Is the global economy heading into a recession? This question has come to haunt us all, from the general public to policymakers, from financial market czars to tech start-ups. The Economist magazine, in its 15 November 2022 issue, had a story titled, “Even a global recession may not bring down inflation: The world economy is slowing dangerously”. Are these apprehensions of the mainstream real? Or is all this the typical overreaction during a downturn?

Recent trends

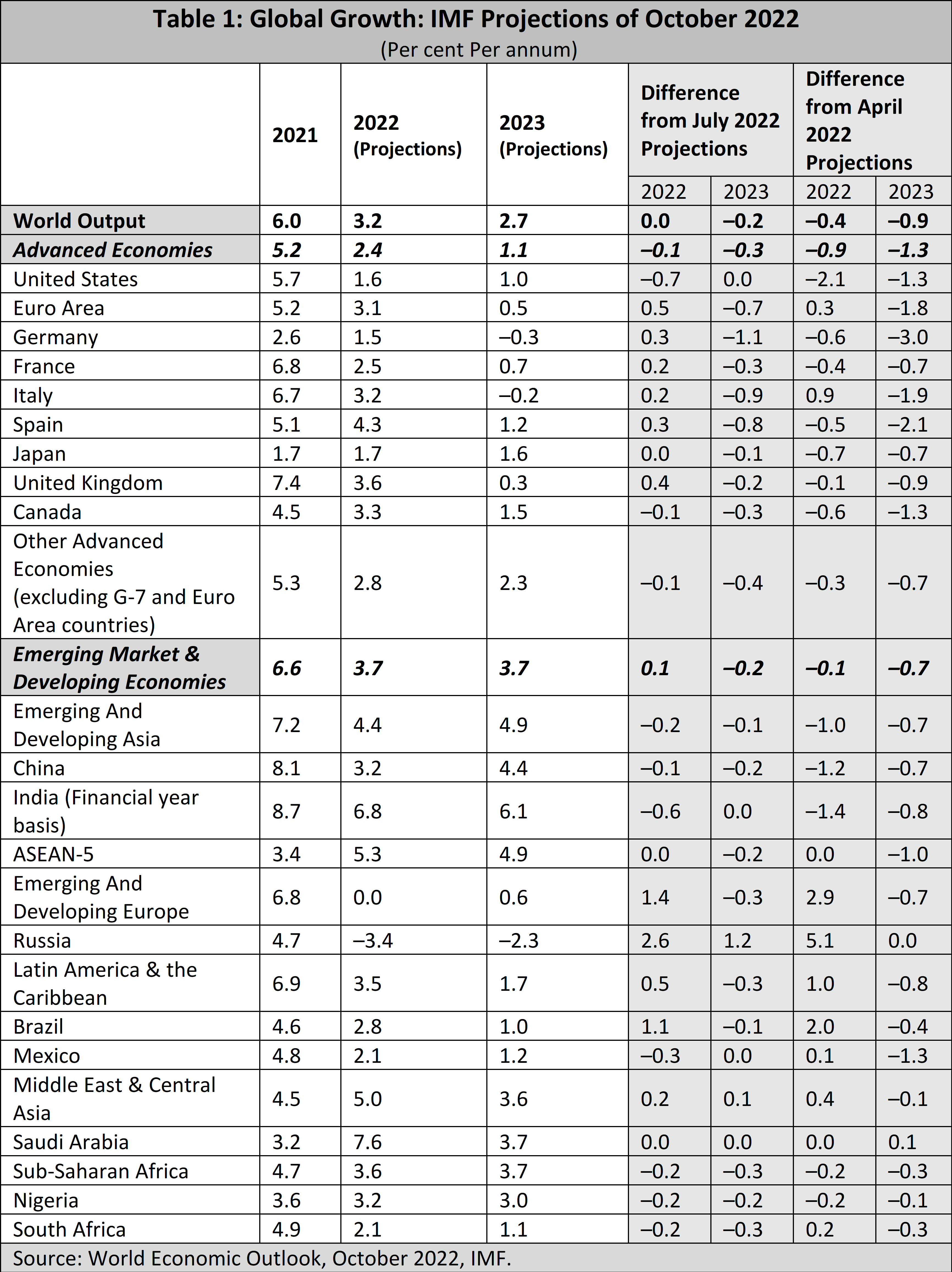

Consider the recent global growth projections released by the International Monetary Fund in October 2022. Global output growth during 2022 is now projected at 3.2% (a downward revision of 0.4 percentage points from its April 2022 projection). In 2023, global output is projected to grow at 2.7% (a downward revision of 0.9 percentage points) (Table 1). The situation is bad in most of the G7 advanced economies, with Germany and Italy being affected the most. Among the major emerging and developing economies, not surprisingly Russian growth is projected to be in the negative territory for both 2022 and 2023. Chinese growth has also decelerated significantly in recent times.

While these are bleak numbers, do they indicate the possibility of a recession?

At a country level, an economy is said to be in a recession when there is a contraction in the country’s real GDP for two consecutive quarters. On the other hand, a global recession is defined as an annual contraction in world real per capita GDP, accompanied by a broad decline in various other measures of global economic activity (Guenette et al 2022, Kose and Terrones 2015). As the world population growth rate is currently around 0.9% per annum, to have a contraction in the world per capita income the global real GDP must grow at less than 0.9%, which seems unlikely from the projections given in Table 1. However, given the economic scenario, the possibility of country-level recessions cannot be ruled out.

The first driver for distinctly lower growth projections is the ongoing Russia-Ukraine war. It has hit us just when the global economy had started experiencing some green shoots in the aftermath of the pandemic. The human tragedy has led to rising energy prices and has forced countries, particularly in Europe, to look for non-Russian energy sources. Germany is actively considering using its coal-based energy for the heating needs of the winter. The war in Ukraine, which is a major agricultural producer (sunflower oil and seed, corn, wheat, amongst others), had its impact on global agricultural prices. These apart, large-scale sanctions on Russia have had an impact on both Russia and the sanction-imposing countries.

…[U]nlike normal stagflation, which is accompanied by high unemployment, we now have unemployment in the US at historically low levels.

The second source of apprehension about a recession comes from dampened Chinese growth. Three things seem to have happened in China in recent times. First, the frequent lockdowns under the zero-Covid policy have affected China’s growth prospects, especially in the second quarter of 2022. Recent reports indicate that rising Covid-19 cases forced more lockdowns in China causing disruptions (before protests led to some relaxation). Second, there is a meltdown in the property sector (representing about one-fifth of China’s GDP). Third, these developments and the general hue and cry about western companies adopting a 'China-plus-one' strategy of investing outside China could have dented the country’s role in the global value chain.

The third source of worry about the global economy is the resurgence of inflation as a global phenomenon and the central banks’ collective pursuit of hiking policy rates. The IMF’s October 2022 World Economic Outlook noted categorically:

Persistent and broadening inflation pressures have triggered a rapid and synchronised tightening of monetary conditions, alongside a powerful appreciation of the US dollar against most other currencies. Tighter global monetary and financial conditions will work their way through the economy, weighing demand down and helping to gradually subjugate inflation. So far, however, price pressures are proving quite stubborn and a major source of concern for policymakers.

Ugly head of inflation

How far is all this true?

There have been questions about the US economic stimulus having stoked inflation. Insofar as the monetary stimulus is concerned, it is important to note that the size of the balance sheet of the US Federal Reserve increased from $4.15 trillion in early January 2020 to around $9 trillion by March 2022. In this context, it is often hypothesised that a large chunk of the stimulus could have ended up generating irrational exuberance in Wall Street (Ray and Pal 2022). In early 2021 itself, questions were raised about the efficacy of the Biden fiscal stimulus. A fiscal stimulus trying to generate demand in the face of Covid-19-induced supply constraints (both locally and globally) is bound to lead to inflationary pressures. While a precise figure may be difficult to arrive at, “a reasonable guess is that excess demand accounted for as much as half the cumulative rise in prices in the United States immediately after the pandemic” (Rogoff 2022).

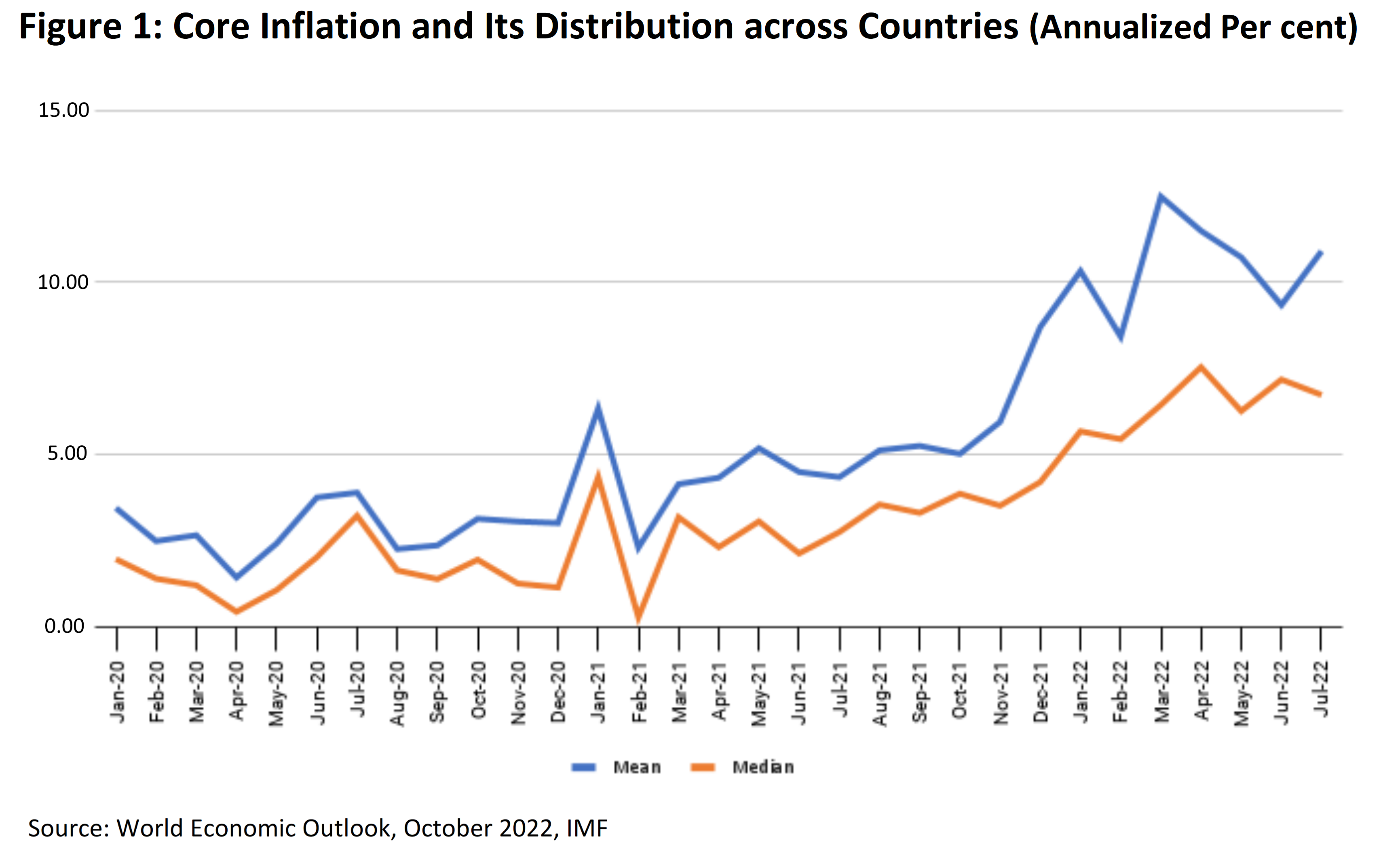

In fact, globally, there has been an increase in the rate of inflation across the board (Figure 1).

The IMF has projected expected global inflation to peak in late 2022 but remain elevated for longer than previously expected, decreasing to 4.1% by 2024. This combination of low growth (though not yet recession) and high inflation makes the task of the policymakers rather difficult.

Disconnect between growth and the job market

To make matters more complex, one of the puzzling aspects of the present economic scenario in the US has been the apparent disconnect between the growth rate and the job market. While US GDP growth was negative in the first half of 2022, and registered around 2.6% growth in the third quarter, the aggregate numbers from the job market have shown continued resilience. Despite a recent wave of layoffs in the technology sector, the jobless claims in the US, which are workers’ filling for unemployment benefits, remain historically low. Low jobless claim data is said to be an indicator that a laid-off worker can quickly find another job.. The latest (November 2022) job market data also suggest that wages in the US continued to maintain an upward trend.

The numbers coming out of the US show that there has been high inflation and weak GDP growth for most of the year. This combination of high inflation and low growth is known as stagflation. But unlike normal stagflation, which is accompanied by high unemployment, we now have unemployment in the US at historically low levels.

Complex nature of inflation

The mixed signals from the US suggest that US inflation possibly has both demand-pull and cost-push components. While the supply chain disruptions and the global increase in energy and food prices are fuelling cost-push inflation, the massive economic stimulus given by the US government is possibly contributing to the demand-pull inflation. This also implies that even if food and fuel prices ease in the near future and the supply chain disruptions get controlled, inflation may persist in the US at a higher-than-average level for a more extended period.

The sharp and rapid interest rate hikes by the US Fed have been mainly targeted at controlling the demand-pull part of inflation. From the commentary of the US Fed Chair, Jerome Powell, it appears that the US Fed will increase the interest rate even higher. Economist and former US secretary of the treasury Lawrence Summers thinks that the terminal interest rate to control inflation may go beyond 6%. To put this number in perspective, the Fed funds rate in the USA has only crossed 6% once in the last 22 years.

The mixed signals from the US suggest that inflation in that country possibly has both demand-pull and cost-push components.

Using interest rates to control inflation essentially works by suppressing demand by reducing consumption and business investment demand. The magnitude of the rate hike undertaken by the Fed in a short span of time has been unprecedented. It may help bring down inflation, but there will be a negative impact on economic growth. There is also a strand of belief amongst economists that the central banks may face a higher ‘sacrifice ratio’ compared to the past, implying that the central banks may have to push up unemployment levels higher to control the present level of inflation. It is not clear whether rapid interest rate hikes will push the US into a recession. However, the transmission mechanism of such a policy is complex and it works with long and variable lags. Therefore, the possibility of a prolonged slowdown in the US in the near future cannot be ruled out.

Elsewhere in Europe and the developing world

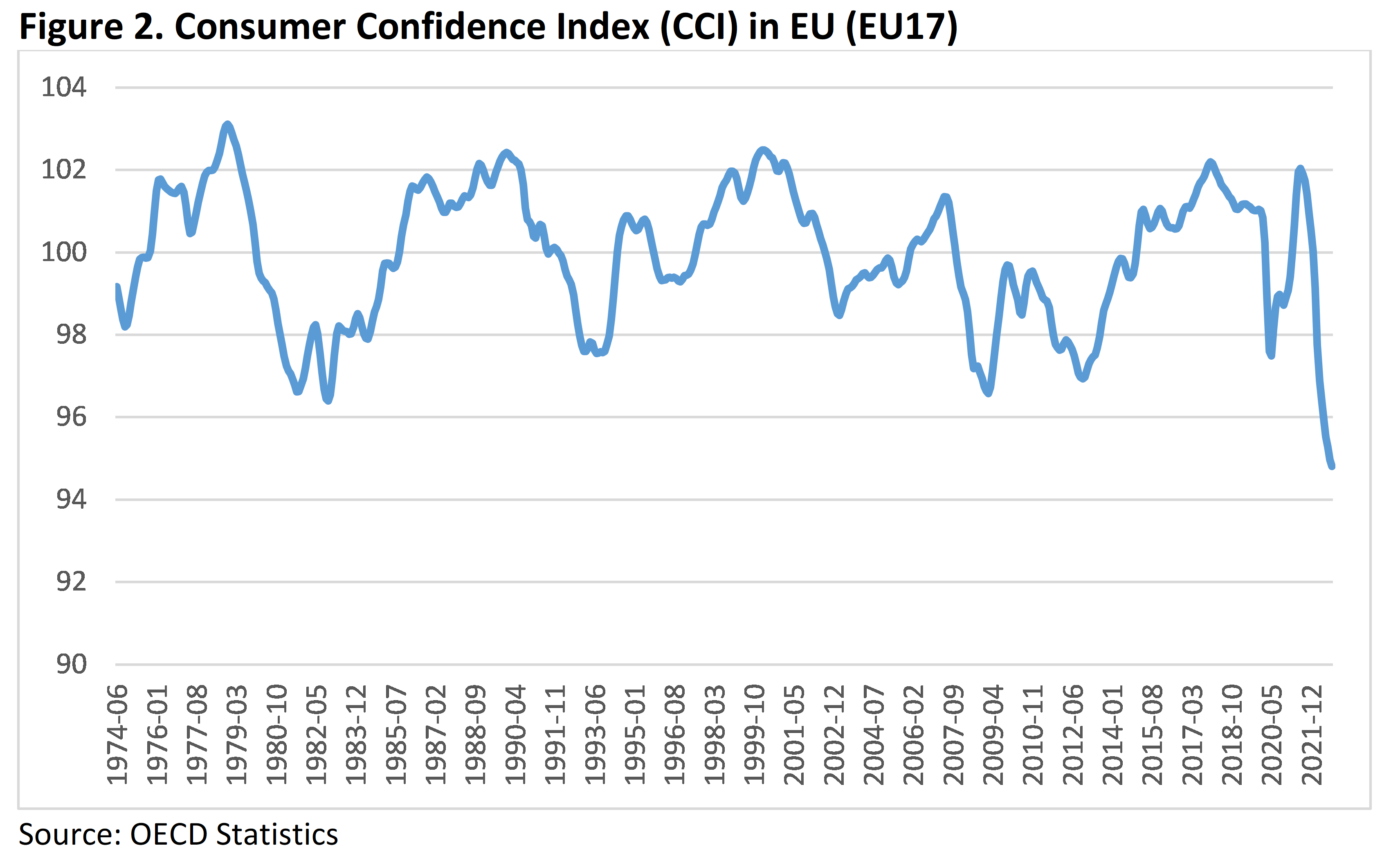

The situation in the other parts of the developed world is somewhat different. The headline inflation numbers in Europe are very similar to that in the US, but the underlying factors driving inflation are markedly distinct. Europe is suffering from high energy and food prices due to a host of geopolitical factors, including Russia’s invasion of Ukraine. Though there are indications that international food and fuel prices may have peaked, households still face a lagged impact of high commodity prices. According to the latest Household Energy Price Index, on average, gas and electricity bills have increased by 111% and 69%, respectively, in the EU region during the past year. The cost-of-living crisis in Europe is having a significant dent in household budgets. As rising prices are reducing real income, reports show that households are making substantial cuts in their expenditure decisions to cope with the situation. Consumer confidence across Europe is the lowest in the last 50 years (Figure 2), and some parts of the EU may have already slipped into a recession.

To make matters more complicated, there is a very strong possibility that the European Central Bank (ECB) will have to keep pushing up interest rates to control inflation and inflationary expectations. The Organization for Economic Cooperation and Development (OECD) has recently suggested that the ECB will have to raise its interest rates much higher to bring down inflation. The OECD said the ECB should narrow the interest rate gap between the EU and the US and increase the key interest rate from 1.5% to around 4% by the middle of next year. The rationale behind the higher interest rate suggested by the OECD is to reduce the depreciating pressure on the Euro. A depreciating Euro is leading to higher domestic prices for imported goods and services and fuelling more inflation.

Managing imported inflation is essential for Europe as it is facing an energy availability crisis, which may go well into the next year with no end to the conflict between Russia and Ukraine.

Despite the slowdown in the EU, policymakers are likely to continue with their anti-inflationary monetary tightening policies, which are likely to depress demand even more. The macroeconomic headwinds in the EU are growing, and the resultant impact is expected to be severe on the prospects for growth.

If the developed world slows, emerging and developing countries will not be immune.

If the developed world slows, emerging and developing countries will not be immune. The disruptions in China will have a significant impact on international trade. China is the top trading partner of over 120 countries. A slowdown in China is likely to affect a large number of these countries. With the US and the EU also facing a possible slowdown in the next few months, the WTO forecasts a sharp decline in merchandise trade volume, from 3.5% in 2022 to only 1.0% (revised downwards from 3.4%). The WTO also suggests that “growing import bills for fuels, food and fertilisers could lead to food insecurity and debt distress in developing countries.”

Overall, the prospects for global growth look bleak. Prolonged and broad-based inflationary measures are prompting a further tightening of global financial conditions. This can have a serious negative impact on debt sustainability in many small and vulnerable economies of the world.

Impact on the vulnerable

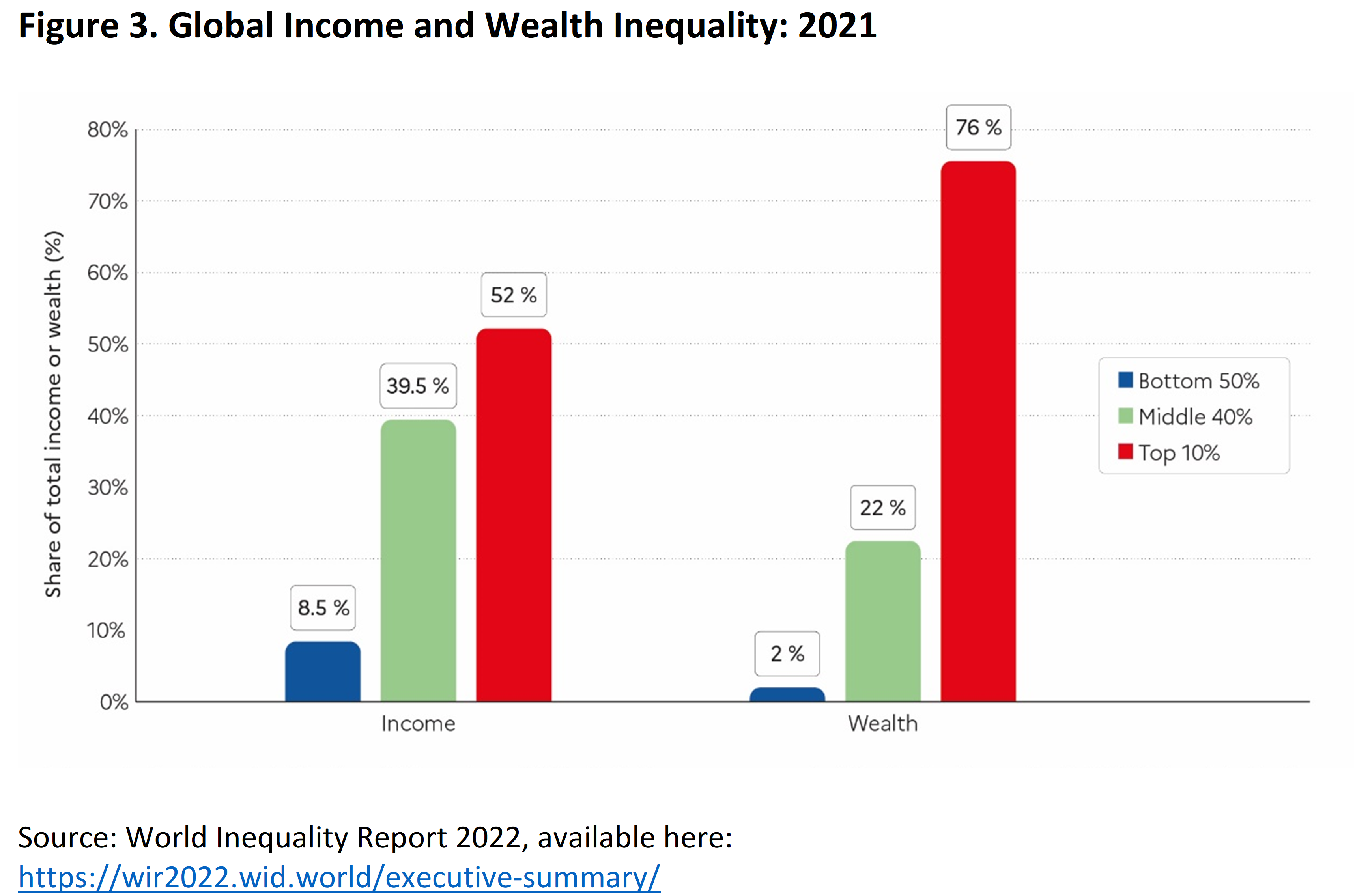

A slowdown or a possible recession is likely to have a differential impact on the vulnerable sections of the population across the world. Food and fuel price inflation and possible lack of access to energy may lead to severe deprivation of a sizeable part of the poor. Monetary tightening and the resultant global slowdown will increase unemployment. Post Covid-19, the world is already going through a phase of very high and growing income and wealth inequality. The World Inequality Report 2022 shows that contemporary global inequality “seems to be about as great today as they were at the peak of Western imperialism in the early 20th century” (Figure 3).

The impending recession is likely to exacerbate this high inequality in the world. In such a situation, governments should be willing to use “temporary, targeted and tailored” fiscal policy measures to support incomes and create a viable safety net programme for the poor. But growing fiscal constraints after the Covid-19 pandemic may imply the fiscal space could be limited. Furthermore, there are headwinds in the global economy (like the Russia-Ukraine war and supply chain disruptions) addressing which are beyond the scope of economic policies.

Where does India stand?

Amidst this global turmoil, India has managed a higher rate of growth than most other countries (Table 1). According to the IMF projections of October 2022, India is expected to grow at slightly higher than 6% in 2023. However, the IMF has been slowly downgrading India’s growth projections since its April 2022 report. Recent reports by the RBI also indicate some signs of slowing down of the economy. Estimates released by India's Central Statistics Office have revealed that economic growth slowed to 6.3% in the July–September quarter of 2022–23.

India has avoided the perils of the global slowdown primarily because of its lower dependence on international markets. Still, it faces three broad sets of challenges. To start with, India’s exports are not doing well. In October 2022, India’s merchandise exports contracted by more than 16.5% compared to the same month last year. As global demand will likely remain subdued for some time, India’s current account balance looks somewhat shaky. Second, the increase in international energy and commodity prices hurts India. India is a significant net importer of commodities and rising oil prices can put additional pressure on India’s current account. However, if the demand slowdown continues, India can look forward to some comfort from the possible softening of global commodity prices. Finally, India faces some pressure in the capital account of its balance of payments.

There are some possible opportunities for India in this crisis as well. As doing business with China is becoming more uncertain, and the global slowdown affects the developed world, some countries may shift to a China-plus-one strategy. If India can take advantage of this production relocation or emerge as an alternate source of supply, then it can gain from this economic turmoil.

Epilogue

In a speech delivered on 30 November 2022, US Fed chairman Jerome Powell mentioned several factors that have contributed to growth deceleration, such as, “the waning effects of reopening and pandemic fiscal support, the global implications of Russia’s war against Ukraine”, as well as the policy actions of the US Fed, “which tightened financial conditions and are affecting economic activity.” He added, “Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.”

Does it not describe the situations in most of the countries that seem to be caught between the Scylla of a possible recession and the Charybdis of accelerating inflation, with very little policy space? Perhaps, a time has come when, contrary to what Leo Tolstoy wrote in Anna Karenina, unhappy families of the world started looking alike.

Partha Ray is with National Institute of Bank Management, Pune. Parthapratim Pal is with Indian Institute of Management Calcutta, Kolkata. The views expressed here are personal.