Listen to the podcast by R. Nagaraj here.

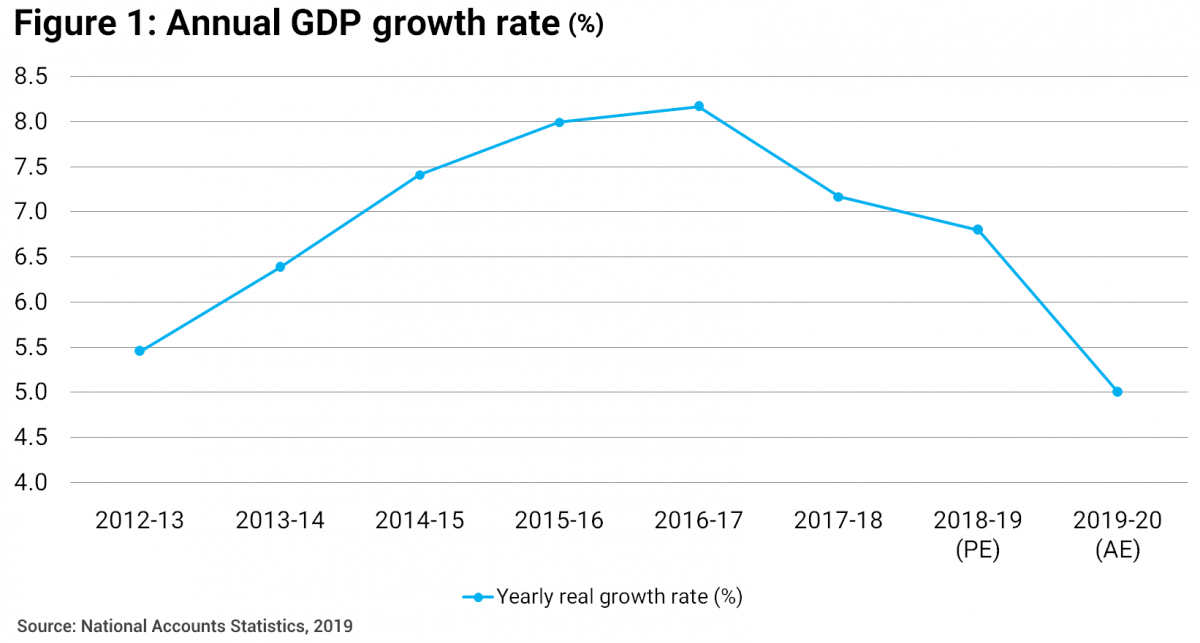

India's economy has fallen on hard times. According to the Advance Estimates (January) of the National Statistical Office (NSO), the growth of the gross domestic product (GDP) will be 5% in 2019-20 in real terms; many private forecasters have put the figure even lower. It is a steep fall from the 2016-17 growth rate of 8.2% (at least according to the official statistics). The fall is more dramatic in terms of the quarterly output estimates, from growth of 8.1% in January-March 2018 to 4.5% in July-September 2019.

With unrelenting bad news of a fall in output and sales and of a retrenchment of workers coming from across sectors and regions, the Government is finally compelled to admit the reality. Yet it claims that it is a temporary and cyclical problem that will go away with the policy measures it has initiated.

In just a few years, India has gone from being one of the world's fastest-growing, IT outsourcing-led, export-oriented economy to a protection-seeking laggard.

The reality may be a lot grimmer, however, if one takes a longer view from when the economy had slumped after the boom of the 2000s – which I had called “India's Dream Run” (Nagaraj 2013). In just a few years, India has gone from being one of the world's fastest-growing, IT outsourcing-led, export-oriented economy to a protection-seeking laggard.

What accounts for such a quick and sharp reversal of economic performance? Is it a mere perception problem or hard reality based on credible evidence? What would it take to restore the growth momentum of the last decade, with equity and inclusivity?

To answer these questions, one needs to have a consistent and quantitative account of economic performance in the last decade (the 2010s). As the Government has changed many standard macroeconomic data series in recent years, the task is daunting. I narrate here a story of how the boom of the first decade of the 2000s turned into a sharp slowdown spanning most of the second decade of this century and how economic policy has failed to respond to the warning signals, a failure which has ended up in the current slump. I believe that a clear and credible narrative will help draw up policy options to get out of the present impasse.

A sub-theme here is on the recent changes in economic statistics which, I am afraid, have primarily contributed to a distorted picture of the economic reality that I will seek to correct.

1. The Boom and its Aftermath

The dream run

A decade ago, India was a rising star in the global economy, with its annual growth rate touching 8-9% between 2003 and 2008, with price stability and modest fiscal and balance of payments deficits. It was hailed as one of the fastest-growing large economies, nipping at China’s heels and reckoned as the emerging global back office as against China being the world’s factory.

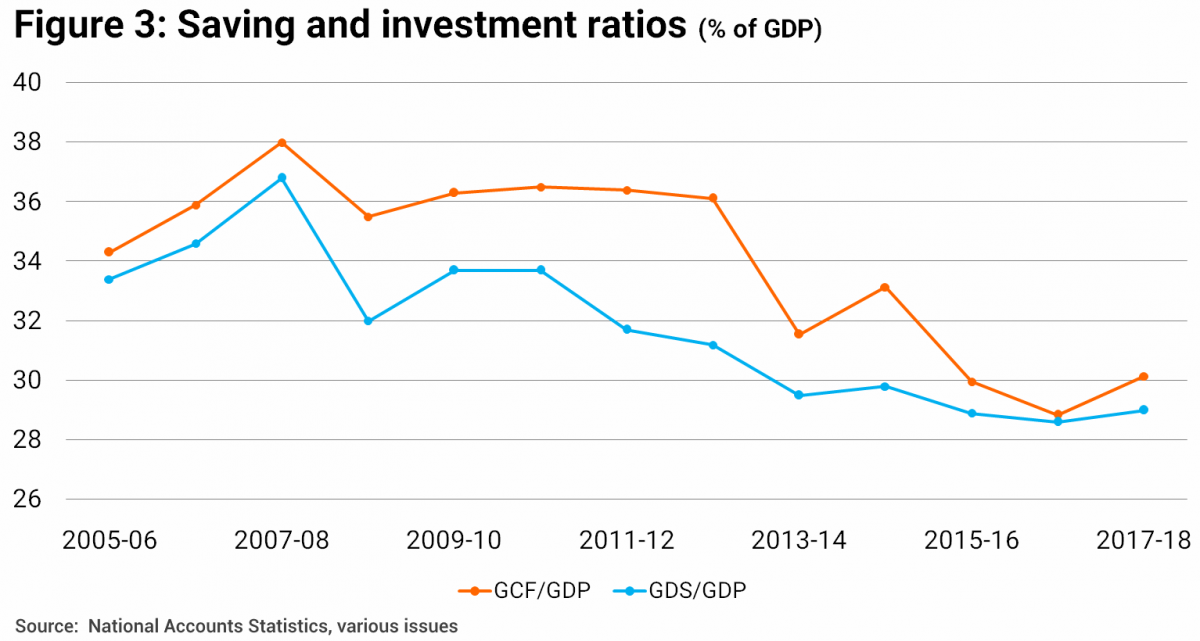

That boom is associated with a sharp upturn in the investment rate peaking at 38% of GDP in 2007-08, with rising domestic saving financing (most) of this investment. Unprecedented foreign capital inflows – foreign direct investment (FDI), foreign portfolio investment (FPI) and external commercial borrowings (ECBs) – at close to 10% of GDP supplemented domestic resources. A rising share of short-term financial inflows caused concerns about financial fragility. However, as the capital inflows were reportedly put to productive use, the criticisms against the inflows were muted. The ‘Dream Run’ was also a debt-led growth with bank credit to the private corporate sector (PCS) burgeoning at an unprecedented pace; a large share accrued to big business and politically connected firms. These resources went into infrastructure projects such as roads, ports, coal, and thermal power plants (Nagaraj, 2013). Public-private partnerships (PPP) was the preferred mode of investment in infrastructure as the Government cut down on public investment to adhere to fiscal orthodoxy in line with the Washington Consensus that was the guiding star of economic policy.

The Global Financial Crisis in 2008 upended the boom, though it affected India only modestly for two reasons: (i) its stricter financial regulations and (ii) relatively large and closed domestic markets. After a brief dip in 2008-09, India, thanks to accommodative monetary and looser fiscal policies (a concerted effort by the Group of 20 countries), witnessed a V-shaped recovery that lasted until 2011-12. Quantitative easing (QE) by advanced economies meant renewed capital inflows into emerging markets in search of better yields (that is, higher returns), until the wake-up call of the ‘Taper Tantrum’ (in May 2013) – when the US Federal Reserve hinted at raising interest rates – took place, reminding India of the perils of fickle capital inflows.

The lower output growth has translated into job losses, withdrawal of workers from the labour force (due to a lack of employment opportunities), a sharp rise in the open unemployment rate, and a stagnation in real wages in rural India.

For the protagonists of the reforms, the ‘Dream Run’ was a period of virtuous growth, with accelerating growth and poverty reduction. There were a fair number of sceptics, however. In 2006, at the height of the boom, political scientist Atul Kohli cautioned against the impact of the reforms that were not so much pro-market (as promised) but pro-business in reality, with the benefits accruing mostly to powerful business groups. Substantiating the idea, Kohli's 2012 book, Poverty Amid Plenty in the New India, demonstrated the unequal distribution of the fruits of market-oriented reforms and growth.

Amit Bhaduri argued how in the name of liberal reforms, rural land and forests were ravaged by powerful businesses, decimating the livelihoods of the poor and marginalized in agriculture and the informal economy. He characterised the decade's economic boom as ‘Predatory Growth’ (2005). Journalist James Crabtree's account, The Billionaire Raj (2018), documented how India's super-rich (The Bollygarchs, as the author called them) quickly made their way into the Forbes’ list of global billionaires. And how the liberal economic policy era cemented the nexus between business people and politicians, substantiating the idea of crony capitalism operating under the guise of impersonal markets. 1 For a close-up view of what the boom and bust was like and what crony capitalism meant, see this ground level account of the iron ore-mining town of Bellary in Karnataka. (How Bellary went from boom to bust, livemint.com, Dec 23, 2019)

As the boom petered out at the turn of the previous decade (2011-12), a revolt against cronyism and capitalist exploitation of land, labour and scarce natural resources came out into the open. The judiciary played its part in putting an end to these exploitative relations. There were massive protests across the country against land acquisition (in Nandirgam, West Bengal,for instance), there were court cases against corrupt business houses for getting scarce natural resources at allegedly throwaway prices (2G, for example). Despite the credible record of economic progress, the perceptions of corruption and cronyism did the government in (The Economist, 2014).

The aftermath of the boom

By the middle of the 2010s, the euphoria about reforms got muted with economic growth distinctly lower than in the previous decade; domestic saving, investment, and capital inflows likewise trended downwards. IT exports were tapering off as the US imposed taxes on outsourcing and because of technological changes. Inflation, however, ruled high on account of international oil prices, and the balance of payments (BoP) deficit became precarious for a while.

Decelerating output growth affected the earnings of corporates and hence their ability to service the enormous debt they had accumulated during the boom. Corporate bad debts got translated into the banking sector’s non-performing assets (NPAs) as firms could not repay loans, restricting banks’ ability to offer new loans. 2 Financial brokerage reports, The House of Debt by Credit Suisse (2013), and, Strategy and Economy by Ambit Capital (2013), offer detailed financial accounts of the debt held by large business houses, and politically connected companies respectively.

2. Wilted Outcomes since 2014-15

Points of departure

Realising the deteriorating economic situation and the discontent with the previous political dispensation, the National Democratic Alliance (NDA) government came to power on the agenda of development (modelled after Gujarat's supposed success), eradication of corruption and enforcement of the rule of law. The collapse of Kingfisher Airlines and then Vijay Mallya fleeing the country leaving behind the public sector banks bleeding, was, in the public imagination emblematic of everything that was wrong with economic management of the previous regime. The incoming Government vowed to use financial regulation (including enforcement of strict tax laws) to probe and punish financial wrongdoings. This was an agenda with a broad popular appeal.

In its political campaign, the new ruling coalition had also advanced the idea of "minimum government and maximum governance," seemingly inspired by Margaret Thatcher and Ronald Reagan to consciously promote free-market ideals. These views resonated well with global financial elites and the globalised Indian community. True to its beliefs the Government sought to adhere to fiscal orthodoxy, promoted inflation targeting, and claimed to enforce the rule of law. To illustrate, the Government devoted its considerable administrative capital to improving India's ranking in the World Bank's Ease of Doing Business (EDB) index to win over global investors. The ranking did move up to the 63rd position in 2019, from the 142nd position in 2014, a widely publicised accomplishment.

Yet, in parallel, the Government nurtured nationalist projects such as Make in India to raise the manufacturing sector's share in GDP to 25% by 2022 and create 100 million additional manufacturing sector jobs. And populist, targeted, welfare programmes were promoted such as the provision of free cooking gas connections to women of below poverty line families (under the Pradhan Mantri Ujjwala Yojana), and no-collateral small bank loans for poor and unemployed (called Mudra loans).

Policy shocks

To eradicate black money and also to encourage greater use of digital transactions, in November 2016 the Government demonetised the large-valued currency notes of Rs.1000 and Rs. 500, accounting for 86.4% of the total value of the currency in circulation. It was indeed a macroeconomic shock, devastating the informal/unorganised sector (which mostly runs on cash transactions), employing up to 90% of the workforce and contributing nearly half of the domestic output. There is near unanimity among economists about demonetisation’s adverse effects (Ramakumar 2018). Many believe that it contributed to a contraction in economic activity. Nor has the policy shock led to reduced usage of cash: as a proportion of GDP it is inching back to its pre-demonetisation level, as per the RBI Annual Report, 2018-19. 3 The following example illustrates how demonetisation was a complete mockery. V K Sasikala, (a close associate of late J Jayalalitha, former Tamil Nadu Chief Minister, now in jail for alleged financial wrongdoing), has reportedly purchased real estate and industrial assets worth Rs 1600 crores using the demonetised currency during the short window of time allowed to surrender the old currency for the new - as per an income tax filing with the Madras High Court. (How Sasikala bought properties with demonetised currency notes worth over ₹1,600 crore, The Hindu, December 23, 2019)

The Goods and Services tax (GST) to replace various indirect taxes has been in the making for quite a while. However, its introduction in 2017 was the second shock in less than a year, welcomed in principle but widely criticised for its poor design and implementation. Besides adversely affecting small and informal enterprises (which find it hard and expensive to comply with GST’s numerous computerised filings and procedures), thus leading to a severe shortfall in tax collection, it has affected government finances and the sharing of revenue between the centre and the states.

Changes in economic statistics

Changing the base year of the national accounts every 7 to 10 years is a routine matter for statistical offices everywhere. The revision helps account for the changes in the economic structure and relative prices; and, it also allows for using better statistical methods and improved databases.

In early 2015, the then Central Statistical Office (CSO) — now the NSO — introduced a new GDP series with the base year 2011-12, replacing the earlier one with the base year 2004-05. Surprisingly, the absolute GDP size for 2011-12 in the new series was marginally smaller (by 2.3%) than that in the earlier series. But its annual growth rates in the following years were significantly and systematically higher than in the older series. As the new GDP growth rates were out of line with many economic correlates, there was widespread criticism that the new series seemed to systematically overestimate the GDP growth rate. 4 The current GDP revision has come under an intense scrutiny for the veracity of the estimates. For a non-technical introduction to the debate, see Nagaraj (2016); for detailed stock-taking of the discussions as the debate progressed see, Nagaraj and Srinivasan (2017), and Nagaraj, Sapre and Sengupta (2019). Two examples best illustrate this problem.

- With the demonetisation in November 2016, output and employment contracted, especially in the unorganised or informal sector. Economists widely believe it to be so based on theory, empirical analysis and numerous field reports. Yet, the official GDP estimate for 2016-17 showed an 8.2% growth, the highest in a decade! 5 IMF Chief Economist, Gita Gopinath’s (co-authored) academic research paper confirmed an adverse effect of the demonetisation on India’s growth rate. See, Chodorow-Reich et al (2018).

- For the same year, according to the actual tax returns filed by companies in the private corporate sector, the fixed investment to GDP ratio fell to 2.8% from 7.5% in the previous year, as per Ministry of Finance’s Report on Income Tax Reforms for Building New India (September 2018). The fall in the ratio seems understandable as demonetisation led to a contraction in economic activity. Surprisingly, however, the corresponding ratio according to the CSO’s National Accounts rose to 12% of GDP in 2016-17, compared to 11.7% in the previous year. The divergence between the two sets of estimates (both the levels and the direction of the change) suggests that the national accounts-based corporate investment estimates are out of line with reality.

Claiming that the National Sample Survey Organisation’s (NSSO) five-yearly Employment and Unemployment Surveys (EUS) – conducted since 1972-73 – are too infrequent and failed to capture the functioning of the urban labour market adequately, the Government replaced the EUS, with a re-designed, Periodic Labour Force Survey (PLFS).The decision was based on the recommendations of the report of the task force chaired by Arvind Panagariya (Ministry of Labour and Employment 2017).

Earlier, consumer expenditure surveys (CES) and EUS were conducted simultaneously with the same sample households. But with the introduction of the PLFS, a separate CES was conducted, also undertaken in 2017-18.

Regrettably, PLFS and CES survey results for 2017-18 have failed to find favour with the Government. The PLFS data, released after considerable controversy and delay, has been officially rejected as it is claimed to be not comparable with 2011-12 EUS data, though most knowledgeable experts have dismissed the official objections. Similarly, as the CES results for 2017-18 are at variance with the administrative data, the CES data has been scrapped and not released. However, many experts find the leaked CES data to be credible, and a few research reports with insightful findings are now available in the public domain.

Evidence on output performance

We now report economic outcomes during 2010s, mostly using the official data sources, subject to the qualifications mentioned above.

Figure 1 plots the real annual growth rate, which shows GDP growth rising steadily from 5.5% in 2012-13 to 8.2% in 2016-17, declining after that to 5% in the current year (2019-20), as per the official Advanced Estimates. If these estimates are correct, the economy has slowed down only after 2016-17, probably on account of the shocks of the demonetisation and shoddily implemented GST.

However, as already discussed, the GDP growth rates are overstated on account of the kind of methodological changes used and the newer data sets that have been used. To illustrate, the annual GDP growth rate for 2013-14 went up sharply from 4.8% in the old series to 6.2% in the new series. Similarly, the manufacturing sector growth rate for same year swung from (-) 0.7% in the old series to (+) 5.3% in the new series.

Statistical exercises to validate the official GDP estimates have indicated a sizeable overestimation of the growth rates. Arvind Subramanian, using cross-country growth regressions, inferred that "Official estimates place annual average GDP growth between 2011-12 and 2016-17 at about 7%. We estimate that actual growth may have been about 4.5%, with a 95% confidence interval of 3.5 - 5.5%.” (Subramanian, 2019).

In a similar vein, in a time-series exercise for the period 2011-12 to 2017-18, Sebastian Morris has suggested, using official quarterly GDP data, that the actual growth rate may be between 5% and 5½% per year. To quote: “We see that there is significant overestimation in the official series in the overall growth rates – on an average by about 1.3 percentage points over the period 2011-12 to 2017-18.” (Morris, 2019). Hence, we may infer the following:

- The GDP growth rates in the current decade are distinctly lower than those recorded in the last decade.

- Rising GDP growth rates from 2012-13 to 2016-17 are overstated by a margin of 1½ to 2½ percentage points in the new series.

- Therefore, the actual growth rates recorded for the last six quarters may be far lower than the officially reported figures.

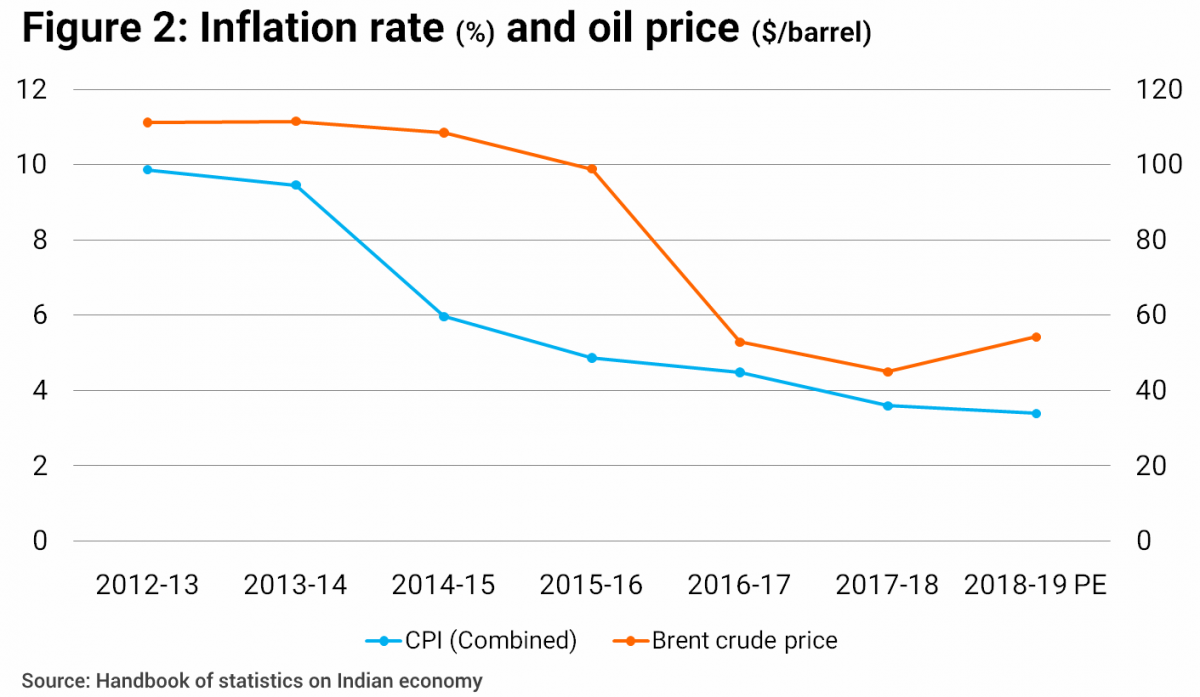

There is, though, a silver lining. The inflation rate, measured by the consumer price index (CPI), has declined sharply from 9.5% in 2013-14 to 3.4% in 2018-19, with an average annual rate of 5.3% during the period (Figure 2). The fall largely mirrors a decline in international oil prices, an exogenous factor. As India imports nearly 80% of its commercial energy requirements, oil prices perhaps remain the best predictor of the domestic inflation rate (besides food prices).

Figure 3 shows gross saving and investment rates from 2004-05 to 2017-18 (all at current prices). 6 The data shown in the graph are computed by splicing the estimates from older (2004-05 base year series) and the current National Accounts series, ignoring the underlying conceptual differences. The reported time series data represent a fairly accurate approximation of the underlying trends. The investment rate peaked at 38% of GDP in 2007-08 (just before the global financial crash) and thereafter, steadily declined to 30% of GDP a decade later in 2017-18. Corresponding figures for the saving rate are 36.4% and 29%, respectively. Such a decline in saving and investment rates is unparalleled in modern India, implying a deep dent in the economy’s potential output growth. If one accepts the stylised fact of economics that a sustained rise in the domestic saving rate is a prerequisite for economic take-off (as happened in all of Asia in the 20th century), the observed fall in India in the saving rate of such a magnitude portends ill for India’s economic progress.

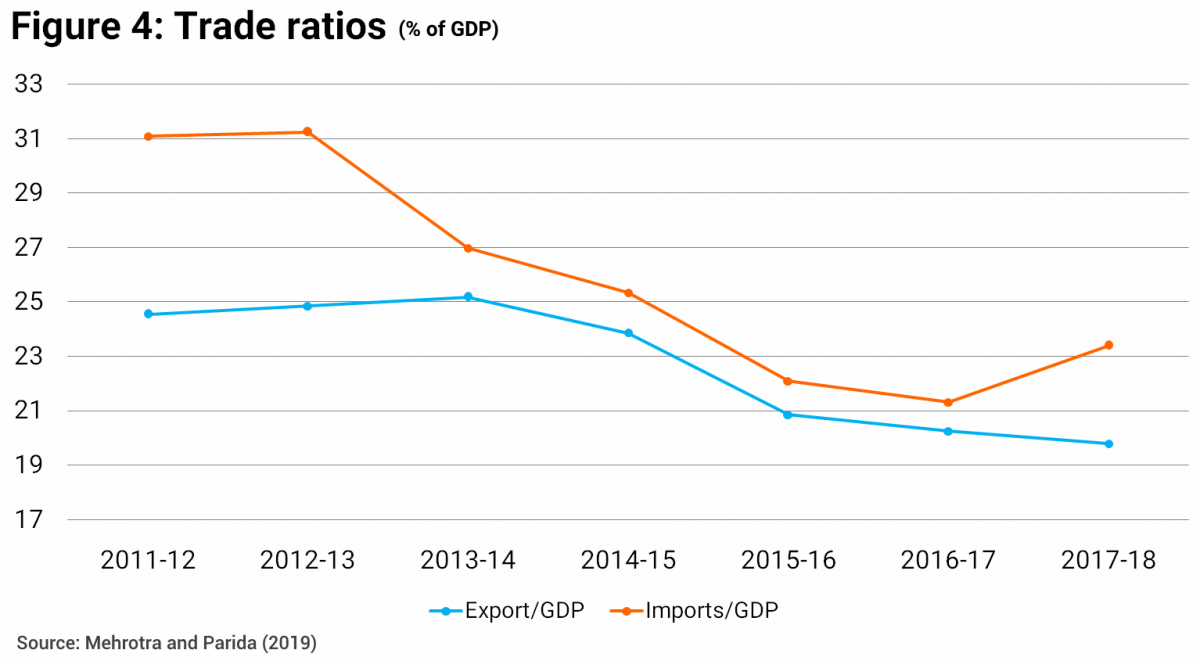

As mentioned earlier, a sharp rise in exports during the 2000s was the principal contributor to the incremental output growth. The Global Financial Crisis followed by the Great Recession witnessed a reversal. India, too, has seen its exports, as a percentage of GDP, fall from 25% in 2012-13, to about 19% in 2017-18 (Figure 4). However, the reduction in oil prices contracted the import bill; hence the ratio of net exports to GDP has not changed much.

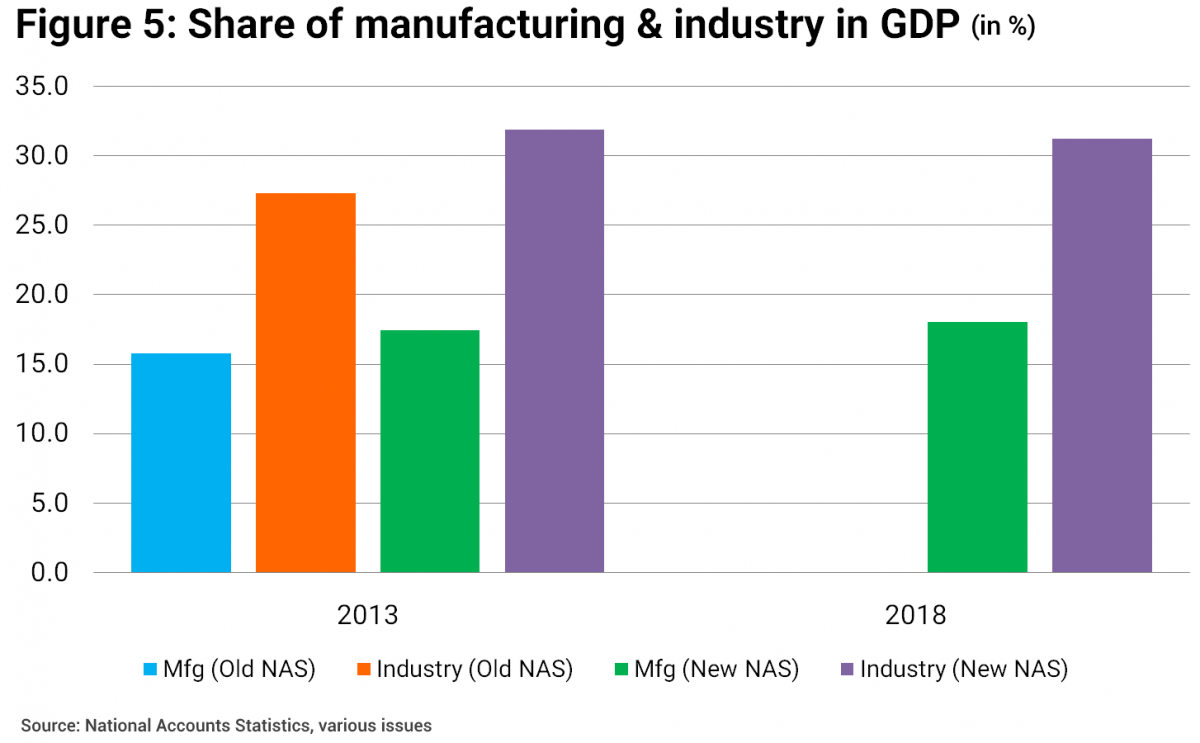

In 2015, the flagship initiative Make in India was launched, whose outcome shows the following dismal picture:

- A stagnation is evident, if not a slight decline, in the manufacturing sector’s share in GDP (Figure 5).

- The industrial sector lost 3.5 million manufacturing sector jobs between 2011-12 and 2017-18 according to the NSSO employment surveys (Mehrotra and Parida, 2019).

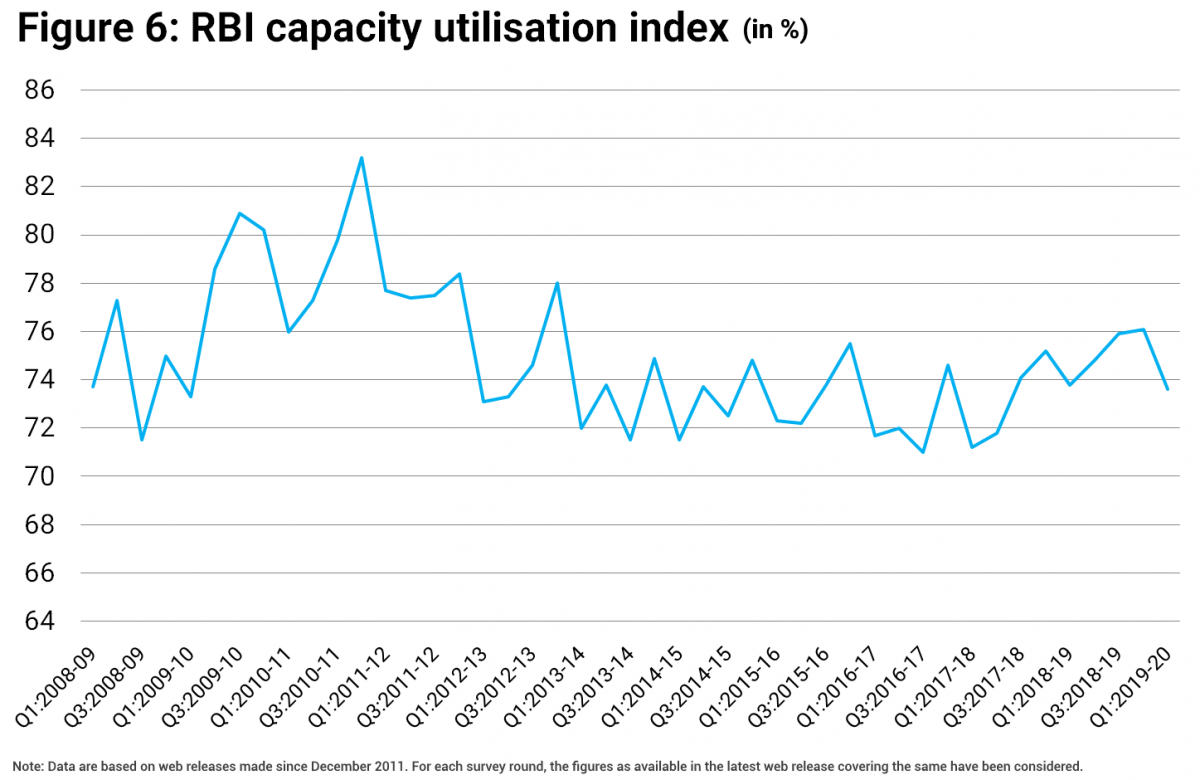

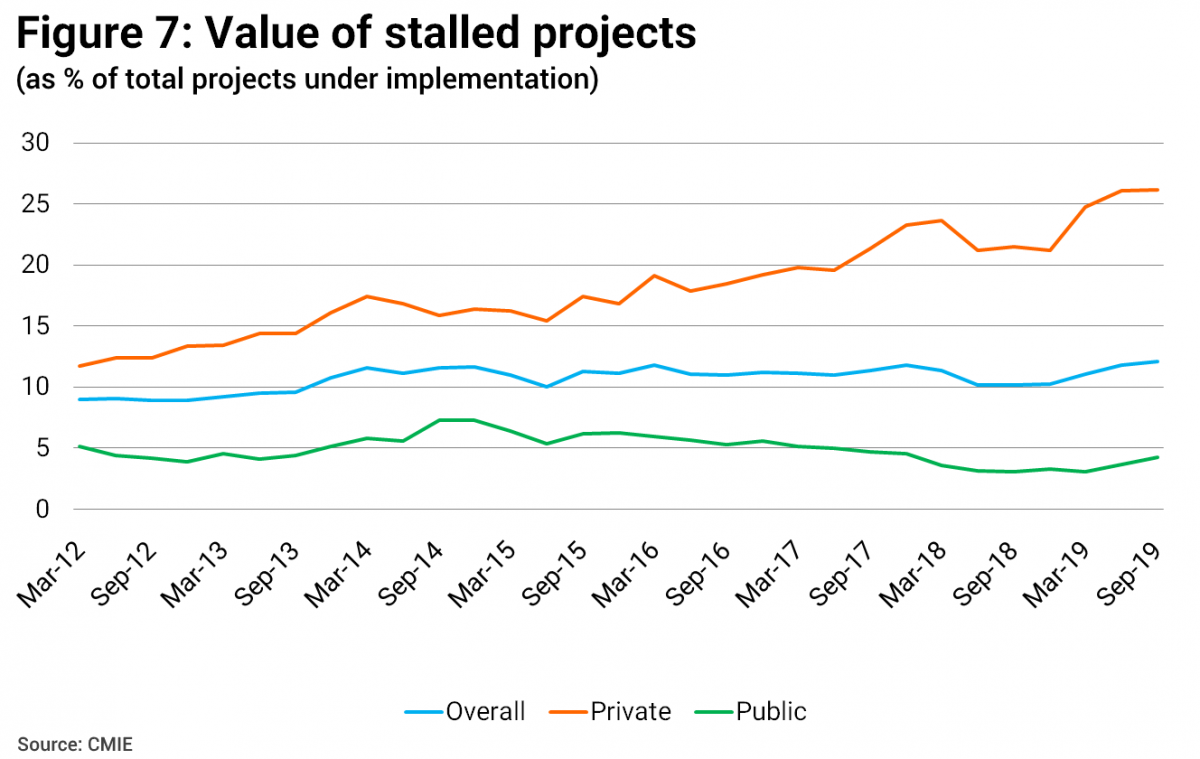

- A secular decline is discernible in (i) industrial capacity utilisation since 2011, and (ii) a rise in the value of stalled investment projects, especially in the private sector since July 2015 (Figures 6 and 7).

Though a lot more disaggregated evidence can be adduced, suffice to say that the industrial sector has performed poorly since 2011-12 (Nagaraj, 2019). Hence, contrary to the official view of a temporary setback, there has been a deep industrial slowdown spanning almost the entire decade of the 2010s.

An aggregative economic account: solving the jigsaw puzzle

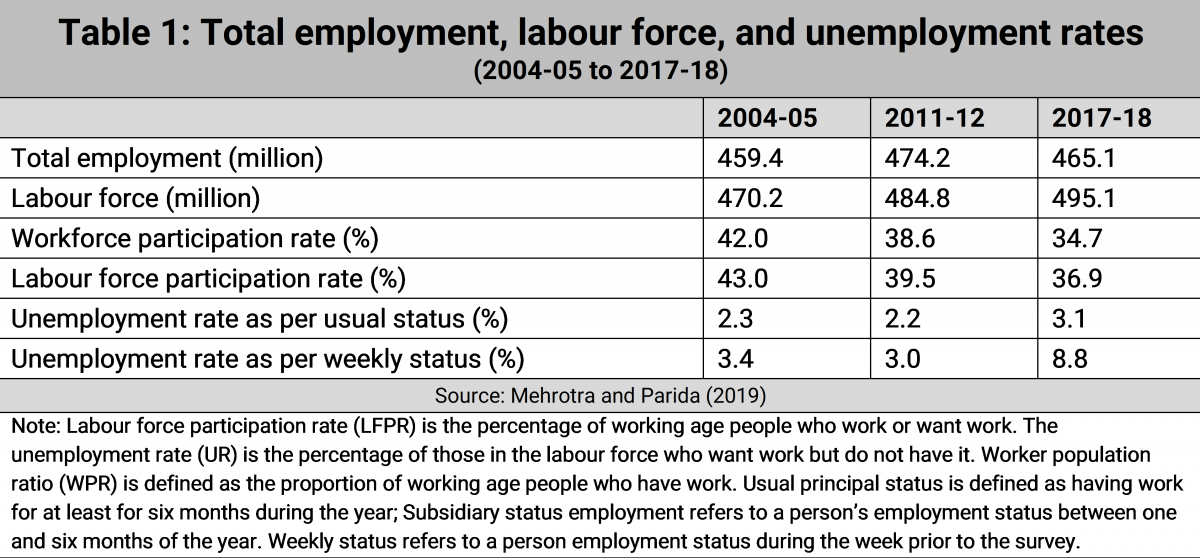

The evidence of the weak domestic output growth,naturally gets reflected in poor labour market outcomes. Table 1 describes some stark changes between 2011-12 and 2017-18 – unprecedented since 1972-73 – when the sample surveys began (Mehtorta and Parida, 2019; Kannan and Ravindran, 2019):

- Job losses in the range of 6.2 million to 15.5 million, depending upon the population estimates used. 7 There are three credible estimates of job losses by Himanshu (15.5 million), Mehrotra and Parida (9 million), and Kannan and Ravindran (6.2 million). They all use the comprehensive definition of employment, namely usual principal plus subsidiary status (UPSS). However, as their population estimates vary,the corresponding job loss estimates are also different. Rural India lost 21 million jobs, while urban India gained nearly 15 million. The most affected population and social groups are women, youth, Muslims, and members of the Other Backward Classes (OBCs). Job gains are primarily for men, members of the Scheduled Castes (SCs), Scheduled Tribes (STs) and the ‘Other’ castes. 8 Amaresh Dubey and Lavesh Bhandari's reported study prepared for the PM's Economic Advisory Council, arrives at an opposite estimate and conclusions. The reasons for the difference are as follows. Dubey and Bhandari use (i) the number of workers by their principal status only, leaving out the subsidiary status workers, and (ii) their population estimate is higher than in the other studies. The research paper does not seem to be yet available in the public domain, hence not commented here.

- Open unemployment – defined as those who did not find a job during the previous week as a proportion of workforce – has risen from 3% to 8.8%.

- The labour force participation rate – that is, those working or looking for work as a proportion of the population in the age group 15-59 – has declined from 39.5% to 36.9%. It means that discouraged workers have dropped out of the labour market due to lack of employment opportunities (after accounting for those undergoing education).

More granular evidence can be added. But it would be right to categorise the current growth episode is one of "job-loss growth" (to use Kannan and Ravindran's phrase), compared to the phenomenon of "jobless growth" earlier, with most of the burden faced by socially and economically vulnerable groups. A rising unemployment rate and the decline in labour force participation rates, expectedly, have adversely affected wage growth in the rural economy.

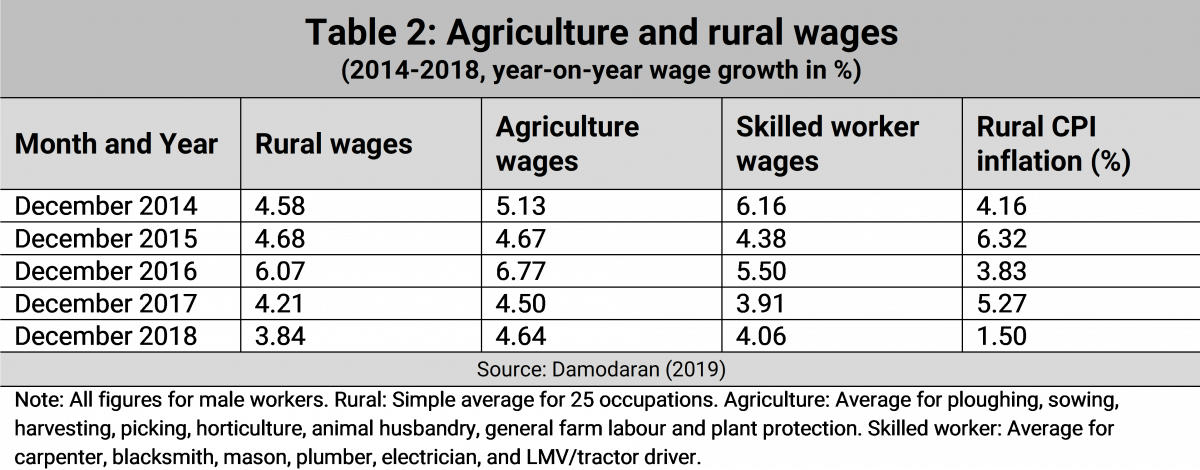

Agricultural labourers – defined as those earning the majority of their income by doing wage work – represent the bottom of rural society. According to the 2011 Census, India has 107 million agriculture labourers constituting 26.5% of the country's workers, and close to half of the agricultural workforce. Between December 2014 and December 2018 (Table 2), the real average wages of agriculture and rural workers grew at a rate of 0.5% per year compared to a rise of 6.7% per year during the previous five years of 2009 to 2013 (Damodaran, 2019).

If domestic output growth has decelerated, millions have lost jobs and rural wages have practically stagnated, it is reasonable to expect a decline in personal consumption (unless, of course, workers can borrow to maintain their current level of living, an unlikely possibility). This is precisely what the leaked (but officially scrapped) NSO report finds. For all-India, between 2011-12 and 2017-18, per capita personal consumption expenditure in real terms has declined by 3.7%. The decline is 8% in rural India, but a 2 percentage point rise in urban India during those years.

Many have questioned the veracity of this decline in per capita consumption arguing that the estimate does not match with a steep rise in consumption reported in the National Accounts (Rangarajan and Mahendra Dev, 2019; Felman et al., 2019). These suspicions of the quality of CES data may not be valid for the following reasons:

- There is no change in the methodology used between the two rounds of CES data (that is 2011-12 and 2017-18); hence the estimates based on the sample surveys are perfectly comparable.

- For well-known reasons, many countries find similar divergence between consumption survey estimates and the national accounts based estimates; India is no exception (as the critics admit it).

- In the Indian discourse on the national accounts, however, the non-comparability of CES and NAS consumer expenditure estimates is a well-researched issue, and conceptual and empirical differences between the two series are well understood but found not resolvable. We can do no better than to quote B S Minhas's (1988) highly regarded contribution on this question, which still holds, commended by Deaton and Kozel (2005).

‘The independent dataset (NAS), it would seem fair to conclude, is far short of the touchstone of quality expected of an independent validator dataset. A number of its components are based on such weak evidence and unverified assumptions as to seriously diminish its value in a cross-validation exercise, On the other hand, the NSS estimates of expenditure on such minor vices such as tobacco and intoxicants, and consumer durables and modern consumer services are of doubtful reliability. Nevertheless, despite these difficulties, which have to be overcome in both data sets, an overwhelming proportion of household consumer expenditure data of the NSS and independent private consumption estimates of the NAS do get cross-validation. (Minhas [1988], reproduced from Deaton and Kozel, [2005] p. 91).

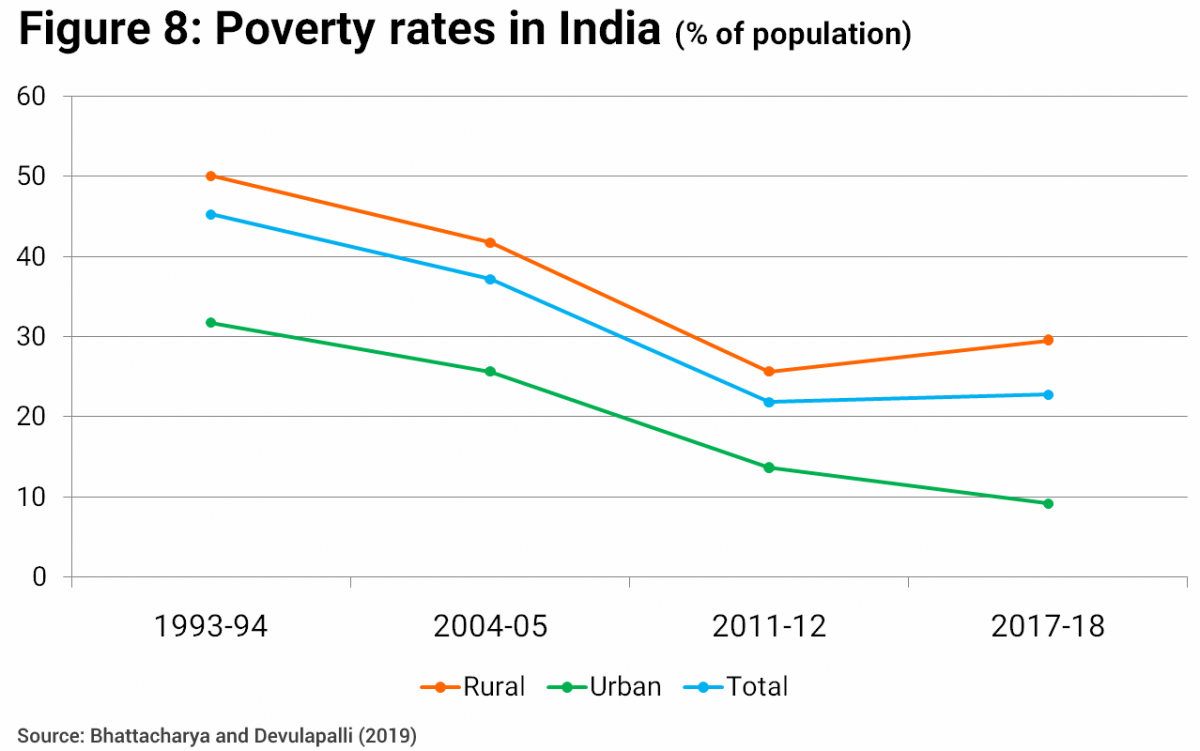

The observed decline in per capita personal consumption, expectedly, translated into a rise in absolute poverty. Figure 8 shows the poverty trends since 1993-94 for all-India, separately for rural and urban areas. Evidently, for the first time in a quarter of a century, absolute poverty went up by nearly one percentage point, from 21.9% in 2011-12 to 22.8% in 2017-18. Though the rise in poverty rate is modest, shockingly, this represents a reversal of a long-term declining trend, translating into 30 million people falling back into the ranks of the poor in six years in 2010s 9 These estimates are based on the Tendulkar Committee report on poverty 2009, which was officially accepted by the erstwhile Planning Commission, and for which comparable estimates are available since 1993-94. . The poverty rate went up by four percentage points in rural India and declined by five percentage points in urban India. The states that have borne the brunt of the increase are mostly the poorer states like Bihar, Jharkhand, Orissa, but (surprisingly) Maharashtra as well. The states showing a decline in poverty rates are the southern states and Gujarat (all figures from Bhattacharya and Devulapalli, 2019).

A simple headcount ratio of poverty, as many an expert would argue, is an inadequate measure of social welfare. However, reporting changes in various (theoretically sound) measures of poverty, Subramanian (2019) in his findings presented in Table 4 of his article found an unambiguous deterioration in economic well-being in rural India (accounting for close to 70% of India’s population as per 2011 Census).

So what is the picture that emerges by piecing together the available aggregate evidence? Sadly, the picture that emerges is sharp and scary: an unmistakable story of economy in distress.The suffering is not just about a declining growth rate in output compared to the previous decade. The lower output growth has translated into job losses, withdrawal of workers from the labour force (due to a lack of employment opportunities), a sharp rise in the open unemployment rate, and a stagnation in real wages in rural India. Weak output growth and poor labour market performance show up in a fall in per capita personal consumption and a rise in absolute poverty, and loss of social welfare (by all standard indicators). Hence, unambiguously, the 2010s have been a decade of an unheard of economic distress and a reversal of past outcomes.

3. Analysing the Slowdown and Policy Suggestions

What could possibly explain such a swift and the sharp change in India's economic fortunes? There have been no major political threats or natural calamities disrupting normal commercial activities. The country has witnessed orderly changes in governments following national and regional elections. Globalisation is on the retreat closing many opportunities, but as India is a domestic-oriented economy the adverse fallout is relatively modest. The fall in international oil prices has kept the external balance under check.

Hence, the reasons for the economic regression during the 2010s are entirely domestic and policy-induced. That demonetisation in 2016 was a disaster is now widely acknowledged. As GST unravels, its glitches are coming to light with rising revenue shortfalls.

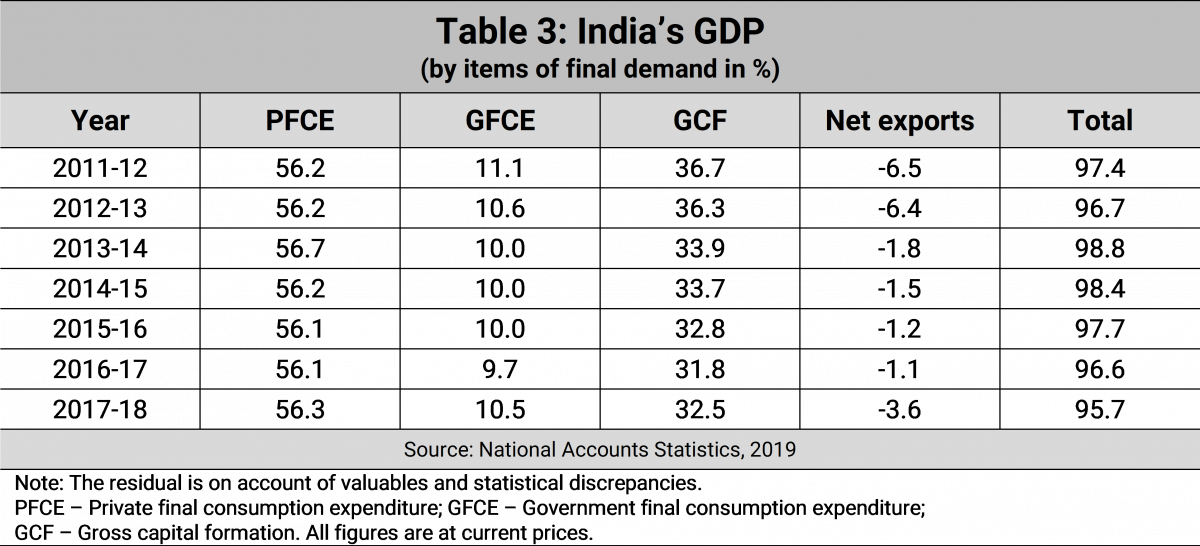

From a macroeconomic point of view, the slowdown in output growth is from the demand side. As Table 3 shows, between 2011-12 and 2017-18, the only item of aggregate demand which has fallen is gross capital formation. It fell from 36.2% to 32.5% as a proportion of GDP (according to the new National Accounts series). If we measure the change from the peak of the boom in 2007-08 when it was 38% of GDP, then the fall until 2016-17 was close to 7 percentage points. The fall is principally on account of the decline in the private corporate sector. But this fact is obscured by the overestimation of the sector’s size and growth in the new GDP series – on account of the use of contested methodologies and the databases of questionable quality.

Admittedly, a collapse of investments when an economic boom unravels is understandable. But its secular decline for close to a decade is a sure sign of policy failure. How can this be explained? Policymakers defended the official growth record by claiming that India is a consumption-led success story and therefore the decline in investment will not matter for output growth. Government sources sought to dismiss the results of official nation-wide economic statistics (such as the Labour Bureau’s employment surveys, NSSO/NSO surveys) claiming that they fail to capture the changing economic reality of growth in the newer platforms and the digital economy (such as Ola and Flipkart). One wonders how the narrative of a consumption-led growth success would square with the observed decline in per capita personal consumption in 2017-18, based on comparable NSSO consumer expenditure surveys.

Rhetoric aside, the narrative of a consumption-led success betrays a lack of understanding of a simple stylised fact of economics: No country has secured sustained economic growth and acquired industrial maturity without stepping up the domestic investment rate to around 40% of GDP for a few decades (with the domestic saving rate at 2-4 percentage points less than the investment rate). China is an extreme example of this with an investment to GDP ratio that has been sustained at over 50% for three decades now, and private consumption has correspondingly reduced to one-third of GDP.

Realistically speaking, reviving private corporate investment was constrained by an unserviceable debt burden and, correspondingly, by rising bank NPAs as a proportion of total bank advances. However, the NPAs admittedly resulted mainly from an unexpected reversal of the economic boom (and changed economic conditions such as rising oil prices and high domestic inflation), and not on account of firm or bank-specific reasons. In such a situation, a suitable policy package for specific sectors and industries would help reverse sagging fortunes.

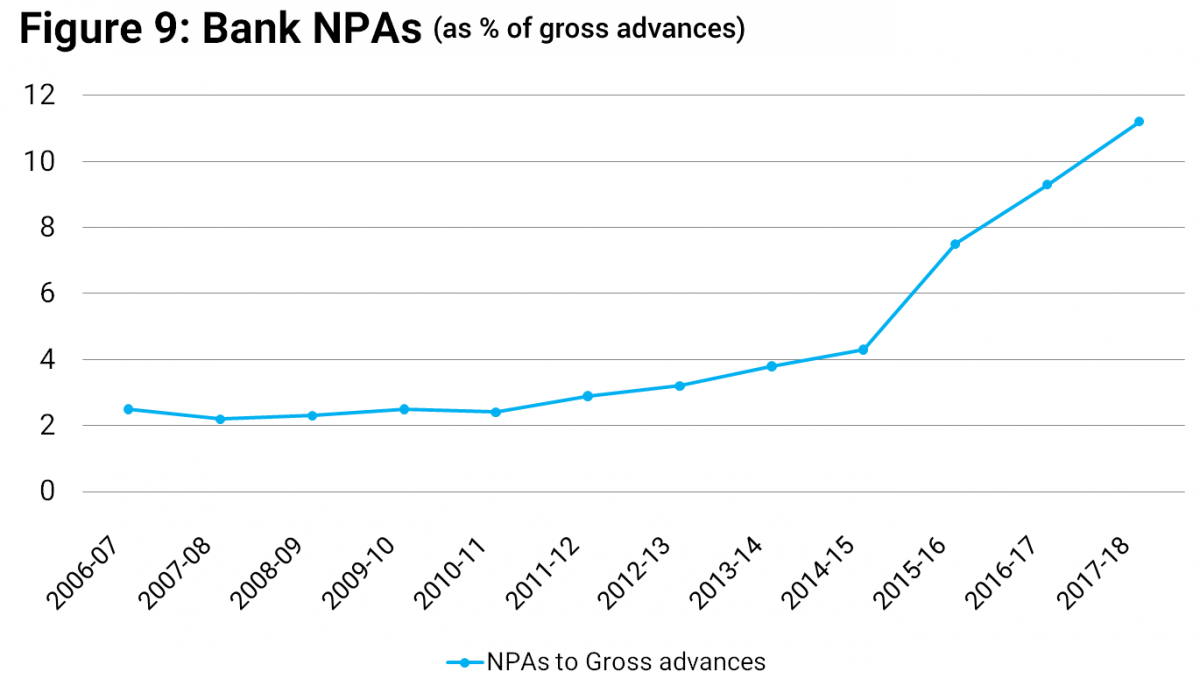

Instead, policymakers viewed NPAs as an outcome of (i) the banking sector's inefficiency in loan screening and lending practices, and (ii) deep-rooted crony capitalism. Such an understanding of economic reality echoed the anti-corruption agenda of the Government. Following such a diagnosis, the RBI sought to route out inefficiency in banks by making the rules for NPA recognition stricter, resulting in a sharp rise in the NPAs as ratio of gross advances, from 4.3% in 2014-15 to 11.2% in 2017-18, as per RBI data (Figure 9).

On NPA growth and crony capitalism

In the 2000s, when the economy was accelerating with rising investment and software exports, bank credit to the private corporate sector was also, naturally,galloping. Foreign capital was flowing in at an unheard-of rate to supplement domestic saving, and foreign capital was also getting into infrastructure in PPP projects. These massive investments assumed the continuation of rapid output growth under benign macroeconomic conditions, following the well-known phenomenon of “herd behaviour”, common in investment and financial decisions. Policymakers, during the boom, urged banks to support the investment boom pro-actively.

The Global Financial Crisis shattered expectations though the investment cycle got prolonged until 2011-12 with the comfortable monetary and fiscal conditions maintained by the G-20 countries. As global growth stagnated and oil prices shot up, India's growth was hurt. Many projects in industry and infrastructure – accounting for the majority of investments – failed to generate adequate revenues to service their debt, thus increasing bank NPAs. And this, in turn, impaired banks' ability to make new loans, setting in a mutually-reinforcing downward spiral.

Admittedly, the banks lent generously to a few large politically connected business houses. Such (alleged) financial malpractices and malfeasance by public officials need to be dealt with strictly, as per the law. However, it would perhaps be erroneous to tar the entire debt-led investment boom with the same brush.

Hence, there can be two ways of looking at the problem of bank NPAs.

- Diagnosing the masan outcome of a widely prevalent crony capitalism, the way to resolve the problem is by strict enforcement of the regulations and strengthening bank norms for NPAs. Such a drive would compel defaulting borrowers to pay up or face liquidation, as per the decisions of the bankruptcy courts.

- Notwithstanding the deep-seated cronyism endemic to India's political economy, realistically speaking,a significant part of the NPAs was the result of slower output growth and changed macroeconomic conditions. Hence,they were beyond the control of enterprises. If such a view has merit, the recovery of growth would have melted away the NPAs with sales growth and expansion of domestic output. The solution to the problem of NPAs then would be to kickstart growth with (autonomous) public investment, at least until private investment recovers its lost momentum.

The second argument above does in no way mean closing one’s eyes to systemic corruption, cronyism, and banks' (alleged) inefficient screening and lending practices. These are long-term issues requiring long-term solutions, such as improving banking governance and supervision. What was needed when the investment boom ended was a boost from public investment to ensure that infrastructure spending was sustained at a high level, as China did (which bore the far bigger brunt) to withstand the shocks of the Global Financial Crisis (Nagaraj, 2020).

The financial problems got accentuated with the NDA government, with its zeal to root out corruption. It has apparently created "tax terrorism" – a term reportedly coined by the entrepreneur Mohandas Pai – after V G Siddhartha, the promoter of Café Coffee Day, committed suicide in mid 2019. Thus, an atmosphere of fear seems to have taken a toll on investment decisions – as suggested by Rahul Bajaj, an industrialist, in an event where senior ministers were present and by Manmohan Singh (2019), the former Prime Minister, in an op-ed in the The Hindu.

The Insolvency and Bankruptcy Code (IBC) was agreed upon, but given the dysfunctional legal institutions and inordinate time the resolution proceedings take, it has had a minimal impact on resolving the bank debt problem – at least as yet.

Policy suggestions

Reviving investment growth should now get priority. The private sector is not in a position to make new capital investment due to a lack of aggregate demand despite declining interest rates. High levels of debt in the private corporate sector, the banking crisis on account of NPAs and the collapse of large shadow banks (for example, of the Infrastructure Leasing and Financial Services (ILFS) and DHIL-Punjab and Maharashtra Cooperative Bank crisis) have squeezed fresh lending for capital investment. Food price inflation is currently high, which I guess, is a seasonal and temporary problem apparently caused by weather factors.

Public investment can be expected to crowd-in private investment to boost the overall level of domestic demand, and hence revive output growth. Public expenditure can be on large infrastructure projects (highways and railways) and rural road connectivity. Even after 70 years of independence, it is an appalling fact that a motorable road does not connect over 20% of 6 lakh villages. The evidence reported earlier shows that rural unemployment and poverty have gone up. Hence there is a crying need for public assistance. What better policy to address agrarian distress than a massive push to the National Rural Employment Guarantee Scheme (NREGS)?

[A]t a time of low real interest rates, an aggregate demand constraint and the private sector's inability to make new investments, public infrastructure investment can have a sizeable multiplier effect on output and employment growth.

These suggestions will face resistance as it goes against deeply ingrained fiscal conservatism. It is worth remembering that the obsession with controlling the fiscal deficit during 2010-15 in developed countries has left deep scars on their economies and politics, as Paul Krugman (2019) recently lamented. Such an orthodoxy surely has a place in times of inflation and external imbalances. But, for now, at a time of low real interest rates, an aggregate demand constraint and the private sector's inability to make new investments, public infrastructure investment can have a sizeable multiplier effect on output and employment growth. A temporary suspension of the fiscal deficit target and devising unorthodox means to turn around the economy are possible (subject to keeping inflation modest and stable). A rise in public debt in domestic currency, held by resident Indians,and used for productive purposes is a sensible policy in such times, as many economists would endorse.

A few years ago, in the new context of weak growth in the US, despite interest rates being close to zero, Nobel Laureate, Robert Solow, said:

… in bad times like now, Treasury bonds are not squeezing finance for investment out of the market. On the contrary, debt-financed government spending adds to the demand for privately produced goods and services, and the bonds provide a home for excess savings. When employment returns to normal, we can return to debt reduction” [emphasis as in the original] (Solow, 2013).

4. Conclusions

The current slowdown in India's economic growth is now widely acknowledged. It is not a mere cyclical (or short-term) decline, as the Government would like us to believe. The economy has been underperforming for quite a while after the boom of the 2000s went bust. Regrettably, the current GDP series, like a faulty speedometer, has been over-stating output growth. It probably helped policymakers propagate a false narrative of India as a consumption-led success story, ignoring warning signals of a decade-long decline in the economy's saving and investment rates (among other evidence). Such a reversal in the investment rate for so long has never happened since Independence.

Hence, our first task was to piece together the recent aggregate data to present a clear and credible account of the economy’s performance. The picture that emerges is not pretty: it is one of unprecedented economic distress. The bold facts of distress are as follows: Between 2011-12 and 2017-18, the country has witnessed job losses of between 6.2 million to 15.5 million, a rise in the unemployment rate from 3.3% to 8.8% of workforce, a fall in the labour force participation rates, stagnation in rural wages, a fall in per capita consumption, and an increase in absolute poverty by 30 million people. Never in the past 45 years – if not longer – for which definitive data are available has the economy witnessed such a disastrous reversal of economic performance.

Over-stated official GDP growth rates – on account of a faulty methodology and data of questionable quality being used in estimating GDP – seem to have obscured the reality and are likely to have misled policymakers. The gravity of the situation appears more realistically captured in GDP validation exercises, which knock-off 1½ to 2½ percentage points from the official growth estimates. The two economic shocks, namely, the demonetisation of high valued currency in 2016 and the dodgy GST in 2017, have precipitated matters, as evident from the sharp fall in GDP growth rates during the last six quarters, from 8.1% in January- March 2018 to 4.5% in April-June 2019.

For now, the infrastructure deficit and unemployment crisis are perhaps far more serious concerns than budgetary prudence.

To analyse the reasons for the slowdown, one needs to start with the boom of the 2000s when there was a steep rise in domestic saving and investment rates, rising bank credit growth and a flood of foreign capital inflows (accruing mostly to the private corporate sector). As the boom went bust in the early 2010s, the un-fructified investments mounted, and new capital investment fell. Corporate bad debts turned into bank NPAs.It is reasonable to believe that a quick economic revival with public support could have melted way the NPAs earlier during the 2010s. But policymakers stuck to fiscal orthodoxy, inflation targeting and structural reforms to reduced policy-induced rigidities.

Policymakers have devoted their attention to cleaning up the banking sector as part of the anti-corruption drive and have sought to strike at the roots crony capitalism with a new corporate bankruptcy procedure that has not helped much – at least as yet – given the legal hurdles. A few large defaulters and high profile corporate frauds made policymakers and RBI view the NPAs as mostly representing inefficiencies and poor lending practices, and deep-seated crony capitalism. Corporate frauds need to be dealt with as such. But banks' poor lending practices and the bank-corporate nexus are long-term issues of corporate governance and political economy, respectively, requiring sustained reforms in corporate and institutional governance.

The way out of the slowdown now, in our view, is to step up public infrastructure investment as the real interest rate is low, and the private sector demand for credit is weak. Public investment in such a situation would help crowd-in (or, bring in) complementary private investment to create demand for the private sector to turn the economy around. Similarly, a substantial boost to the National Employment Guarantee Scheme and bank credit in the rural economy would help mitigate the agrarian distress, create jobs and add to rural public works.

These policy measures warrant setting aside fiscal orthodoxy for a while. For now, the infrastructure deficit and unemployment crisis are perhaps far more serious concerns than budgetary prudence. A rise in domestic public debt held domestically to create productive assets (within a tolerable inflation rates) is sensible economic policy at a time of acute economic hardship.

(This is an edited version of the I G Patel Memorial Lecture delivered on January 4, 2020, at the Gujarat Economic Association’s Golden Jubilee Conference held at N S Patel Arts College, Anand. Permission to reproduce the lecture is gratefully acknowledged. The author thanks Atul Kohli and the Editor of TIF, for their comments and suggestions on an earlier version of the paper)