even by the performance of previous regimes.

Rural wage growth rates are at a 10-year low and in 2018 growth was less than the rate of inflation, that is, it was negative in real terms. Prices of agricultural produce have increased at a much lower rate than that of non-agricultural goods over this period, and in the post-demonetisation period, crop prices have tended to be deflationary. This has squeezed rural income and purchasing power relative to the non-agricultural sector. The 2018 upward trend in fuel prices has worsened the sense of impoverishment of a sector that accounts for the livelihood of almost half the population while contributing less than one-fifth of national income.

Yes, we know that in the course of economic development, people tend to move from agriculture to non-agricultural sectors. Yet, post- demonetisation, the agricultural labour force’s migration options have been cruelly cut off. Prior to this period, rural menfolk would leave their farms in the care of women and travel to nearby cities for day jobs in the informal sector, such as in construction, real estate, and manufacturing. Those jobs disappeared after November 2016 as this sector is largely cash dependent. For example, the growth rate in the construction sector was negative in the aftermath of demonetisation. This, in turn, exacerbated the rural income crisis and, yet, the government in all its wisdom continued to financially neglect the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), which experienced a huge demand during this period of crisis in informal sector employment.

To defend its woeful performance on employment and providing livelihood, the government often points an accusing finger at the industrial sector. This is partly true, and it brings us to the other major economic fault line of the last five years: the abysmally low growth of the corporate sector and its unwillingness or inability to invest in new capacity and jobs.

Curiously, even as the GDP numbers supposedly continue to grow at a reasonably healthy rate, at least as per declared data, corporate profits have languished over the last four years. In February 2014, the earnings per share of the Nifty index, the country’s most important stock index comprising 50 top companies that represent two-thirds of the entire market value of Indian stocks, was 350. In February 2019, it had limped up to 404, a compounded annual growth rate (CAGR) of around 2% (Figure 4). These companies are supposed to be the most efficient economic actors in the country, and anyway, corporate profits have historically grown at a faster clip than GDP. A quarterly aberration can be understood, but a four-year mismatch is truly baffling.

Not just this, most companies have massive unutilised capacity, which is why they are loath to invest in more. The Gross Capital Formation (GCF)—which is the investment in plant and machinery—has dropped sharply from 34.3% of GDP in 2014 to 30.7% of GDP in 2017. The average of GCF as a percentage of GDP during the Modi era is 31.8%. This is considerably lower than the average during the decade of UPA rule of 39%, and only slightly higher than the average during the decade before, namely, 28% (Figure 5). The CMIE reports that new project announcements plunged to a 14-year low in the October–December quarter of 2018, which means the trend in private sector investment continues downward.

While foreign direct investment (FDI) norms have been eased for sectors like retail and aviation, it is still only 1.5% of GDP (the same percentage figure as in 2013, after slight improvements in 2014 and 2015) and so cannot be relied on to make too much of an impact on the overall economic prospects of the country.

If we look at other sources of demand that could potentially provide a boost to the economy, such as exports, there, too, we see a dip in performance under the Modi regime.

Non-food bank credit charted an abysmally low trajectory through the last four years, stifling economic growth: from a yearly growth rate of 13.5% in the first quarter of 2014, it hit rock bottom at 4% in the fourth quarter of 2016 right after demonetisation, and then slowly climbed up to a growth rate of 8.7% in the third quarter of 2018, which is still only around half the average growth rate that prevailed in the so-called policy paralysis phase of 2012–14. If we look at the growth rate of credit to only industry, the overall pattern looks similar to non-food bank credit but the numbers look even worse.

When companies do not build new capacities and credit dries up, jobs vanish, which is precisely what is happening today. If we look at other sources of demand that could potentially provide a boost to the economy, such as exports, there, too, we see a dip in performance under the Modi regime. During 2014–17, India’s average ratio of exports to GDP was 20% while the corresponding figure for the previous decade was 22%. Since 2014, Indian exports have grown at a dismal average pace of 1.68%, while in the two decades preceding that, it was 13% to 14% (Figure 6). Given this, Modi’s target of $900 billion of exports by 2020 seems completely far-fetched. This in turn, has led to a spike in India’s current account deficit (CAD) to 2.9% of GDP, the key reason behind the rupee’s collapse to 70 versus the US dollar. Yet comparing across the same periods, neighbouring countries like Bangladesh and Vietnam were able to improve their performance in this dimension. Scaling up labour-intensive manufacturing exports has helped them address their unemployment problem.

“Make in India” sounds good as a slogan, but in reality the economic outlook under Modi seems to be more like “mess in India.”

Clues to the underwhelming growth performance during the last few years can be found in the falling investment rates in response to insufficient domestic demand, and the failure to expand exports. “Make in India” sounds good as a slogan, but in reality the economic outlook under Modi seems to be more like “mess in India.”

Outside the organised sector, the problem is graver. Medium and small enterprises (MSME) and unorganised units were dealt a deathly blow by the Prime Minister’s demonetisation scheme and have not yet recovered. The CMIE estimates that 3.5 million jobs were lost in the unorganised sector in the aftermath of demonetisation, a phenomenon we cited earlier as a major contributor to the crisis in the rural economy by choking off seasonal migration prospects. A ham-handed implementation of the Goods and Services Tax (GST) has only exacerbated this trend.

Add to this the NDA’s pathetic attempts at revamping the country’s education system to ensure that new graduates are employable. Government expenditure on education as a percentage of GDP has dipped in the four years of the Modi government and almost all the news about education that gets into the news cycle is about government interference with the running of institutions of higher education, saffronisation, and a backward looking, “it-was-all-discovered-in-ancient-India” approach to science and technology.

The overall picture that emerges is a gloomy one, indeed. Farmers struggling with poor farm prices and low income, rural and semi-urban jobs vanishing under the assault of demonetisation and chaotic implementation of GST, the corporate sector stuck in a low-profit-low-capacity-utilisation trap that prevents them from offering more jobs, and an alarming crisis in skill-development affecting the millions that are entering the labour market every year. It is a ticking time bomb with the most alarming social ramifications.

Yet, this is not the full picture. To start with, it is shocking that we do not have any government estimates of poverty since 2011–12. That aside, what must be even more rankling for millions of Indians struggling to eke out a modest livelihood is how fast the wealth of the rich keeps growing.

According to the World Inequality Database developed by Thomas Piketty and his colleagues, in India the shares of the bottom half of the population in total wealth is 6.4% according to the latest available figures. In contrast, the share of the top 1% in total wealth is 30%. Not surprisingly, the share of these groups in national income shows a similar gap: the bottom 50% earn only 14.6% while the top 1% earn 21%. What is even more alarming is, the share of the top 1% has been steadily rising at a rate that is much higher than how average wealth or income has been growing. And commensurately, the share of the bottom 50% in both income and wealth has been steadily decreasing.

If you think about the reasons, this is not surprising and for that one does not have to be nostalgic about the license-control Raj when growth was low and so was inequality. In a labour-surplus economy, wages are low and returns to capital and non-labour inputs like land are high to start with. If, in addition, GDP growth does not lead to commensurate job or wage growth, very little of its benefits will trickle down to the poor. It is true that these figures reflect long-term trends for which Modi alone is not responsible. But given this reality, making promises like "sabka saath sabka vikas" without any concrete follow-up actions adds to the pervasive sense of popular discontent with Modi’s economic record.

Public Services

To be fair, achhe din is not all about economic prospects in the narrow sense and one should look at some other indicators of quality of life or welfare, such as infrastructure and various public services and amenities. In this regard, there has indeed been some progress in several important areas.

For example, the total number of rural houses constructed under various central government schemes since 2013–14 has more than doubled, and so has rural road construction. There has also been significant progress in building rural toilets under the Swachh Bharat Abhiyan, and in providing electricity and liquefied petroleum gas (LPG) connections under the Saubhagya and Ujjwala schemes. There also has been considerable progress in financial inclusion; more than 33 crore bank accounts have been opened, with 19.75 crore accounts in rural areas under the Jan Dhan Yojana.

However, there are concerns about the extent to which the government claims success under these schemes. For example, contrary to the government’s claim that almost 99% of Indian households now have access to toilets, an independent survey by the Research Institute for Compassionate Economics (RICE) reports that in the states of Bihar, Madhya Pradesh, Rajasthan, and Uttar Pradesh, 71% of the rural population owned a latrine in 2018. The corresponding figure for 2014 was 37% and so the increase is indeed significant, but well short of the full marks awarded by the government to itself in this regard.

Moreover, the National Annual Rural Sanitation Survey (NARSS) in 2017–18 suggests that a significant share of households have toilets but no water in them, which is also confirmed by the RICE survey. Clearly, one needs to move beyond a mechanical approach of “dropping” toilets in rural areas without an integrated approach that takes into account water connections and waste management.

Similar concerns have been raised about numbers relating to electrification. The claim that 25 states had brought electricity to 100% of their households by the end of 2018 does not seem quite credible. An examination of government documents by Scroll.in suggests at least some of the claimed success is due to targets being revised downwards as opposed to performance moving upwards.

There has been a huge increase in LPG connections too and clearly the Ujjwala Yojana is largely responsible for it. For example, almost two-thirds of those with new LPG connections in 2016–17 were beneficiaries of this scheme. However, studies indicate that this has not translated commensurately into use of LPG because the gas cylinders are not cheap. The difference in refill patterns between newer customers who are more likely to be beneficiaries of the scheme and those of earlier users, as well as various field-visit-based media reports, indicate that the number of refills are far from sufficient to meet the cooking needs of the beneficiary households.

The Jan Dhan Yojana has been widely and deservedly praised as a successful example of a policy of financial inclusion. The World Bank in its Global Findex Database reported that 80% of Indians now hold a bank account, a sharp rise from the figure of 54% in 2014. However, a significant percentage (20% according to latest reports) of these accounts are still dormant or zero balance, even though the percentage of such accounts has come down over the years.

It is too early to comment on the success of the recently launched health insurance scheme, Ayushman Bharat, but the experience of the failed Rashtriya Swasthya Bima Yojana (RSBY) suggests that without a major investment in the planning and design of such a scheme, it is unlikely to be effective and likely to end up with public subsidies being funnelled to private providers. The key aspect of the design of any health insurance is to take into account potential abuse by patients (over-use and false claims) and hospitals (turning away patients or over-treating and over-charging them to benefit from the scheme). Changing the name of a scheme or even increasing budgetary allocation will not solve this core architecture problem.

To sum up, despite some of these reservations, there have certainly been some improvements in infrastructure, public services and amenities. Yet it is notable that in the late 2018 state elections, the ruling party suffered electorally in some of the key heartland states. The crisis in people's livelihoods has clearly dominated any improvements in other aspects of quality of life.

Macro and Fiscal Management

Defenders of the Modi government can hardly dispute these criticisms, which are based on official government statistics. They thus try to shift the debate to the quality of economic growth. Much is made of the government’s fiscal rectitude; how it has managed to rein in the fiscal deficit to 3.3%. Yes, the Modi government has marginally reduced the deficit to GDP ratio relative to the UPA. Even though the government gets some credit for reducing the fiscal deficit ratio, reports from the Comptroller and Auditor General of India (CAG) suggest that this is largely due to creative accounting methods to roll over subsidy data and the windfall of falling oil-prices that allowed it raise fuel taxes without much protests.

For example, news reports of a CAG report of January 2019 say that the government is using off-budget financing such as funds of state-owned enterprises for revenue as well as capital spending, rolling over subsidy payments to the Food Corporation of India (FCI), and underpaying states their share of taxes and duties as per the 14th Finance Commission guidelines. In the interim budget for 2019-20, the government claims that its fiscal deficit of 3.4% of GDP is very close to the budgeted 3.3%. But according to some calculations the fiscal deficit would have been 4% if the government just paid the FCI what it is owed. Moreover, as oil prices start to rise, the government will be under greater pressure to use non-standard measures to deal with the deficit.

If we look at tax revenue collection, another key determinant of the fiscal deficit equation, despite the government’s claim about the rise in the number of indirect tax payers due to the GST, the actual collections have not been impressive. The growth in indirect tax collections accruing to the centre in the post-GST era actually shows a decline. An examination of the Central Board of Direct Taxation data suggests no significant increase in the number of income tax payers since 2013–14, despite the often-heard claim that demonetisation led to a large increase in the number of income tax payers.

Another oft-repeated claim is that inflation was consistently higher under the UPA. Indeed, if we take the annual inflation rate in consumer or retail prices as measured by the Consumer Price Index, the average for the UPA period was 8.1% while that for NDA-II is 5%. However, if we take the difference between India’s CPI inflation rate and the world average, the corresponding figures are 3.7% and 3.1%, respectively for the two regimes (Figure 7).

Therefore, while some credit is indeed due to the Modi government for fighting inflation, this seemingly dramatic improvement can also be partly attributed to external factors affecting the global economy. There was a sharp rise in oil prices and a commodity price boom (especially food prices) across the world during the UPA years. Crude oil prices hit a record of $160 a barrel in 2008, the average price being $93 per barrel during UPA-II, as opposed to $53 per barrel during the Modi years. Rising oil prices not only contribute to inflation but lead to a rise in deficits (by raising the fuel subsidy bill) and so, in this respect, the Modi government has been very fortunate since it has experienced a decline in oil prices during most of its regime. It could have done so much with this lucky break but squandered the opportunity.

Fighting Corruption

A key part of Modi’s campaign promise was to root out the corruption that seemed to have become a normal part of Indian life, like a parasite that lives inside the system and sucks out all life-energy, ranging from petty bribe-taking by traffic policemen, to government jobs-contracts-licenses for sale, to mega-scams relating to infrastructure and defence deals. This part of Modi’s campaign rhetoric – “Will not take bribes and will not let anyone take bribes”—appealed strongly to voters cutting across political lines. Here, too, his promises were extravagant—to raid the mountain-like stock of black money stashed abroad and put Rs 15 lakh rupees in every bank account. If we pause for a second and do the arithmetic, this was a patently absurd promise: the total promised sum is 14 times India’s GDP and 25,000 times the estimated amount of black money in Swiss bank accounts according to the White Paper on Black Money (2012)! No wonder even Amit Shah acknowledged that this was a jumla (an empty promise).

If it was a mere penchant for exaggerated promises backed up by some action, perhaps one could have been kinder in evaluating Modi’s performance, given the Augean stables proportions of the problem. But fast forward a few years and Rafale, like Bofors before, is yet another foreign brand name that has become famous in India for the wrong reasons. Vijay Mallya, Nirav Modi, and Mehul Choksi have now become household names as part of a long line of fugitive businessmen who have escaped the supposed iron-fist of the Modi administration and are living luxuriously in exile.

4. What Got us Here?

This brings us to the issue of economic policy administration and where it has failed. So far we have assessed the government’s track record in terms of economic outcomes that look far from impressive whether one weighs them against the promises or in terms of India’s performance in the recent past or that of comparable countries over the same period.

Unfortunately, whichever way you look at it, if the last years of the previous government was described as a regime of “policy paralysis”, under the present government it can only be described as “policy pandemonium.”

However, in principle, it is possible that policy changes take time to show results. Is it the case that the Modi government was just unlucky despite having a solid policy framework in place? May be good days are indeed around the corner? Unfortunately, whichever way you look at it, if the last years of the previous government was described as a regime of “policy paralysis”, under the present government it can only be described as “policy pandemonium.”

No amount of data-jugglery or advertising expenditure can hide the fact that economic policy under Modi swings from repackaging and reinventing old policies to complete pandemonium and paroxysm.

In 2014, Modi had made a promise of “Minimum Government, Maximum Governance.” Four and a half years on, the exact opposite has happened with policy-making becoming far more centralised than ever. Equally, there had been an assumption that Narendra Modi, by virtue of his experience in managing Gujarat efficiently, was a master administrator who would streamline all administrative processes to unleash India’s true entrepreneurial potential. This belief now lies in tatters. No amount of data-jugglery or advertising expenditure can hide the fact that economic policy under Modi swings from repackaging and reinventing old policies to complete pandemonium and paroxysm.

Sins of Omission and Commission

First, there are the sins of omission. Where tough decisions could have effectively shed some of the baggage of the licence-control raj, the government has shown little political will beyond the symbolic renaming of the Planning Commission as Niti Aayog. The biggest disappointment from the reforms perspective has been the centre’s inability to cut out any major wasteful expenditure (such as regressive subsidies or administrative flab) or make any serious attempt at factor-market reforms, such as land acquisition or labour regulation or disinvestment. This is not what one would have expected from a leader whose image is that of a bold decision-maker, unafraid to take tough decisions, in the Thatcher or Lee Kuan Yew or Deng Xiaoping mould.

Then there are the sins of commission. The biggest instance is, of course, demonetisation. This showed up Narendra Modi to be a whimsical stuntman with no regard for due process or consequences. It also showed an utter disrespect for the Reserve Bank of India (RBI), a fault line which was to deepen in the subsequent months. This was a completely misguided policy misadventure; as much as no doctor would ever recommend taking out 86% of a patient’s blood to cure a disease, no economist, whether a Marxist or a free-marketeer, would recommend a shock to the total currency supply in the economy to the tune of 86%. Predictably, the consequences for economic activity were severe.

Even the government’s Economic Survey acknowledges that demonetisation knocked off at least 1% from the growth rate (recent work by the US-based Gita Gopinath and others show this was more like 2%). The loss in national income from a one-time reduction in the growth rate of 2% is equivalent to the entire budget on the military or health disappearing and, as we mentioned earlier it, led to job losses of 3.5 million.

Modi’s reputation as a capable administrator was also dealt a severe blow by the hasty and ill-conceived implementation of the GST, even though as a policy this was a sound one. The constant bickering with states highlighted his inability to work with members of a team and finally when the plan was rolled out, the entire system froze up because of the numerous glitches in the format. Over several months, in a process that still continues, rates were rationalised several times to plug the original holes in conception. The GST is a classic example of how not to go about a much-needed taxation reform.

The uncertainty and chaos created by the policy-induced shocks of demonetisation and GST-implementation have led to a general sense of anxiety about a key element of the vision of reforms, the targeting of “black money.” This must have contributed to the steady decline in India’s investment rate. Fighting corruption is a laudable goal, but that cannot be the core economic vision for reforms in a country like India, and, even if it was, a hare-brained scheme like demonetisation was not the way to go about it.

These measures exemplify the government’s emphasis on optics or its tendency to launch policies that are packaged in headline-grabbing catchy slogans but fall well short of achieving results. If any, this has been the one recurring theme of the Modi era; what one could call “Minimum Achievement, Maximum Publicity.”

Contrary to lofty expectations of autonomy and galvanisation, the Indian public sector touched its lowest ebb during the Modi tenure. Non-performing assets (NPAs) of public sector banks touched an all-time high of Rs 9 trillion. While earlier governments must bear a fair share of responsibility for the problem, when it peaked during its term, the Modi government could do little to resolve it.

In fact, Modi's initial attempt was the classic band-aid approach: to kick the NPA can down the road by throwing more taxpayer money at the problem. First came the Indradhanush 1 scheme in 2015 to recapitalise ailing public sector banks, then another Indradhanush 2 scheme in 2017 with more money, and finally the mother of all bail-outs; a mammoth Rs 2.1 lakh crore bank recapitalisation plan. The objective was to somehow paper over the structural problems leading to these bad assets in the first place and to give public sector banks more liquidity so that they could prime credit growth that had remained stubbornly anaemic through Modi's tenure.

Predictably, all of these schemes ended in disaster. Other than frequent jibes at the UPA on how he had rooted out “telephone banking,” the reformer did not take a single step to address the deep structural fault lines that lay at the heart of Indian banking.

The problem would have been worse had it not been for the efforts of Raghuram Rajan during his tenure as the RBI governor. To be fair, the government can also claim some credit for the Insolvency and Bankruptcy code (IBC) passed in 2016. Like the GST it is another piece of reform that has not yet delivered the kind of successful resolutions the beleaguered banking sector may have hoped for, but a start has been made and one would hope the results will follow.

However, this has to be viewed against the long-term potential damage of the souring of relations between the RBI and the NDA government which has raised serious questions about central bank independence. This started off with Raghuram Rajan’s insistence on greater disclosures and provisioning for bad assets. The government wants the RBI to allow ailing public sector banks, already under huge pressure because of bad loans to industry, to resume lending to small business and to lower interest rates to stimulate the economy. It also wants a share of the RBI’s surplus funds to finance a public spending spree right before the elections. The ensuing tussle between the RBI and the NDA government culminated in the resignation of Urjit Patel as the RBI Governor. The last time a Governor of the RBI resigned was 43 years ago and this has only happened twice in India’s post-Independence history.

In fact, through the Modi tenure several other economists of international stature have left their positions at the helm of advisory bodies, at a rate of turnover that does stand out compared to earlier regimes. One can only wonder as to whether this is due to the routine “personal reasons” that were officially stated or due to their inability to stomach the unilateral and regressive economic policies of the government.

Reinventing Central Planning

Narendra Modi’s main failure on the economic front is that his basic approach remains that of a central planner who relies on heavy-handed measures of command-and-control in administration. This is not just in the case of banking, but evident in the manner of implementation of Aadhaar, the stalled land acquisition bill, the ill-conceived and badly executed demonetisation exercise, the electrification, fuel, and sanitation programmes, and even the healthcare reforms that are under way.

In an ever-changing and complex world inhabited by millions of economic actors, we cannot plan for the desired outcomes as there will always be some uncertainty. But we can agree on desirable processes and respect the integrity and autonomy of institutions. That will ensure we will stay on the right track, even though sometimes we may get lucky and sometimes unlucky.

Modi’s actions have, however, have paid little heed to process and consistently undermined the authority of institutions like the RBI, the CSO, the Parliamentary Committees, the bureaucracy, and the Central Bureau of Investigation (CBI), to an extent that almost every day we wake up to read about some new controversy involving these institutions.

The reputations of institutions and the public confidence they enjoy take a long time to build and yet can be squandered in a very short period. Administrations come and administrations go, but the network of institutions that constitute the circuitry of government go on forever and thus need to be preserved.

An obvious casualty of the Modi administration’s tendency to interfere with every aspect of government has been the erosion of confidence in central bank independence and of faith in government data. Leaving aside all the policy fiascos—which in principle could be reversed easily—rebuilding the reputation and independence of institutions like the RBI and the CSO would be a challenge in the years to come.

The underlying reason for all of this seems to be the government’s obsession with quantitative indicators: if they are good, exaggerate widely and launch a publicity blitz, and if they are bad, just ignore, stall, suppress official reports, or put out questionable data. However, indicators are a noisy reflection of actual economic outcomes – like the number of toilets is to sanitation – and economic outcomes in turn are the results of the actions of millions of individuals and numerous institutions. If one does not pay attention to the processes that govern the behaviour of these individuals and institutions, or, worse, interfere with them in ad hoc and autocratic ways, the outcomes cannot be good whatever the indicators might be stretched to show.

We have focused on the economic shortcomings of the Modi government in this essay. However, it is difficult to ignore the damage done to the social fabric of the country in the last few years which too may be difficult to repair like the damage to institutions.

Leaving aside the controversy about the exact number of deaths in mob violence targeted at minorities, the incendiary nature of the rhetoric of elected representatives such as the Chief Minister of Uttar Pradesh has polluted public political discourse and contributed to a festering state of sporadic eruptions of mob violence. An atmosphere of mistrust and insecurity has been the result. Social cohesion is of paramount importance in a country as diverse as India in terms of religion, ethnicity, language and caste in and of itself. However, the lack of social cohesion can also seriously impair economic vitality.

If rampaging mobs can get away with murder with impunity, and crowds can dictate who can buy or sell what, irrespective of what the law might be, what kind of environment does it create for commerce and industry? Without security of life and property and freedom of trade and association, what kind of economic vitality can we hope for? To take a concrete example, the cow vigilantes have undermined the rural economy by literally creating a mass of abandoned cows that are raiding farms for food because farmers simply abandon cows when they no longer give milk, and they can no longer be sold for slaughter.

Those reformwallahs who held their nose in 2014 to the toxic nature of Hindutva politics in the hope that it was a price worth paying for economic reforms ignored this basic point about the economy: sustained economic growth is impossible without social cohesion and a spirit of citizenship and solidarity.

5. Conclusions: It All Adds Up

So here is what we have after four and a half years: job growth at multi-year lows, a farm crisis, a crippled unorganised sector, currency value at near all-time lows, a soaring current account deficit, high interest rates, a half-frozen banking system, a sputtering tax regime, a struggling corporate sector...

For a man who promised the moon, the current economic environment does not present a pretty picture. The CSO’s most recent estimate of GDP growth for 2017–18 published on January 31 is 7.2% while the advanced estimate for 2018-19 published on February 28 is 7%. The 2018-19 growth is the lowest for the five years of the Modi government even going by the CSO’s latest revised estimates (that, among other things, put the post-demonetisation growth rate to be 8.2%). That, in essence, should be taken as the exit rate for growth during the Modi tenure.

So here is what we have after four and a half years: job growth at multi-year lows, a farm crisis, a crippled unorganised sector, currency value at near all-time lows, a soaring current account deficit, high interest rates, a half-frozen banking system, a sputtering tax regime, a struggling corporate sector, sinking exports and a GDP growth rate that, for all the constant revisions and data controversies associated with it, does not stand out compared to the earlier decade.

When the fundamentals are not in sync with the expectations, bubbles are bound to burst, leaving behind a wreckage of broken promises and bitter disappointments.

Campaigns are run on promises but governance is judged by performance. As the US politician Mario Cuomo, former governor of New York and one-time challenger to Bill Clinton for the Democratic Party nomination for the US presidency, put it: “One campaigns in poetry but governs in prose”. It is easy to make promises but hard to keep them. Like the stock market, one can create a bubble by stoking expectations. However, at some point the numbers need to add up. That is why it is wise to under-promise and over-deliver, as Narayanamurthy said. When the fundamentals are not in sync with the expectations, bubbles are bound to burst, leaving behind a wreckage of broken promises and bitter disappointments.

For Modi, the numbers are beginning to add up and the sums look ominous. Yes, and that sum too. The one that he started off with: the magical figure of 282 out of 543 Parliamentary seats that he won in 2014.

[We thank Parikshit Ghosh and Niranjan Rajadhyaksha for helpful discussions, Pramit Bhattacharya and Puja Mehra for suggesting useful references, C Rammanohar Reddy and Manishita Dass for comments on an earlier draft, and Xin Zeng for research assistance. Special thanks are due to Somesh Jha of Business Standard for sharing with us the data from the unpublished NSSO 2017-18 report that was first reported by him in Business Standard on 30 January 2019. None of the above are responsible in any way for the content of the essay, for which the authors alone remain responsible.][This is a revised and updated version of the article that was first published on 8 March 2019, corrected for a few errors in the charts.]